After five years, the inter-agency task force has re-proposed Section 956 of Dodd-Frank. This proposal is clearly more prescriptive and covers all financial institutions with balance sheet assets over $1 billion that are regulated by the six agencies.

-

Three levels of classification beginning at $1 billion and resetting at $50 and $250 billion in assets.

-

Two primary classifications of employees: senior executive officers and significant risk takers.

-

For firms $50 billion and larger: all incentive compensation includes deferrals and seven year clawbacks.

-

All firms have a seven year record keeping requirement to be made available to regulators upon request.

-

Proposed to be effective in 2019 with the comment period ending July 22, 2016.

Regulatory background

The OCC, Federal Reserve Board, FDIC, FHFA, NCUA, and SEC ("Agencies") are re-proposing incentive-based compensation rules under Dodd-Frank 956 to establish more specific requirements for compensation arrangements at all covered firms. These proposed rules continue to define covered financial institutions as those having balance sheet assets of $1 billion or more. The Agencies have released the proposed rules on April 21, 2016 with a comment period for firms to submit feedback open until July 22, 2016.

This re-proposed rule is 279 pages in length; this contrasts with the original proposal released in April, 2011 that was 77 pages.

Tiering of institutional coverage

In contrast to the 2011 proposal, the current proposal categorizes covered institutions into three tiers based on balance sheet size:

-

Level 1: Firms with average total consolidated assets greater than or equal to $250 billion (subject to the most rigorous requirements).

-

Level 2: Firms with average total consolidated assets greater than or equal to $50 billion and less than $250 billion (subject to rigorous requirements).

- Level 3: Firms with average total consolidated assets greater than or equal to $1 billion and less than $50 billion are generally subject to a basic set of disclosure requirements and prohibitions.

- The proposed rules reserve an institution's Federal regulator the right to require compliance with some or all of the more rigorous level 1 or 2 requirements for firms with $10 to $50 billion in total consolidated assets.

Employees at level 1 and 2 firms are classified into two categories

There are two classifications of employees at Level 1 and 2 covered firms: Senior executive officers and significant risk takers. Regulators reserve the right to deem other persons as covered who have the ability to expose the firm to material financial loss.

-

Senior executive officer: This definition from the 2011 proposed rule is expanded to include the chief executive officer, executive chairman, chief operating officer, chief financial officer, chief investment officer, chief lending officer, chief legal officer, chief credit officer, chief compliance officer, chief audit executive, chief accounting officer, and heads of a major business lines and control functions.

- Significant risk takers: These positions are defined as individuals whose incentive compensation comprises at least one third of total compensation AND who meet either of the following criteria:

- Relative compensation test: Individual is in the top 5% of highest paid (level 1) or top 2% of highest paid (level 2) for the calendar year that ends at least 180 days before the beginning of the performance period.

- Generally, the 5% threshold for level 1 firms would include positions such as managing directors, directors, senior vice presidents, relationship and sales managers, mortgage brokers, financial advisors, and product managers.

- Exposure test: Individual has the authority to commit or expose half a percent or more of the institution's capital with, for most firms, the definition of capital being common equity tier 1 capital.

Deferral, forfeiture, downward adjustments, and clawbacks at level 1 and 2 firms

At level 1 and 2 covered firms, incentive compensation must include several design features, including:

-

Forfeiture: All deferred compensation, including long-term incentives, must be subject to forfeiture. The forfeiture applies to the deferral period which varies by type of compensation as highlighted below.

-

Stock options: To meet the rules minimum deferral requirements, stock options for senior executives and significant risk takers cannot exceed 15% of total incentive-based compensation.

-

Clawback: All incentive-based compensation is subject to clawback for up to seven years post vest.

-

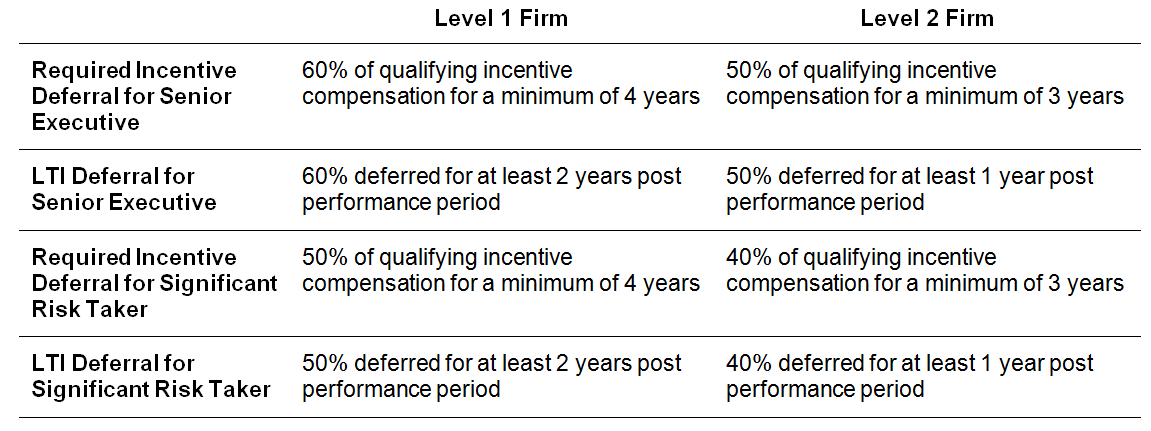

Deferrals: All incentive compensation is subject to a deferral as shown below. Deferred incentive compensation must be in form of cash and equity-like instruments and cannot vest faster than pro-rata.

Note: "LTI" refers to plans having a performance period of at least three years.

-

Leverage capped: Maximum leverage of 125% of target pay for senior executive officers and 150% for significant risk takers and this limitation applies on a plan by plan basis including LTI plans.

-

Specific prohibitions defined: For firms hedging on behalf of individuals, relative performance measures in isolation, and volume-drive incentive compensation without being combined with other factors to account for risk (applies to level 1 and 2 firms).

What applies to all firms greater than $1 billion in assets?

The annual reporting requirement in the original proposal has been replaced with an annual record keeping requirement. All covered firms (level 1, 2, and 3) would be required to create annual records and maintain these records for seven years. The annual records must include documentation of the structure of incentive-based compensation and demonstrates compliance with the proposed rule. Upon request, these records must be made available to the appropriate Federal regulator. At a minimum, the covered firm must keep a record of the following:

-

Copies of all incentive-based compensation plans.

-

A list of who is subject to each plan.

-

A description of how the covered institution's incentive-based compensation program is compatible with effective risk management and controls.

A covered firm would not be required to report the actual amount of compensation, fees or benefits of individual covered persons as a part of this requirement.

For level 1 and 2 firms only, there are additional record keeping requirements. These firms must maintain annual records that document:

What has changed since the original proposal in 2011?

The Agencies issued proposed rules in 2011 and the three key principles upon which they were developed remain unchanged. These three principles state that incentive-based compensation arrangements:

-

Should appropriately balance risk and financial reward.

-

Be compatible with effective risk management and control.

-

Be supported by strong corporate governance.

Since the initial rules were proposed, the Agencies have continued to focus their supervisory oversight on the design of incentive-based compensation for senior executives, deferral practices, including forfeiture and clawback mechanisms, governance of incentive compensation arrangements and the use of discretion, ex-ante risk adjustments, and control function participation in the design of incentives and risk evaluation. Although significant improvement has been made since the financial crisis, there are still areas where improvement needs to continue. The areas identified for continued improvement are:

-

Better targeting of performance measures and risk metrics specific to activities.

-

More consistent application of risk adjustments.

-

Better documentation of the compensation decision making process.

Effective date of changes

The earliest date for implementation of the proposed rules would be performance year 2019 given that the publication states that the rules will apply to compensation arrangements with a performance period beginning the first quarter following 18 months from final publication of the rules. The proposed rules do not affect the application of other federally regulated compensation requirements that are in effect from supervisory agencies, i.e., Sound Incentive Compensation Policies, June 2010.

Note: For a covered institution that is an investment adviser, average total consolidated assets would be determined by the investment adviser's total assets (exclusive of non-proprietary assets) shown on the balance sheet for the adviser's most recent fiscal year end. The SEC estimates that 131 broker-dealers and approximately 669 investment advisers will be covered institutions under the proposed rules. The SEC further estimates that of those 131 broker-dealers, 49 will be level 1 or level 2 covered institutions, and 82 will be level 3 covered institutions and that of those 669 investment advisers, approximately 18 will be level 1 covered institutions, approximately 21 will be level 2 covered institutions, and approximately 630 will be level 3 covered institutions.

To read Part II of this article, please click here.