Job Families and Promotions

Another term that you will see a lot when it comes to surveys is job families. A family is a set of individual jobs that each involves the same basic type of work but at different levels of skill and responsibility. Companies with an accounting team, for example, will typically have a variety of levels within the function. In this case, the job family is divided into different levels, each with a different target rate of pay. As a compensation professional, your task to define job levels is a critical skill; it creates motivation for your employees to learn new skills and helps them identify career paths.

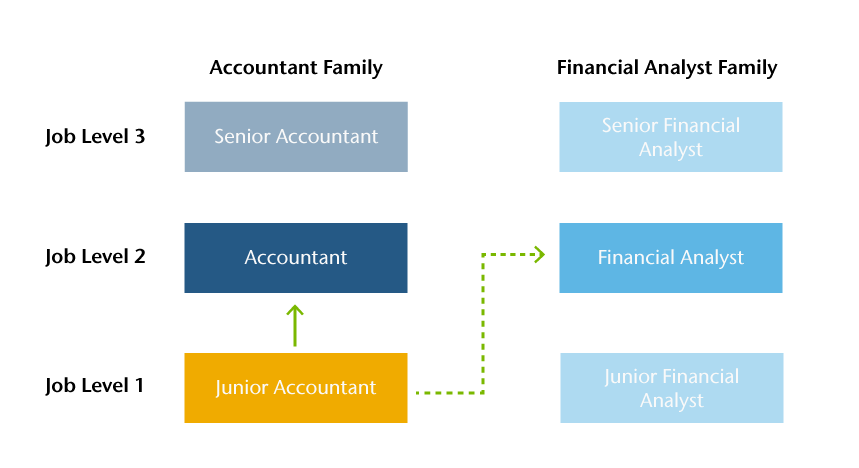

Multiple levels in the job family create promotional opportunities for people who grow their skills in one discipline over time. When an employee assumes greater responsibility while continuing to perform the same basic function, it is recognized as an in-family promotion. An example of this is an accountant being promoted to a senior accountant. These promotions usually happen around the time an employee receives a review or a salary increase. A shift to a job at a higher level in a different job family is referred to as an out-of-family promotion. An example of this is an accountant 1 that becomes a financial analyst 2. These promotions usually happen when a requisition is filled by an internal candidate or some form of department reorganization occurs.

Figure A below shows the promotion path of a junior accountant. If he follows the solid gold line and is promoted in the accountant family, then he has received an in-family promotion. If instead he follows the dotted gold line and becomes a financial analyst, then he receives an out-of-family promotion.

Figure A: Promotion path of a junior accountant.

Why don't salaries in the labor market move as fast as the average salary increase for an individual? We hear this question a lot. For example, if every accountant gets a 4% increase, why wouldn’t the average salary increase by 4%? Promotions are one reason. When an employee is promoted, they move from one job level to another. Since it is usually a highly-skilled and well-paid person who gets a promotion, they tend to be paid above the average of their peers. Once promoted, they move to a job where they are no longer the most senior and often receive below-average pay since they are new to that level of responsibility. Moving an above average paid employee into a higher job level lowers the average pay rate in the job they leave. Moving into a new job as a below average paid employee pushes the average pay for that job down, too. Lower starting pay for new hires can also explain why rates move more slowly overall than you might think.