In the wake of pandemic-related workforce changes, clients from the banking industry explain how they are reimagining their approach to total rewards, broadening their focus from compensation to include other elements, like flexible work, employee wellbeing, and more.

With the new year officially underway, it’s time to kick compensation planning into full gear and reflect on 2020 and all the changes that took place due to the COVID-19 pandemic. From shifting demands and virtual work to taking on new approaches to performance management, there are numerous factors to consider when determining a total rewards package that’s right for you.

To discuss this further, we recently hosted a client panel with three rewards professionals in the European banking industry. During the discussion, they shared key global rewards insights, advice and what to expect as we head further into 2021. This article summarizes the main takeaways from our conversation.

Going Beyond Pay

Banks have historically been known to center their rewards practices around pay. However, the onset of the COVID-19 pandemic has brought about new expectations when it comes to keeping employees safe and satisfied. The traditional “cash is king” mentality has shifted, causing many financial services firms to adapt and reexamine their rewards approaches. But, how quickly must these adjustments occur and where do firms currently stand? We are seeing increases in health and safety investments and additional benefits, such as medical care, flexible working arrangements, relaxed leave policies and mental health and wellbeing services.

For the core of their rewards programs, most of our panelists agreed that they are not making major changes. What they are doing is broadening it to include more than compensation. For example, one firm spoke directly to its insurance providers to open enrollment outside of the normal open enrollment period, offering employees the ability to make changes that suit their current needs. Another provided free COVID-19 tests and vaccinations for the flu at their on-site medical center, in addition to launching new online career development and management programs.

Above all else, supporting employees through difficult times is key. As one rewards leader from a UK-based bank with a large footprint in Asia summarized, the most important part of a rewards package is establishing a coherent strategy that includes mental health and financial wellbeing.

Embracing Technology

Providing the necessary equipment for efficient virtual work is now another facet of rewards to actively consider. Firms that had already introduced flexible and agile work arrangements were ahead of the curve when faced with the sudden need for a remote environment. This was the case for one of our clients, who explained that 85% of colleagues had previously registered to work from home in 2018. Their systems were already equipped to support 30,000 to 35,000 global employees working virtually on any given day. Therefore, when the pandemic hit, the organization was quick to react and build off this strongly established system.

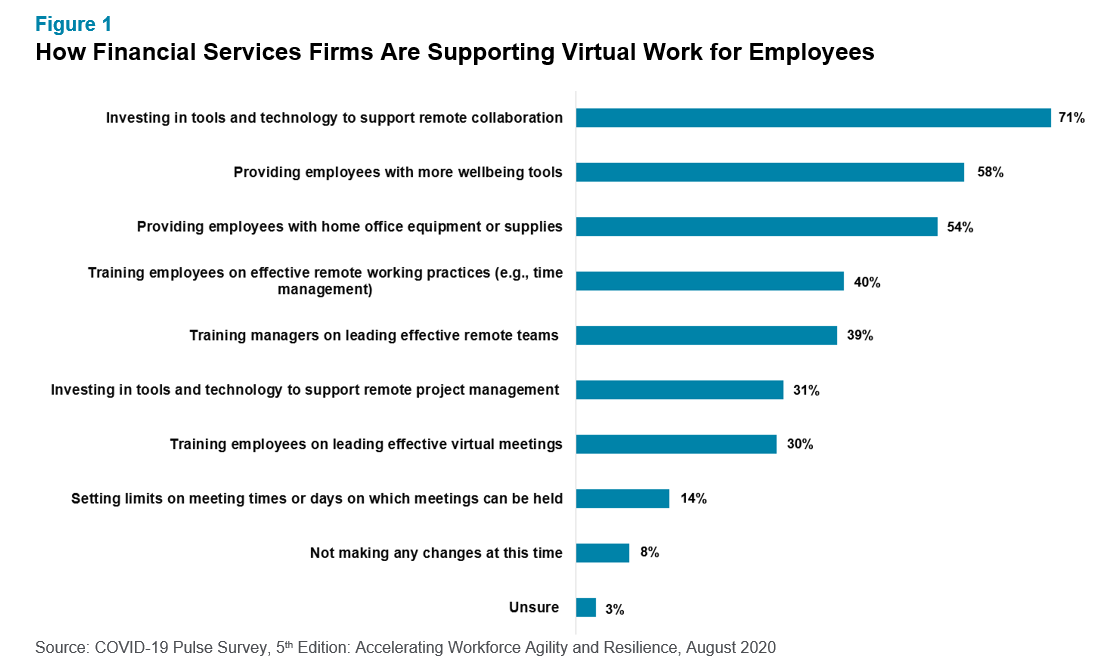

The figure below shows the top ways that financial services firms are providing extra support to employees in today’s evolving virtual business environment.

For banks that rely heavily on retail branches, remote work and the digital revolution is happening at a slower pace. Workforce planning strategies should focus on skills needed for today and in the future, with investments in educational programs to help upskill employees into new jobs and adapt to new structures that will become more digital over time. To successfully enable this model, all firms must provide employees with the support needed to be productive in the current environment — a work in progress, but a main goal for many traditional banking firms.

Factoring in Location

Clearly, virtual work is an unavoidable reality for most firms. However, is it here to stay? And if so, how will it influence compensation?

Many large global banks are based in high-cost locations like New York City and London. Yet, the sudden move to remote work opens the door for employees to relocate to new, lower cost parts of the country or world, bringing about the very complicated question involving pay reduction and adjustments.

Consequently, analysis of geographic pay differentials is now front and center for all organizations, including financial services firms, who continue to offer more flexible benefits and remote work options to their employees. Many businesses with high-cost centers are actively designing and testing regional pay variations. This means building a regional salary grid and slotting people in to compare against previous grid positioning. If you are above the mid-point or below the mid-point, you remain in the same position against a new mid-point for where you are currently located. However, this implies that some employees may have lower base salaries going forward, which raises concerns around engagement and retention and so will have to be carefully managed and communicated.

“The key takeaway is going to be what this will do to value propositions,” explains Guy Pritchard, a partner in Aon’s Rewards Solutions business who, during the panel, shared technology industry insights to help demonstrate the direction financial services firms will likely follow to stay ahead of the curve and remain competitive for digital talent. “The Googles, Apples and Facebooks of the world are very campus-centric organizations. The experience you get working for those firms is linked to engaging office space, free food and other lifestyle perks. If you take that all away, the experience will change. It will be interesting to see how that evolves and how firms will also factor this in when revisiting their total rewards strategy.”

While the banking industry is considering remote work more permanently for certain eligible roles, the tech sector has really led the way. Therefore, as financial services firms continue to accelerate their digital transformation efforts in response to workforce changes due to COVID-19, leveraging practices and learnings of the tech sector will be instrumental to their success.

Virtual Work and Performance Management

Another hot topic during our recent banking virtual event centered on changes to performance management as firms adjust to a virtual work environment. According to our recent Aon HR Pulse Survey, 72% of financial services firms expect a greater emphasis on continuous feedback and manager communication in the coming year. In addition to communication, there are many other factors to consider, such as time management, productivity and goal-setting — all of which is expected to be more challenging without direct, in-person interaction with managers. However, it’s important to note that every organization and situation is unique and should be addressed accordingly.

For example, one of our client panelists said that her bank had removed performance ratings and curves back in 2019, replacing them with the need for fostering real conversations. Managers were provided with the skills necessary for having open dialogue and regular check-ins. Due to these methods and behaviors that were already in place, when COVID-19 hit, the firm was well-prepared and able to take efforts one step further by working with a neuroscientist to determine how to have optimal conversations around maintaining a sense of purpose in a remote environment.

Other banks, who may not be at the same stage of the game when it comes to removing performance ratings systems, are focused on the model itself — how it’s structured and how it’s done — as well as seeing tangible results. What did the employee actually accomplish? Their main goal right now is to help managers find the right tone for employee conversations, equipping them with the proper tools and training so they are able to manage in all kinds of scenarios. Exploring conscious and unconscious bias is also important.

“The system should be as fair and transparent as possible so different managers can properly cater to each of their employees,” says Pritchard. “There needs to be a lot of emphasis on trust — having trust in your team and vice versa is key. Employees need to know that their managers have their best interests at heart.”

Next Steps

After nearly a year of unprecedented disruption, rewards leaders in the banking industry and beyond are tasked with the challenge of rethinking longstanding practices to adapt to the “new normal.” Determining pay is not a one-size-fits-all endeavor. The process is complicated, with countless variables to consider as we continue to navigate unchartered territory. The notion that there are some things money can’t buy now rings truer than ever before, as firms look for fresh ways to build trust, improve engagement and satisfy their employees during turbulent times.

To learn more about compensation trends in the banking industry or to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles