In the face of the challenges and disruption caused by the COVID-19 pandemic, businesses have opportunities to revamp their HR strategies to meet short- and long-term needs. Here are five useful tips for navigating and embracing change to secure a positive future.

The reality of the COVID-19 pandemic on businesses is clear: We are experiencing disruption both economically and from a human capital perspective. During this historic moment in time, it’s important to focus on what specific HR tactics can be applied to remedy not only short-term concerns, but also account for long-term considerations that will ultimately help build the talent needed for the future. This starts with embracing digitization. While a shift towards technology was already happening pre-pandemic, COVID-19 just turbo-charged the speed of this transformation. The firms that had already been addressing digital disruption to their business were, unsurprisingly, the ones best positioned to handle the current crisis.

Many job roles now have one labor market — for example, data scientists don’t just work within the technology sector; they can be recruited by health care, retail or any other type of industry. How you think through the implications of this, from structural changes to location strategy, is a crucial piece of the puzzle for navigating change. For many organizations, the COVID-19 pandemic has encouraged firms to determine their critical roles, focus on current talent and rewards philosophies, optimize their people spend and assess how well-positioned their internal systems are to support the future of work.

This article recaps a recent webinar collaboration with our partners from beqom, Five Key Rewards Trends & Tools for Navigating Change. During the discussion, we walked through five recommendations for overcoming new obstacles and how to use the right digital tools to inform better workforce and rewards decisions in the years ahead.

#1. Accelerate Workforce Change

Change is happening at a quicker pace than ever anticipated. Based on our COVID-19 Pulse 5 survey findings, conducted from August 17 to August 25, 72% of firms across industries are actively identifying functions and roles that can best operate remotely going forward. But, why stop at a virtual work model? What if you could adapt to long-term transformation from digitization as an extension to the return-to-workplace strategy? HR needs to serve as a strategic partner to help fast-track decision-making through data and analytics. We recommend using this market intelligence as a benchmark to evaluate and optimize your people spend and return on investment (ROI).

With accelerated change comes the potential for new risks. Therefore, it’s also essential to stay on top of people-related risks and determine ways to manage and prevent issues before they occur. We have seen increases in unwanted turnover for certain key roles like information technology, continued reputation risks fostered by more transparency on pay practices, and persistent pressure to invest in technology while keeping overall expenses low. Workforce and business success in an uncertain future go hand-in-hand with the strong establishment of agility, resiliency and trust, which is fostered by properly aligning your firm values and employee experience. It’s wise to include stakeholders in decision-making around change and communicate the benefits of the change throughout the process. The result should provide value to the end users, as well as to management, and the user experience should be smooth. To support this, investing in new tools to transform the HR function and build transparency, efficiency and proper governance is a necessary task.

Put simply, it’s essential to identify your workforce’s propensity to change, the impact of technology and your ability to safely adapt and transform longstanding practices at scale and speed — and to then weigh these against the cost of doing nothing.

#2. Release Economic Value

Most firms are trying to avoid layoffs throughout the pandemic, while also changing operating models and becoming more efficient. In fact, 71% of firms in our pulse survey claimed they are not looking to make layoffs this year, though we have seen some furloughs and performance-related cuts. Balancing improving company financials, maintaining productivity and retaining employee engagement can be tricky.

The first step to overcoming these challenges is to build an HR strategy that uses a data lens to examine current programs and create priorities for improvement. Focus on strengthening your pay philosophy, while also building a list of potential changes that adapt to future needs. For most firms, a simple starting point is examining your compensation to revenue and profitability ratios. This helps evaluate your people spend, not just based upon market benchmarks, but also against what the firm views as affordable. Then, you can improve your concentration on staffing levels, job architecture/career framework, location strategy and establishing new peer groups.

And don’t stop there — looking further into the future is important. Be sure to ask yourself how you will continue to evolve as a business, centering on the delicate balance of upskilling talent for certain roles while dealing with real work-life situations. By quantifying this from a data and analytics perspective, and then building a strategy rooted in facts, you will be able to drive a clear view of your people levers as they relate to cost and investment.

#3. Create Transparency

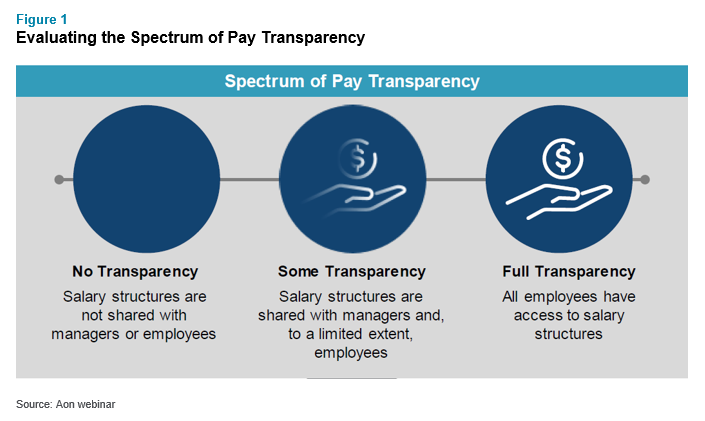

In the current environment, employees, managers and outside entities (e.g., regulators, shareholders) want more transparency around compensation decisions. This means organizations should be transparent not just when it comes to how pay is determined, but also about present job levels, functions and families and how they apply both in the current situation and down the road. Figure 1 below depicts the levels of transparency that exist as it relates to salary structures and programs.

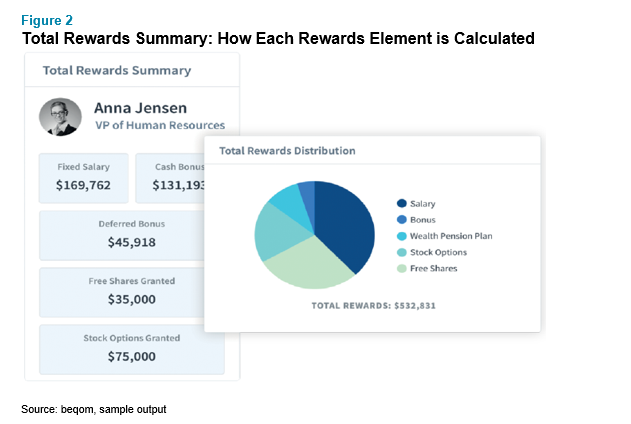

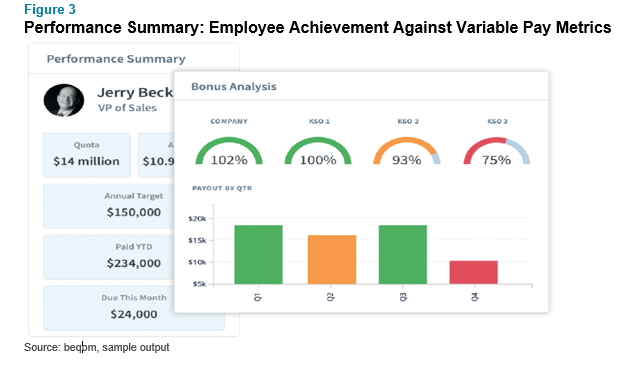

However, transparency is about more than just salary structures. It also requires communication, which is only possible with the right technology foundation. A comprehensive total rewards platform can give employees a view of their total rewards, in addition to visibility into exactly how their pay was calculated, including bonus, commissions and long-term incentives. It can also show employees their performance against the goals that drive their variable pay. A centralized compensation data repository arms managers and HR with the ability to analyze total rewards for internal and external fairness and competitiveness. Providing pay information to employees in real time is motivating and reduces time wasted on trying to understand their compensation.

Figures 2 and 3 below share examples of total rewards and performance summaries that provide pay transparency, helping employees understand how their pay is calculated and how their performance relates to pay. For both, it is important to use the appropriate technology and tools to offer the employee the fundamentals of what is expected of them from a performance perspective for their specific role, how they did against those objectives and how the components of pay stack up to deliver a competitive pay package. In each case, there is a clear increase in the use of transparency and buy-in for managers over-seeing the plan, HR administering the plan and the employees participating in the plan.

The common glue that holds everything together is an employer’s open, transparent relationship with its people. Creating an integrated experience for employees and managers will drive agility and performance, while at the same time, improving employee engagement — an incremental asset for retention during such ambiguous times.

#4. Enhance Employee Value

To become a top employer that individuals seek out is a two-way street — for your employees to deliver value, the employer must make them feel valued. This is especially difficult in today’s environment, where many individuals are still working from home (and may continue to do so). Appropriately rewarding your people is therefore crucial for allowing employees to see that their company values their contributions. We recommend taking a two-fold approach that includes both communication and technology: advising and enabling your managers to have detailed rewards conversations and giving everyone access to a full picture of their total rewards so they understand their value.

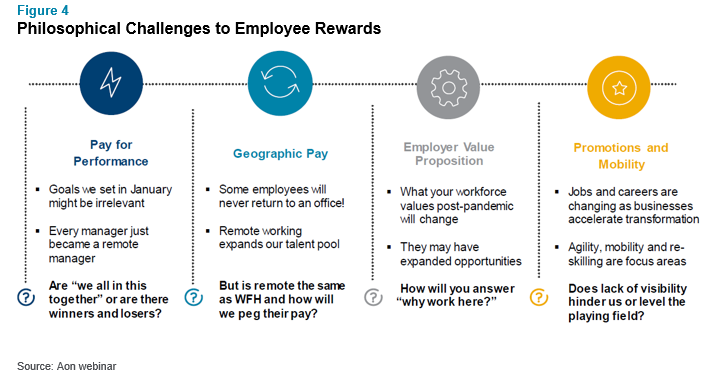

Figure 4 highlights four emerging challenges during the pandemic and key areas to consider as you enter into year-end pay discussions and plan for 2021:

Everyone is looking to create a culture and talent strategy that is more innovative and adaptive. How will you cross pollinate pivotal roles and skills and what career architecture will support a more agile environment? Since the COVID-19 pandemic, has your firm changed what roles are deemed “essential?” When you think about the talent pools for these roles, is it locally based or location agnostic? Examining the balance of pivotal, critical and support roles and where they sit geographically can influence your ability to optimize your talent sources and how much you need to spend to attract the right skills.

#5. Establish a Digital Foundation

Investing in HR technology now helps support everything we’ve discussed above. It’s the only way to continue to establish transparency and build agility within your rewards programs. Today’s increased focus on remote work has further accelerated the need for rewards administration tools. Achieving this all comes back to having a solid digital platform that allows you to manage a holistic rewards strategy. To do this, be sure to choose rewards management technology that is flexible, accommodates all components of pay and holds up against disruption -- no matter the circumstance.

To promote quick decision-making — which was forced upon us by COVID-19, but a valuable method to follow all the same — you must have a digital strategy that allows you to change compensation plans accordingly. How can you be nimble enough to make rapid plan changes, while at the same time, establish an agile working model that enables firms to react to these changes? It’s time to bring a technology angle to rewards design and management across the board.

Next Steps

As we continue to deal with the impact of COVID-19, we encourage you to use these five key steps as a framework for adjusting to the unknown and embracing change. These guiding principles are consistent across industries, but may be altered to conform to your specific business needs. Accelerate your workforce change by applying data analytics. Build a transparent environment so that all stakeholders understand what you are trying to achieve with your workforce strategy. Unlock the economic value of your workforce so that employees and shareholders win. And, perhaps most importantly, accelerate your digital transformation, as it will be the key to long-term success.

To learn more about navigating rewards through change or to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com. To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles