At a macro level, European life sciences companies are moving away from stock options as their equity vehicle of choice. It is now a well-documented trend that restricted shares/units are on the rise, with performance-based awards increasingly common at senior/executive levels. However, distinct differences in equity strategy remain when examining our survey data by corporate stage of development, industry and region.

In particular, pre-commercial biopharma companies are resisting the move to full-value shares, and with good reason. To start, pre-commercial biopharma companies typically face less governance pressure to apply performance conditions to their equity awards. And secondly, leadership teams often view stock options as wealth creation vehicles that keep employees motivated in the face of daunting regulatory hurdles on the road to commercialization.

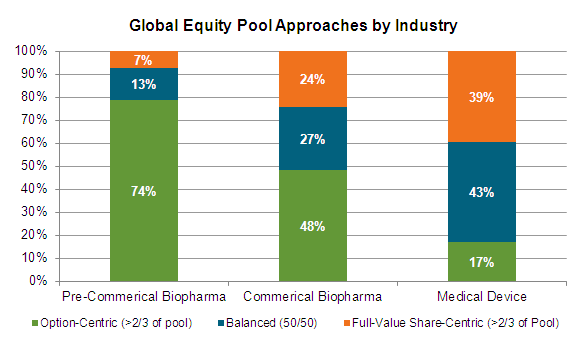

Both the macro-level trend toward restricted share/unit adoption and the reluctance of pre-commercial biopharma firms to follow suit is borne out in the data presented below. Radford's equity pool analysis examines the nature of shares granted annually by a company, and places that company into one of three camps: option-centric, balanced, or full-value share-centric. As the chart below illustrates, 74% of pre-commercial firms remain option-centric, while this rate drops to 48% for commercial biopharma companies and only 17% for medical device firms.

Clearly, remaining competitive in the market for key life sciences talent requires more than a one-size-fits-all approach to equity compensation. A more nuanced and careful approach is required; one grounded in the realities and needs of corporate stage of development.

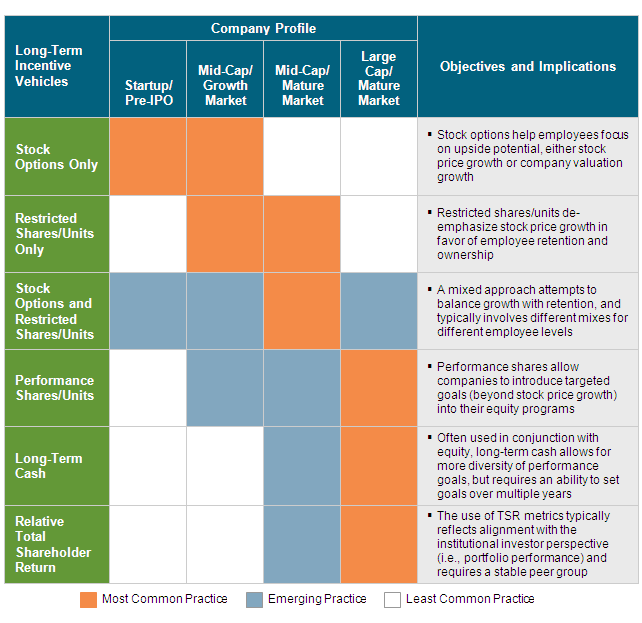

To illustrate how approaches to equity strategy can change as an organization matures, we typically advise our consulting clients to consider the chart below. It shows both the most common and newly emerging equity practices by stage of development.

Beyond equity vehicle approach, there are a number of other key factors (dilution, participation levels, and grant guidelines) where pre-commercial and commercial companies in Europe differ. For example, at pre-commercial companies, nearly 100% of employees participate in new-hire and annual equity grant programs. Meanwhile, at commercial organizations participation rates tend to decline as companies grow. With more headcount and stricter governance oversight from investors, there is often less and less equity to go around.

Furthermore, at private pre-commercial companies, equity award levels are typically determined based on a percentage of ownership in the company. Current or anticipated award value may play a role, but it is much harder to use value as a point of company-to-company comparison. In contrast, commercial companies typically set award sizes by value, especially when restricted shares/units enter the mix. This subtle difference has a big impact on selecting appropriate peers and compensation benchmarking datasets.

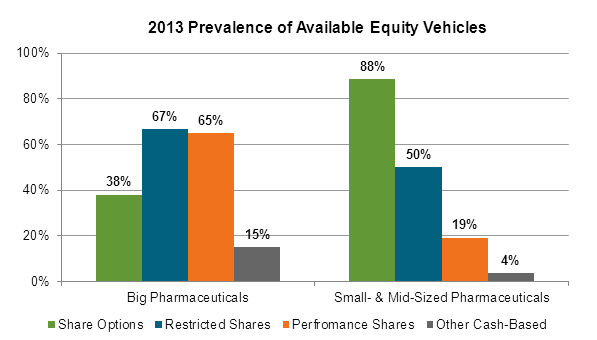

Of course, differences in equity strategy do not start and stop at the overall company level. Within any single organization, there are numerous other factors to address. Consider the chart below, which examines the prevalence of large vs. small to mid-size pharmaceutical firms in Europe using various equity vehicles. This chart indicates further diversity of equity practices, as firms clearly use multiple vehicles at the same time. Smaller firms might be option-centric, but 50% use restricted shares to some degree and nearly one-in-five use performance shares. This data suggests companies are providing diverse equity portfolios to employees based on line-of-sight to performance objectives (i.e., job level) or perhaps employee retention priorities.

Note, the percentages on the above chart add up to more than 100%, as companies can use multiple vehicles at the same time. Clearly, multi-vehicle approaches are widespread, but nevertheless, distinct differences in approach remain between larger and smaller biopharma companies.

Again, remaining competitive in the market for key life sciences talent requires more than a one-size-fits-all equity approach. Even for pre-commercial firms, who are seemingly comfortable in their option-based ways, understanding other forms of equity compensation is critical.

Increasingly, we find our Compensation Committee clients at companies of all sizes asking the following questions:

- When is the right time to create a performance-based equity plan?

- Once a plan is in place, when should we use it?

- Who should receive performance-based equity awards?

- Key executives

- All executives

- Senior staff

- All employees

- Over what period should we measure performance?

- Annual plan

- Multi-year plan

- Milestone-based plan

- How should performance levers be designed?

- All or nothing vs. payout schedules

- High vs. low payout leverage

- Financial vs. operational metrics

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles