As 2020 Annual General Meetings enter into full swing in the U.K., we analysed early public disclosures on how FTSE 350 companies are addressing the economic impact of COVID-19.

The impact of the COVID-19 pandemic on both people and business is immense, and rising economic uncertainty will force HR leaders to make difficult compensation and workforce decisions in the months ahead. Therefore, it is safe to say that increased scrutiny on executive compensation and director pay is inevitable.

To assess the governance response to the unprecedented crisis at hand, we recently analysed the regulatory announcements of FTSE 350 companies, as well as the first 50 Directors' Remuneration Reports (DRRs) published in the 2020 Annual General Meeting (AGM) season. This data provides early insights into how U.K. companies are addressing the updated Corporate Governance Code and shareholder guidelines. Companies that are subject to the new governance code include 28 FTSE 100 companies, 21 FTSE 250 companies and one SmallCap company. Of this group, 20 companies are also subject to a binding shareholder vote on their Directors’ Remuneration Policy at the 2020 AGM.

Insights From Regulatory Announcements of FTSE 350

This year’s AGMs have been materially impacted by the COVID-19 pandemic, the ramifications of which are being felt across the economy. In the current climate of volatility, characterised by job losses and an uncertain financial future, perceived excesses in executive pay will not go unnoticed. Investors, proxy advisory firms and politicians are demanding that executives “share the pain,” which should translate into cuts in their own compensation if the company is suspending the payment of dividends to shareholders.

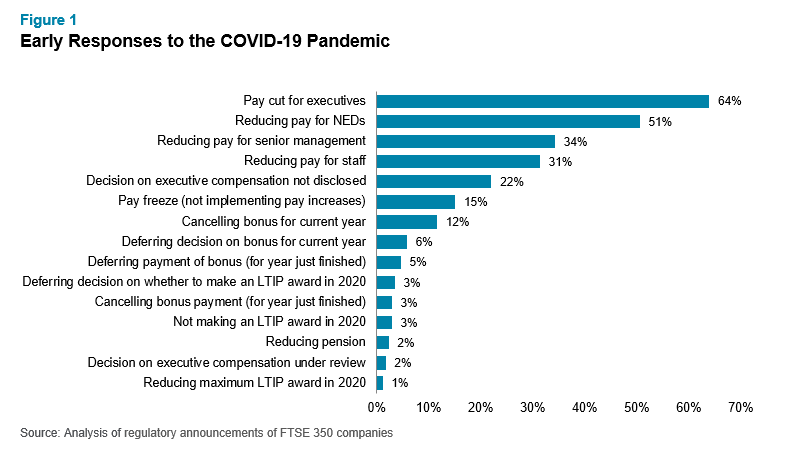

Early insights of the impact on executive pay from the first 100 companies in the FTSE 350 that disclosed a response to Covid-19 suggest:

- The most prevalent response has been the cancellation or suspension of dividend payments, with 16% cancelling dividends, 32% suspending dividends and 20% reviewing their approach. Only a small minority, 3%, have explicitly stated that dividends will not be affected.

- For executive directors, the most common approach, adopted by 56% of companies, has been a reduction in salary; the typical reduction adopted by most companies is 20% and the average, which includes all disclosed reduction levels, is 30%. Such reductions are mostly temporary and last for three months. Where companies have reduced executive director pay, 80% have also reduced non-executive director fees by a similar percentage (an average of 28%).For companies where executive pay has already been cut, a third have also announced reductions for the senior leadership team. In these cases, the average salary reduction for senior management was lower, at 17% on average. Most companies have not disclosed the impact of such reductions on pension contributions, future bonus payouts or LTI awards granted while salary has been reduced.

- Bonus cancellation or deferral is less common; only nine companies have currently deferred or cancelled bonuses. When action is taken, it generally includes the bonus for the year just ending rather than for the year ahead and, in most cases, firms have simply deferred payment rather than cancelling it altogether.

- The current uncertainty is causing grave difficulties in setting three-year targets for long-term incentive plans (LTIPs). We expect companies to potentially delay LTIP grants as they consider the most relevant performance metrics and appropriate targets. However, so far companies have said little on this. To date, 3% have cancelled grants, 6% have suspended grants and 2% have reduced the plan maximum.

Insights From Early DRR Disclosures

As workforce changes continue to emerge, it is critical for companies to remain on top of any time-sensitive information regarding refocused executive governance practices in response to the evolving COVID-19 pandemic. Here are a few key highlights from the first 50 DRRs.

Pension Plans

Pension plans were the hot remuneration topic going into this AGM season. Of the first 50 DRRs, the pension contribution level for newly appointed executive directors has been aligned to that of the workforce in all but four companies. For 93% of these companies, pension contribution levels are being reduced. Full alignment of incumbent pension levels to the level of the workforce by the end of the policy will be achieved by 83% of these companies.

The Investment Association (IA) continue to take a tough stance on this issue and have already sent an early warning to companies with pension levels at or above 25% of salary that are not disclosing a credible plan for alignment to the workforce, with a RED Top recommendation based on pension for one of the first disclosures. In response, and to prevent potential further shareholder dissent, the company updated its approach post-publication to align the CEO’s pension level to that of the majority of the workforce by 2022, which saw a revised AMBER Top recommendation replace the earlier RED Top.

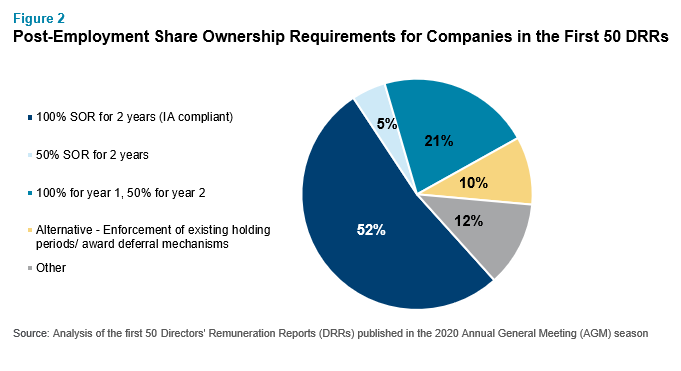

Share Ownership Requirements

One of the requirements of the revised Corporate Governance Code was for a formal post-employment share ownership requirement policy. Forty-two companies, 84% of this early group, disclosed a policy; four companies made no disclosure and only four companies have not implemented a formal policy at all. Of those companies that disclosed a formal policy, around half (52%) of companies are IA compliant (in-employment shareholding, for a period of two years post-employment). The other half of companies, whilst complying with the Code, have not implemented a policy that goes as far as the IA guidelines suggest. Instead, these companies have implemented a plan that reduces the share ownership requirement in the second year (21%), requires a lower shareholding for the entire two-year period (5%), or enforces the existing deferral and post-vesting holding periods already in operation for the variable pay awards (10%).

The IA have AMBER Topped all companies that have not followed their guidelines.

The expectation of the IA for in-employment shareholdings is that remuneration committees should set out the minimum share ownership requirement the executive is expected to meet, the time period in which the executive must achieve the requirement, and the consequences if not achieved. Over half the companies have disclosed a time requirement. Of those disclosing a timeframe to meet the in-employment shareholding, all but two specify a five-year timeframe.

Salary Increases

For those companies that disclosed an increase in salary for their executive directors in their published DRR, the median salary increase was 2.1%. Salary increases were in line with, or below, increases awarded to the wider workforce in all but two companies. The IA and Institutional Shareholder Services noted those companies with higher increases than the broader workforce in their voting recommendation (Amber Top from the IA and Contentious FOR from ISS). For 2020, over 20% of CEOs and nearly 35% of CFOs will have their pay frozen. Clearly, since the publication of their DRRs, several companies have since made further commitments on salary in response to the COVID-19 crisis, including proposed salary increases not being implemented or salary being temporarily reduced.

Incentive Opportunities

Annual bonus opportunity remains static, with only a single company increasing the maximum annual bonus opportunity in the policy. A small number of companies also disclosed an intention to increase the annual bonus opportunity, but within the limits of the existing policy maximum.

Median annual bonus outturns in respect of the 2019 financial year were 58% of the maximum opportunity, similar to last year, but below the longer-term average. Target bonuses for all but a single company in the first 50 are set to deliver no more than 50% of maximum for on-target performance, suggesting that these companies are broadly achieving target or are slightly above performance. There were several examples of remuneration committees applying downward discretion to the bonus outturns, typically due to health and safety incidents.

The median percentage of LTIP awards vesting is 69% of the maximum among FTSE 100 companies, which falls to 37% in the FTSE 250. The median vesting for threshold performance in this group is 25% of maximum. Where there has been a significant (i.e. greater than 20%) fall in the company’s share price, the remuneration committee is expected to reduce the size of the next LTIP grant. The impact of COVID-19 on share prices has been substantial. The share price of around three-quarters of this early cohort of 50 companies decreased drastically between 1 January and 31 March 2020, with an average share price fall of 33%. The share price fall of the FTSE 350 over the same time frame was 26%.

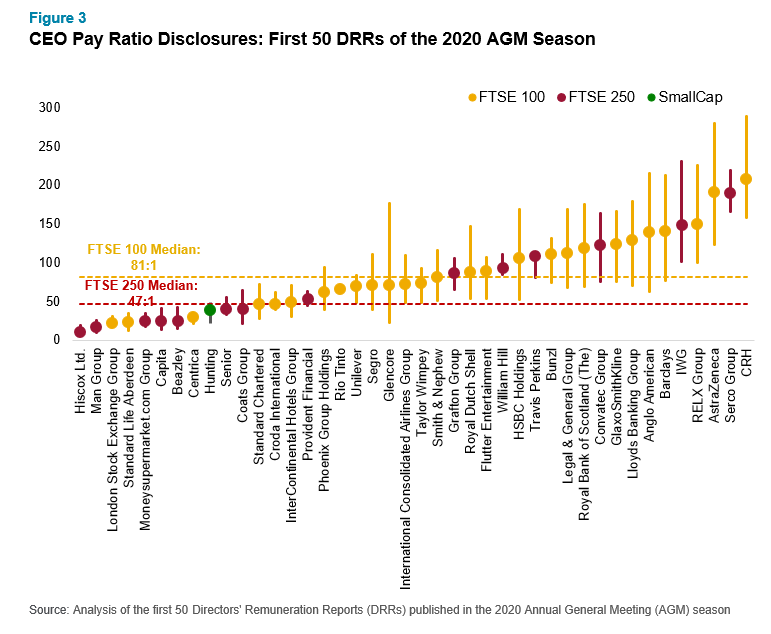

CEO Pay Ratio Disclosure

Companies who are within scope of the CEO pay ratio regime will be required to report their ratios for the first time this year. Sixty nine percent of companies used the methodology favoured by the IA: Option A. With relatively small samples of companies in the FTSE 100 and 250 in the first 50 disclosures, it is too early to draw conclusions on absolute levels of the CEO pay ratio.

Next Steps

The COVID-19 pandemic has undoubtedly heightened already increasing scrutiny on executive pay. We can expect assumptions on compensation to continue to be challenged, particularly where there is a notable disparity on the impact for executives compared to that of the company’s wider workforce and its shareholders. Shareholders, politicians and the media will hold companies and their executives accountable – a reality that holds significant reputational risk for both companies and individuals in the current environment.

Aon’s database of COVID-19 actions is available for special analyses of peer groups or industries. To learn more please write to rewards-solutions@aon.com.

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles