Given the enormous risks presented by the COVID-19 pandemic and a renewed focus on social justice issues across the United States and globe, boards that have begun to address ESG issues in a material fashion will be better positioned to navigate current and future challenges. Below, we examine five steps boards can take to ensure they have the right processes in place.

Corporate boards have evolved significantly over the past two decades — transforming from limited bodies that approved executive compensation and CEO succession plans in many cases to robust teams of advisors who oversee risk and strategy and provide meaningful oversight of management. Yet, despite the rising influence and capabilities of boards, the COVID-19 pandemic, along with today’s economic and social challenges, will undoubtedly test the effectiveness of corporate boards even further as they attempt to help companies navigate through crisis. At the end of the day, it will likely be boards with the strongest governance processes that are best positioned to help.

To fully understand the expectations that investors, the media, proxy advisory firms, employees and other stakeholders have for boards today, it is helpful to revisit the evolution of board oversight since the turn of the millennium. Doing so can also provide a roadmap for how high-performing boards can help companies respond to the current pandemic, manage their way out of the crisis and embrace a new normal.

How Past Crises Improved Boards

Increased corporate board responsibility in the United States can be traced to the passage of Sarbanes-Oxley Act (SOX) in 2002, drafted in response to high-profile accounting scandals like Enron and Worldcom. Following SOX, boards implemented fully independent audit committees charged with greater oversight of financial controls and reporting. For a while, focus was centered on the audit committee’s responsibility in overseeing financial aspects of the business and ensuring ethical behavior by management in that specific discipline.

After a period of robust growth, the credit crisis began in 2007, followed by the Great Recession of 2008-09. Legislators responded by passing the Dodd-Frank Act in 2010, which included many corporate governance-related requirements like disclosure of risk management oversight, more details around executive compensation plans and the formation of risk committees for boards of financial services companies.

From around 2011 to the current COVID-19 pandemic, there were no major corporate or market crises that inspired sweeping legislation like SOX or Dodd-Frank. Thus, the role of boards has evolved more organically. On a parallel path and driven largely by increased European regulations and demands from investors, many businesses have added corporate social responsibility to the boardroom agenda. As these stakeholder demands continue to escalate, environmental, social and governance (ESG) issues are rising to board-level oversight, setting aside past beliefs that these topics were outside their purview. All of these past crises have strengthened the function and value that corporate boards bring to their companies.

ESG’s Permanent Place in the Boardroom

There are now more than 2,000 studies that link environmental, social and governance issues to corporate performance. “As a result, shareholders have become attuned to material ESG issues as indicators of both off-balance sheet risk and market opportunity,” says Laura Wanlass, partner and head of corporate governance in the Rewards Solutions practice at Aon.

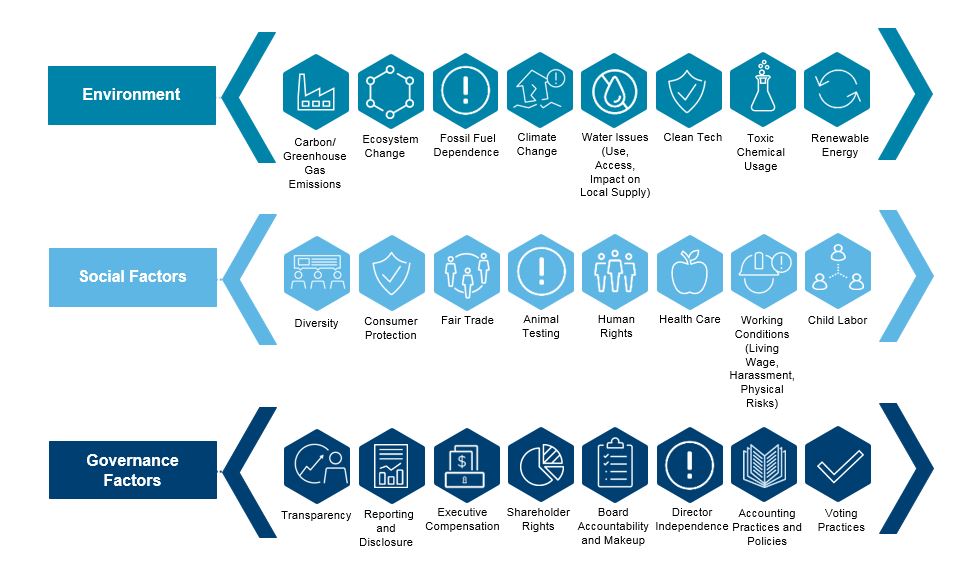

By the beginning of 2020, 86% of S&P 500 companies had disclosed ESG data in corporate sustainability reports. In addition, numerous independent groups such as the Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI) and others have developed guidance for formal reporting of material ESG metrics. These issues span a broad range of topics, as shown in the graphic below.

How Boards Should Evolve to Meet Current Crises

Boards that have truly embraced enhanced governance responsibilities over the past 20 years will be in a far better position to help business leaders navigate this crisis and develop a strategy for operating in what will be a changed world ahead.

“Governance is a dynamic field and requires boards to continuously stay on top of evolving complex issues. The demands and expectations of boards have never been higher, and that trend will continue at faster rates of change than ever before,” says Abby Adlerman, CEO of Boardspan, a digital solutions provider of board governance tools.

In order for boards to provide their companies the necessary guidance and support during this time, there are five steps all boards should be taking to strengthen their governance processes.

- Boards must be holistic in how they respond. This isn’t the time to take a narrow definition of the board’s oversight role. Paying attention to financial and non-financial risks, compensation matters, and broad stakeholder issues should be a priority before they become talking points at next year’s annual general meeting.

- Don’t pull back on progress made toward sustainability. In an economic downturn, it can be tempting to focus only on the bottom line. For maximum resiliency, however, it is essential to focus not just on short-term profitably but on long-term growth and viability. This is particularly true given the enormous non-financial risks uncovered by COVID-19 — from human capital challenges to supply chain risks.

- Ensure oversight processes are strong. While it may be tempting to fall into survival mode, the current crisis environment means rigorous board oversight is more, not less, important. Objectively assess where you are and where you need to be, using benchmarks and external data to guide you.

- Push for enhanced internal and external disclosure. Ensure management is keeping the board informed as critical risks and opportunities develop. Clear and honest communication with shareholders, employees and other stakeholders should be a priority as well.

- Consider forming ad hoc committees or holding additional meetings. Existing committees and meeting schedules may not be sufficient during a crisis. If attention to an emerging issue is required, it should be addressed early before it develops into a bigger problem. This is also an opportunity to identify where gaps in board expertise exist, so they can be addressed in future nomination cycles.

For questions about corporate governance in the current environment please contact one of the authors or write to rewards-solutions@aon.com.

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles