On March 30, 2016, FASB released the final version of the updates to Accounting Standards Codification Topic 718: Compensation-Stock Compensation (“ASC 718”). The update includes an option on how a company may account for forfeitures in its expense amortization.

New Versus Old: A Comparative Analysis

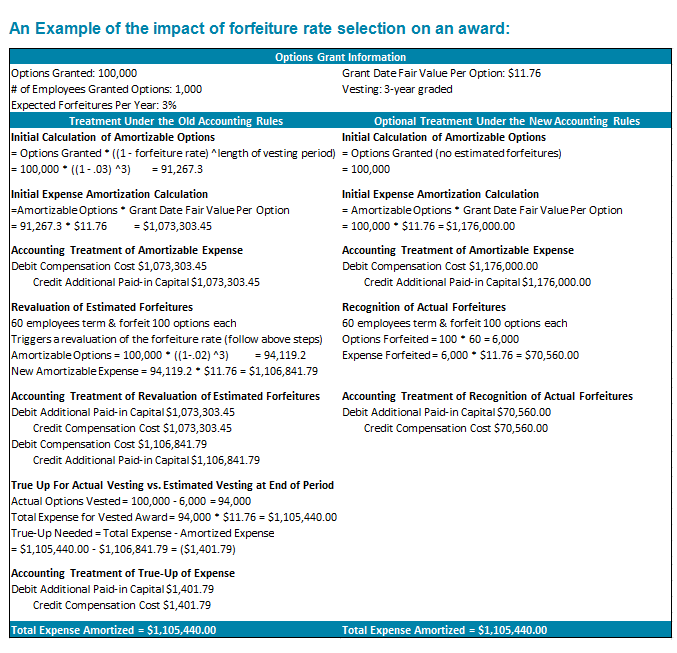

Under the current accounting rules, an employer must estimate forfeitures (resulting from the failure to provide the requisite service) when recognizing compensation cost for all share-based payments (equity or liability).

Under the new rules, an entity can make an entity-wide accounting policy election to either estimate the number of awards that are expected to vest or account for forfeitures as they occur (new option).

Please note: For simplification purposes, we have included an example where true-up occurs at final vest date rather than at forfeiture date. Your plan may not follow this design, in which case, the Treatment Under the Old Accounting Rules would include the true-up adjustments as of the forfeiture date.

Our Recommendation

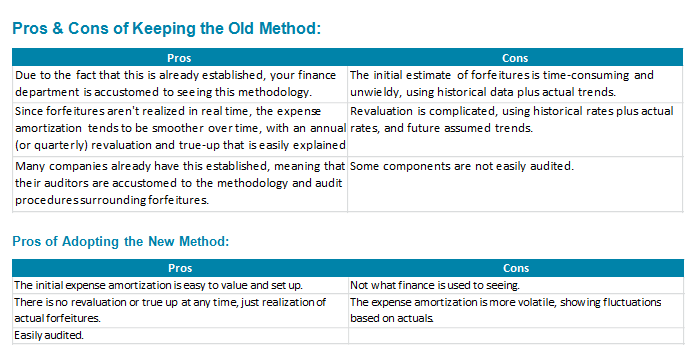

Whether your company chooses to adopt the new option or continue with the old option, your expense will end up being the same at the end of the amortization period. Aon’s recommendation depends largely on two things: the size of your company and your experience granting stock-based awards. For large, established companies with a lot of granting experience, a reasonable prediction of forfeitures can typically be estimated. Because this more accurate prediction allows for consistent and predictable accounting, Aon recommends the company continue to estimate forfeitures, and apply any true-ups when necessary.

For smaller companies with limited experience granting stock-based awards, an accurate forfeiture rate is much harder to determine, potentially spurring an environment of volatile accounting. In order to avoid uncertainty created by inaccurate predictions, Aon recommends the company recognize forfeitures as they occur. This eliminates the potential of inadvertently overstating the forfeiture rate, thus leading to a sudden unexpected increase of expense.

It is important to note that any further change in policy after the initial election will qualify as a change in accounting principle, thus requiring a preferability letter from an entity’s external auditor and further retrospective application.

To learn more about the Equity Services team at Aon, visit our website: radford.com/home/valuation. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles