Wealth management firms in Asia are faced with both immense opportunities and challenges when it comes to serving the next generation of wealth. This article provides an overview and advice to help lead the way.

While 2020 has upended companies’ business forecasts and near-term plans, we have taken a moment to go beyond the torrents of uncertainty across financial markets to highlight a significant opportunity on the horizon for Asia’s financial services industry – specifically, for wealth management and private banking.

Asia remains on track to contribute more than 50% of global GDP by 2040, while also driving over 40% of worldwide consumption.

This passing of wealth and economic torch to a new generation of digitally nurtured, mobile trading, WebEx aficionados will likely change the dynamics of financial markets, from day-to-day banking to the upper echelons of wealth management and private banking.

With such a lucrative and breakthrough opportunity for banks, insurance, wealth managers and the financial services industry at large, we pose the critical question: How prepared is Asia to meet the needs of the next generation of wealth?

Next-Gen Wealth Barriers in Asia

Asia’s wealth market remains a fragmented, sociologically and ecologically diverse habitat for affluent and high-net-worth (HNW) individuals. To meet the financial and personal needs of wealth clients, financial services firms rely heavily on specialised roles, such as Relationship Managers (RMs), Financial Advisors (FAs) and Investment Experts / Counsellors (IEs/ICs). McLagan’s Pay Benchmarking and Pay & Productivity studies have revealed an ongoing challenge that financial services firms are facing within their wealth management arm: individual RM productivity not fully capturing the growth of wealth in Asia and the revenue opportunity this presents to banks.

In recent history, Asia’s wealthy population and total assets have enjoyed a period of growth. However, return on assets (ROAs) at higher assets under management (AUMs) in Asia are very low, resting more than eight basis points below that of mature markets. McLagan’s proprietary data outlined that AUM across seven of the top banks in Asia grew 21% between 2018 and 2019, while the total number of RMs servicing these clients only rose 8%.

Stagnant cost/income ratios, which can be attributed to the high cost of RMs in a market where supply remains stagnant, also raise concerns regarding RM quality and consequential productivity. The region faces a stark dilemma of how it can increase the productivity of existing RMs, as well as empower future RMs to be best positioned to maximise their output in terms of revenues, net new assets (NNA) and other performance metrics.

Regardless, this challenge has not impeded the ambitions of banks across the industry to publicly announce hiring goals. Some of the largest global banks have all committed to increasing their headcount within their wealth management departments. At the same time, we have seen a spike in the number of family offices, external asset managers and independent financial advisors emerge within Asia, all of which are also competing for the same talent pool required to service the current and next-generation of wealthy individuals in the region.

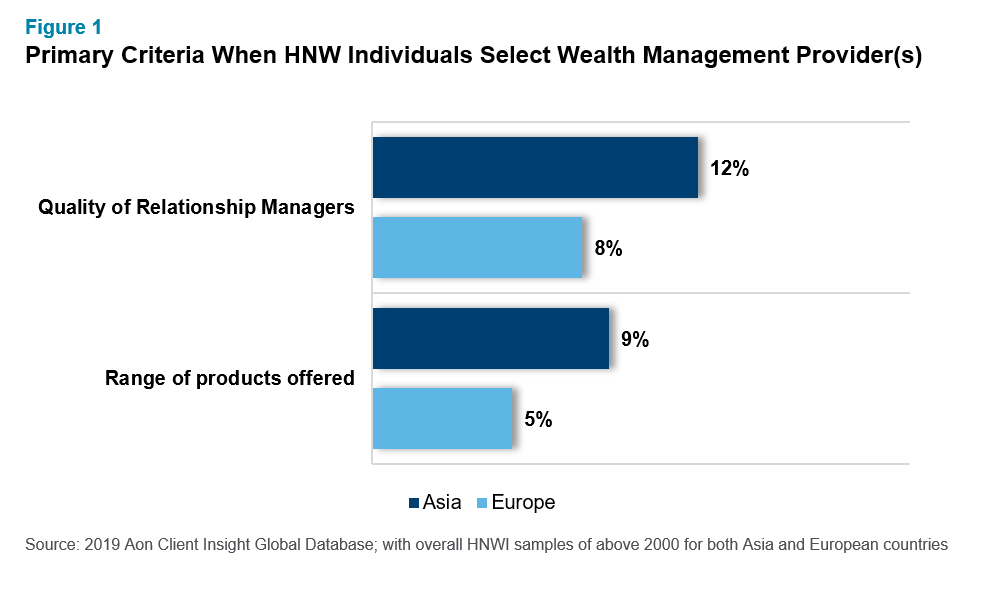

Compounding this productivity challenge is also the uphill climb that banks face when attempting to keep pace with a rapidly changing consumer base. Over the last 20 years, Aon’s Client Insight team has been actively listening to the perspectives of affluent and HNW individuals across North America, Europe and Asia. In recent years leading up to 2019, we have seen a distinct behaviour shift among clients in Asia compared to their Western peers. We identified that when selecting a wealth management provider, Asian HNW individuals are more likely to choose a financial services firm based on the quality of their RMs and their product range than their European peers (see Figure 1).

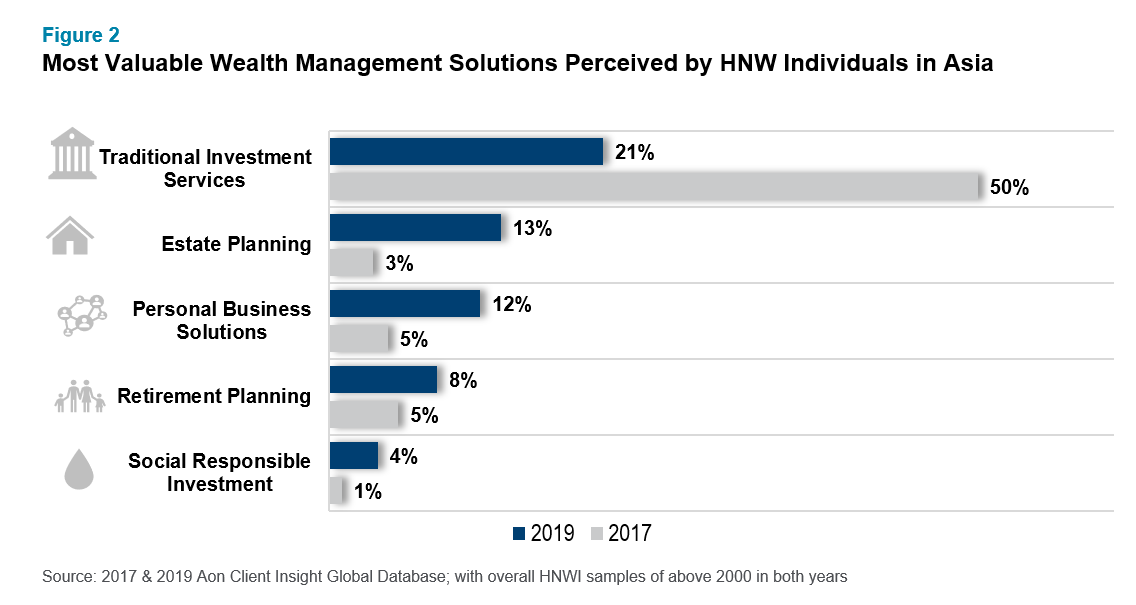

Further, we observed that there has been a seismic shift in the landscape of solutions being considered by Asian wealth management clients between 2017 to 2019. HNW individuals have, in the span of two years, moved away from prioritising and valuing traditional investment management services and towards more comprehensive solutions, such as estate planning, personal business solutions and philanthropic services (see Figure 2).

How Can Asia's Wealth Managers Lead the Way?

In the haste of tapping into the next-generation wealth of Asia, financial services firms may fall onto their own sword when it comes to hiring. We believe that now is the perfect time for wealth managers and private banks across Asia to build a brand-new ecosystem of hiring, grooming and improving RMs of today and tomorrow using available resources and technology. Doing so will align your firm for success in the long term.

The first hurdle currently facing financial services firms is recruitment. The cost of hiring RMs in Asia is amongst the highest in the world. Additionally, today’s imbalance of RM supply and demand across Asia has led to rudimentary and ad hoc “hire and fire” recruitment strategies across many banks. We believe that financial services firms have the capacity and capability to empower their hiring process by looking for candidates that embody the appropriate business culture and ethos, as well as skill sets, to meet the needs of HNW clients.

To provide support, as a joint effort across our Human Capital Solutions team, we leveraged our client insight, assessments and production data to create tools and assessment metrics that help firms identify success profiles and map them to existing staff and future hires. These initiatives help firms to not only identify key traits and behaviors, but also develop methods of recognizing these attributes among future and existing talent within their business. The first step is to identify these “critical client journey” moments, followed by equipping RMs to succeed in these moments to help asset gathering and revenue generation. Success profiles developed in such a way allow companies to embody both firm culture, as well as HNW and affluent clients’ needs and values in their RMs and teams.

Below we share advice and two key areas of focus for ensuring your recruitment and hiring processes are fully equipped to acquire the talent your firm needs to thrive using success profiles, even during uncertain times.

- Talent recruitment – Establishing a success profile allows wealth management firms to have access to a full suite of tools to identify the right behaviors among future RMs. Enforcing assessments during recruitment processes permits wealth managers to better identify RMs who fit not only the firm’s culture, but also the existing needs of the client base – hence reducing the need for the high-risk, uncertain rewards strategy of “hire and fire.”

- Talent onboarding and development – Having hired the appropriate talent, wealth managers need to be aptly equipped to onboard RMs in the most optimal way to meet client needs. Aon’s Client Insight research has outlined that the next generation of HNW individuals are empowered investors, constantly seeking financial knowledge and education. It’s important to build up the advisory client serving model, with which existing RMs and future RMs are familiar, and integrate it into the firm and client framework.

Overall, through our client insight work, we’ve noticed that understanding individual needs and goals is one of the most significant attributes that HNW clients value.

All these points culminate into many of the present challenges that face the wealth management industry today. At the end of the day, offering customized solutions that cater to the needs and goals of each HNW individual, coupled with the right level of financial knowledge, acumen and capability, is the key to satisfying client needs, while also aligning your wealth management firm for next-generation success. That includes hiring the right talent.

To learn more about the wealth management industry in Asia and driving business growth and performance through the integration HNW client needs into decision making, please visit our Client Insight page here. You can also reach out to one of the authors or write to rewards-solutions@aon.com.

Related Articles