CEO compensation is vastly different at public and private companies — from the total amount of pay to the way it’s structured. As both types of organizations increasingly compete for talent, understanding these differences is important to attract and retain executives.

Compensation among private and public company executives is vastly different in both total value and the way rewards programs are structured. With private and public companies increasingly competing with one another for top talent, it’s important for boards to better understand these differences as they benchmark executive pay to the market and against a peer group of companies they compete with for executive-level talent.

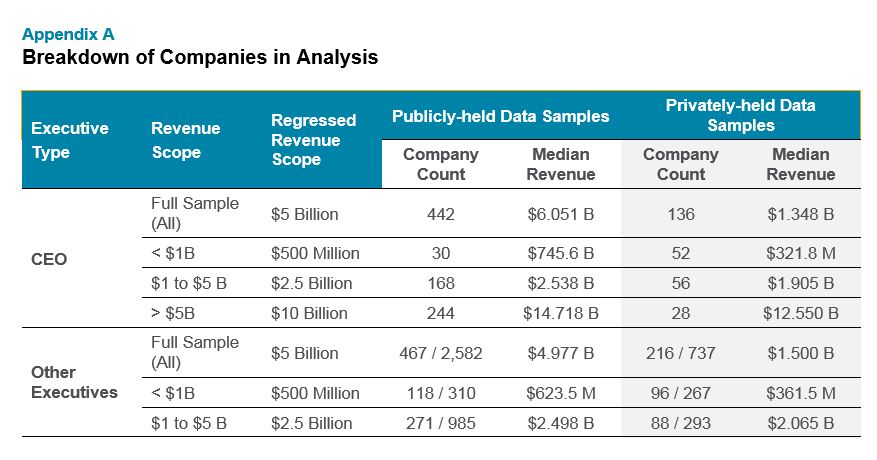

To gain a sense of the compensation landscape for executive talent, we analyzed executive compensation data at nearly 450 public companies and more than 130 private companies that reported pay for 2019 to Aon’s Total Compensation Measurement Survey. Companies are based in the United States, span all industries and have a median revenue of $5 billion for the public companies and $1.3 billion for the private companies (see Appendix A for more details). Private companies in this analysis are generally companies that intend to remain private (e.g., family-owned businesses, S Corporations, non-profits, business units) rather than private equity or venture capital sponsored companies.

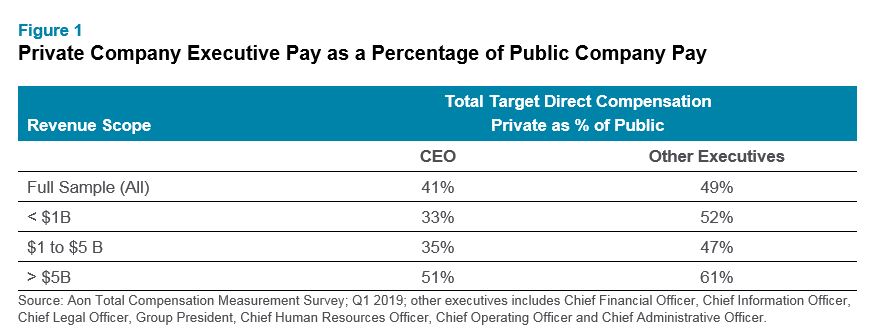

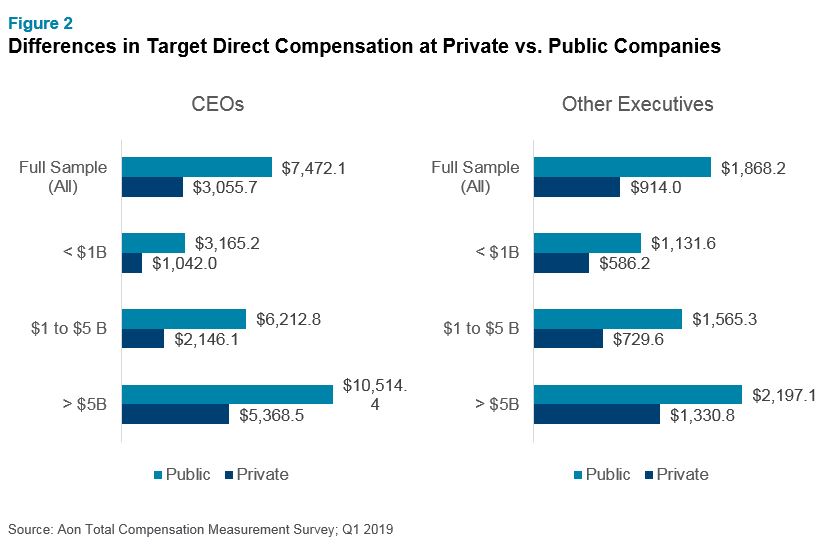

We found that total direct compensation for a CEO at a privately-held company trails publicly-traded companies by 40%. That premium is slightly lower for other private company executives who earn about 50% of their public company counterparts. However, as an organization’s revenue size increases, this gap narrows significantly.

Figure 2 shows the differences in total target direct compensation value between the two types of companies for the CEO and other executives. Target direct compensation is the sum of annual base salary, target bonus opportunity and long-term incentive value.

Driving Factors Behind Compensation Gaps

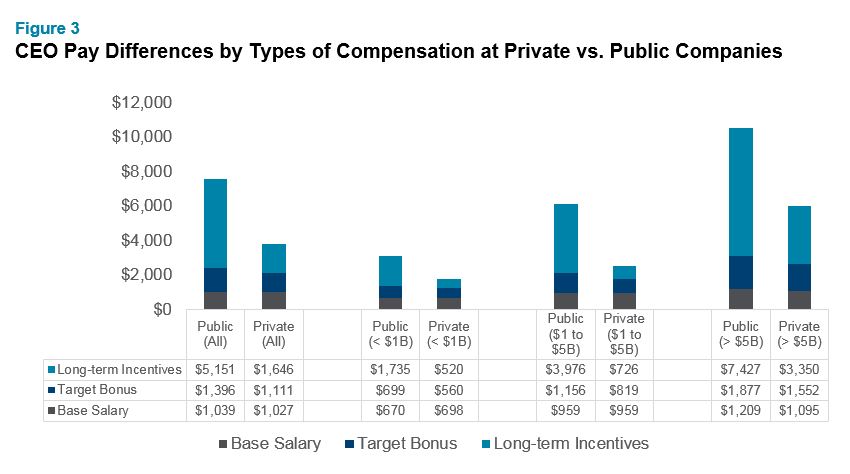

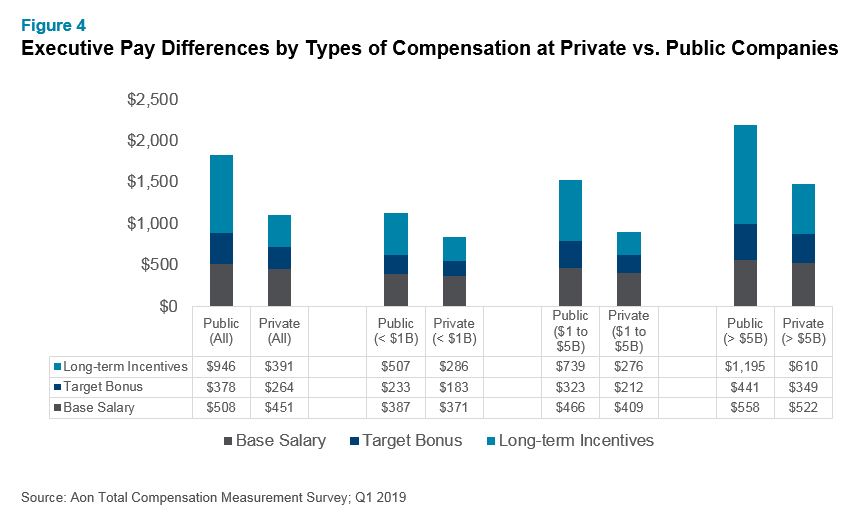

The difference in value of executive pay is largely due to the prevalence of long-term incentives at public companies. When it comes to cash compensation, including base salary and annual bonus, the value is only slightly smaller for private company executives, as shown in Figure 3 for CEOs and Figure 4 for other executives.

Only 38% of all private company CEOs in our analysis received long-term incentives last year compared to 97% of public company CEOs. Of those private company executives that received LTI payouts, most value is delivered by cash-based performance awards. Public companies tend to diversify awards among at least two vehicles, with performance shares and/or time-based restricted stock being most prevalent.

Only 38% of all private company CEOs in our analysis received long-term incentives last year compared to 97% of public company CEOs. Of those private company executives that received LTI payouts, most value is delivered by cash-based performance awards. Public companies tend to diversify awards among at least two vehicles, with performance shares and/or time-based restricted stock being most prevalent.

Next Steps

Historically, publicly-held organizations have increased complexities due to regulatory compliance and external market and shareholder scrutiny, and therefore, higher pay levels reflect that. However, the large gap in compensation between private and public companies could narrow over time as competition for top talent increases — a prominent trend that is already occurring among the largest organizations.

To learn more about participating in one of our surveys or to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com.

Related Articles