During stock market volatility, many executives may find that they are no longer compliant with stock ownership guidelines. However, there are two design provisions you can add that will make ownership guidelines more resilient against an economic downturn.

Executive stock ownership guidelines are nearly universal among large, publicly traded companies in the United States and a key component of an organization’s executive compensation and governance program — helping to further align executive and shareholder interests. Although well-established, these programs face current challenges, with decreased stock prices causing some executives who had met their ownership guidelines to fall out of compliance.

In this article, we offer strategies to create a set of ownership guidelines that can weather a volatile stock market. First, we’ll talk about market practice for the design of ownership guidelines and then cover the design elements we recommend that will make these programs resilient against market turbulence.

Overview of Stock Ownership Guidelines

Executive stock ownership programs are guidelines adopted by an organization’s compensation committee that set an amount for company stock executives to acquire and hold based on specified criteria, such as a multiple of annual salary, a fixed number of shares and/or a defined dollar value of stock.

Using S&P 500 company proxy filings from Aon’s Compensation and Governance Professional (CG Pro) database, below we examine the prevalence of the primary features of stock ownership guidelines, holding guidelines and proxy advisory firm best practices. Our analysis includes 481 of the S&P 500 companies that have disclosed ownership guidelines.

- Executives under ownership guidelines: CEOs are almost universally included in ownership guidelines (96%), followed by executive vice presidents (91%), senior vice presidents (78%) and vice presidents (52%).

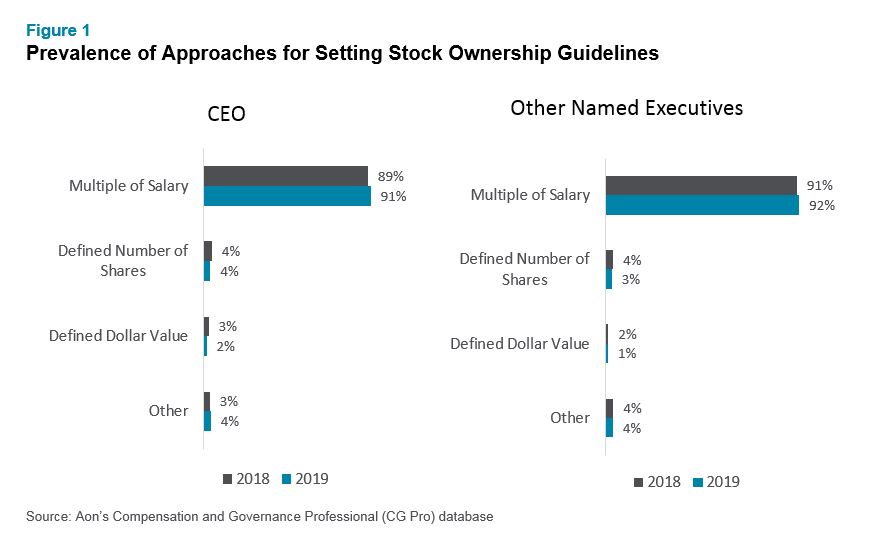

- Approaches for setting ownership levels: Companies most commonly base ownership levels on a multiple of annual salary. With this approach, the goal increases as salary increases. Less common approaches include share amounts or dollar values. Figure 1 shows the prevalence of different methods.

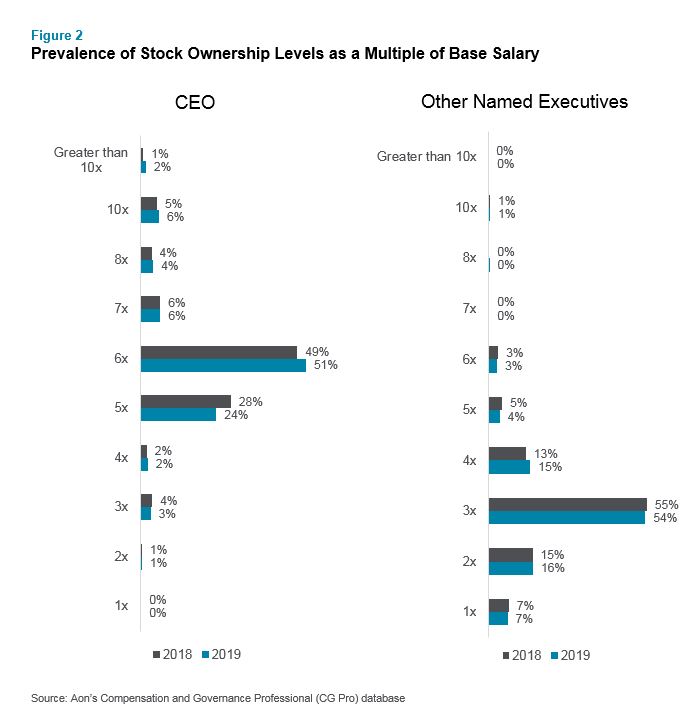

- Amount of stock ownership guidelines: Using five times an executive’s annual salary had been the majority practice; however, over the last few years, that has climbed to six times salary for S&P 500 CEOs. Guideline levels are lower for other applicable executives, with three times salary the majority practice and only one and a half times salary for vice presidents as shown in Figure 2.

- Time period for meeting ownership guidelines: Around 90% of the reporting S&P 500 companies give their executives five years to meet ownership goals. Often, the timeline resets when an individual is promoted to a new role that has a higher salary and, therefore, a higher ownership guideline. As we’ll discuss below, an extended period of depressed stock prices can make it challenging to achieve the ownership level within the time period.

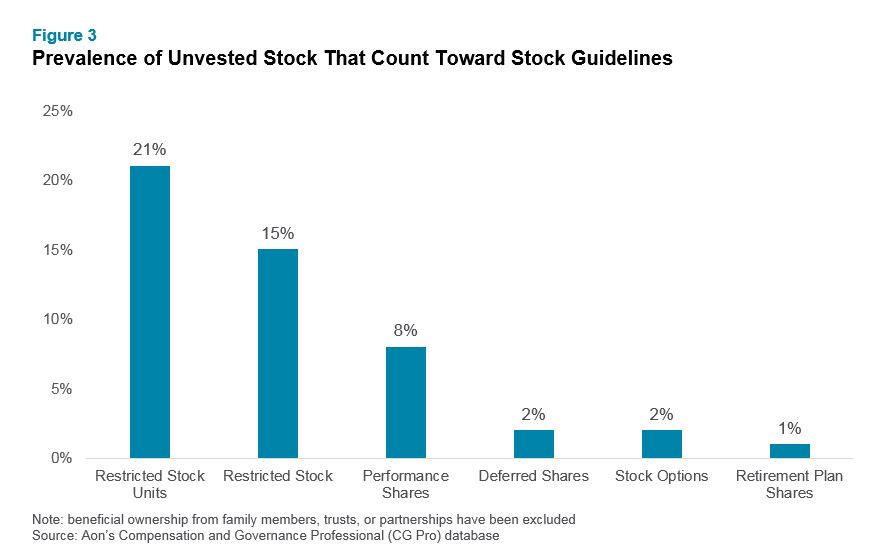

- Types of equity eligible for ownership guidelines: Generally, stock earned by an executive under the company’s incentive compensation program, as well as shares owned outright by the executive, count towards ownership guidelines. Granted equity is another potential source, but there are differences in what type of granted equity counts and when it counts. Unvested time-based restricted stock, whether as shares or units, most commonly counts towards ownership since these vehicles are very likely to be delivered. Guidelines are less likely to allow equity vehicles where the certainty of receiving the shares is lower, including stock options and performance shares.

How Proxy Advisory Firms Rate Stock Ownership Guidelines

The two-main proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, have long-held stances on stock ownership guidelines. Both organizations believe executives should own substantial stock to align their interests with shareholders.

ISS will cite a concern over a “lack of risk mitigators” under the analysis of executive compensation if a company does not disclose formal stock ownership guidelines and holding requirements. Historically, for ISS’ QualityScore ratings, the firm gives minimum credit if the CEO has ownership of stock that is three times their salary and one times the salary for named executive officers. Maximum credit is awarded for CEOs holding stock that is six times their salary and three times the salary for named officers. Additionally, companies get credit for disclosing a holding policy until ownership guidelines are met for appreciation awards and full-value awards (if guidelines say 50% of net-tax post-vest shares). ISS does not currently rate companies for their policies around the period required to achieve a guideline or the types of awards which count towards the guideline.

While not as specific, Glass Lewis’ policy will flag whether a company has stock ownership guidelines for all named officers but does not set out specific guidelines.

Stock Ownership Guidelines Today

Although off its lows in mid-March, the S&P 500 Index as of July 1, 2020, is down roughly 8% from its February high. A severe or sustained market downturn has implications to stock ownership guidelines. For example, executives who formerly met their guidelines may no longer — or it may be tougher for non-compliant executives to reach their ownership goal. Companies in this situation should consider disclosing any action they are taking to address the shortfall in their proxy statement.

When designing stock ownership guidelines, there are two design elements that can help mitigate this issue before it becomes a problem. These include:

- Retention ratios that require a portion of vested or acquired shares to be held until ownership guidelines are met, and/or

- A “once-and-done” provision that states that once the guideline is achieved, the executive is considered to have met the guideline irrespective of any future stock price changes.

Retention ratios began to appear after the 2008-09 Great Recession. Among the S&P 500, 53% disclose using a retention ratio as part of their ownership guidelines. These ratios state that the executive must retain a certain percentage of their shares (acquired pursuant to company incentive programs) until the company guideline is met. If an executive has met the company guideline, but then falls below the guideline due to a decrease in stock price, the retention ratio is then reinstated until the guideline is again met.

In a retention ratio approach, there are two design decisions to make — how to count shares (gross vs. net) and what percentage of shares need to be retained. Gross shares refer to the total number of shares received while net is the number of shares received after taxes. We recommend a net share approach, a practice used by about three-quarters of the firms with retention ratios. When determining the percentage of shares to specify retaining, organizations tend to select a percentage that allows the executive some flexibility to sell shares, which most find is around 50%.

A once-and-done provision states that once an executive has attained the company’s guideline, he/she is considered to be in compliance, irrespective of changes in stock price thereafter. However, if the executive falls below the guideline as a result of selling of shares, then the executive is not in compliance. Promotions would also reset the guidelines to reflect the new role’s guideline.

Next Steps

As we design or revise stock ownership guidelines with our clients, we are now recommending that they include retention ratios and once-and-done features. We believe that these are effective in making plans successful in all market environments and relieve management of the need to address changes in executive ownership posture on an annual basis.

If you have any questions about stock ownership guidelines or other executive compensation policies, please write to rewards-solutions@aon.com.

Related Articles