As the humanitarian and economic toll of the COVID-19 pandemic continues to climb, organisations across Europe are taking big steps, including layoffs and furloughs, to manage costs.

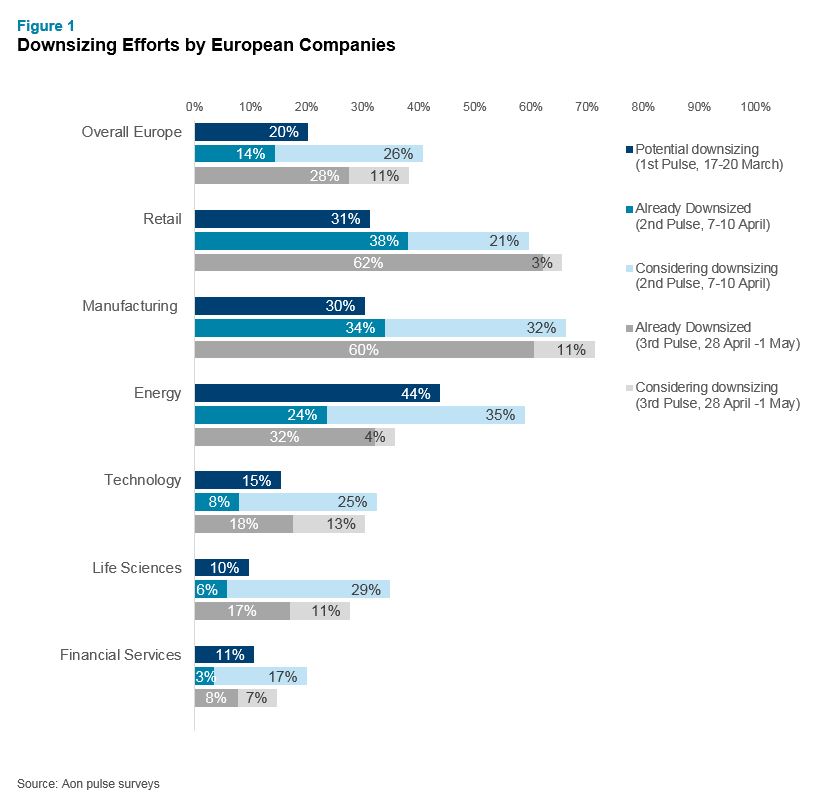

Organisations across Europe are accelerating plans to reduce headcount amid dire economic forecasts resulting from the COVID-19 pandemic. In a three-week period from late March to mid-April, there was a doubling in the number of survey participants who said they are planning to downsize their workforce via layoffs or furlough arrangements — from 20% to 40%. From mid-April to 1 May we did not see significant movement in terms of the overall number of companies with downsizing plans; however, during the second half of April, the number of companies executing downsizing efforts doubled, from 14% to 28%. This indicates many organisations considering downsizing earlier executed their plans by end of April.

The data comes from three separate Aon pulse surveys on workforce and compensation arrangements conducted during the COVID-19 pandemic, including our most recent on return to the workplace plans. More information and access to the survey on Adjusting Total Rewards Programs and Workforce Strategies in Response to COVID-19 can be found here. Results from our third survey conducted from 28 April to 1 May on Setting the Stage for a Return to Work and the New Normal, is available here.

Specific downsizing strategies vary by business sector. The highest levels of projected downsizing are in retail (including hotels, restaurants, wholesale and e-commerce), and manufacturing, which have been disproportionately impacted by government closures of non-essential businesses, followed by the energy sector. Financial services and technology companies are on the other end of the pendulum and have been more insulated from the economic downturn.

Sectors With High Levels of Downsizing

More than 60% of the retail organisations in the survey have already downsized by 1 May. The majority of these firms have furloughed employees; layoffs are more common across hospitality, restaurants and travel companies. “Laying off parts of your workforce is clearly not the preferred route, and most of our retail clients are avoiding it if possible by pursuing other cost-saving measures,” says Egé Edi Siva, director in the Rewards Solutions practice at Aon and leader of European data solutions for the technology, e-commerce and retail sectors. In fact, half of the retailers in the fashion industry and other e-commerce companies are not considering layoffs at this time. About a third of the retail sector have already deployed long-term restructuring plans for its operations and workforce, with an additional third considering doing so. “The COVID-19 outbreak is a major catalyst for the structural change we expected in the sector for years as more traditional retailers compete with a growing e-commerce industry,” Siva says.

An overwhelming number of manufacturing companies in our surveys are considered essential businesses, as a whole or in part. However, despite the continuation of their business operations, it seems consumer demand has dampened. Two-thirds of these respondents say they are planning furloughs or layoffs, with that number climbing to 85% for non-essential manufacturing businesses.

When considering the energy industry as a whole, 32% of organisations have already downsized their workforce via layoffs and/or furloughs as a result of COVID-19, and an additional 4% are still actively considering this action. This trend increases to close to 50% for just oil and gas companies in Europe. “After the initial shockwave triggered by the arrival of the pandemic, the recent signalling of a return to work has slowed the urgency for further downsizing actions, with many energy companies now favouring furloughs over layoffs,” says Carlos Andina, director in the Rewards Solutions practice and leader of European data solutions for the energy and transportation sectors. At the beginning of the pandemic, parts of the energy sector were already in distress due to other economic factors like falling oil prices. By mid-March, the sector was leading all others in the intent to downsize. However, with many headcount reduction efforts already implemented, the return to some level of work activity on the horizon in several European countries, together with mild signs of demand recovery in the oil and gas industry, have reduced the initial urge to downsize.

Sectors That Are Resisting Downsizing

Technology, life sciences and financial services are amongst the least impacted by the economic downturn.

Only 18% of technology firms responding to our most recent survey are reporting layoffs or furloughs, while 13% are actively considering them. On one hand, software firms are likely to benefit from the increased demand for cloud-based tools and productivity solutions driven by the drastic shift towards remote working. However, uncertainty over jobs, financial concerns and shut-down measures curbed consumer confidence and spending, which impacts hardware sales growth. And although the time people spend online has surged, online advertisement spend has slowed.

The percentage of financial services firms currently downsizing is also low at 8%, and most survey participants are identifying opportunities amidst the crisis. “Future working models, such as working from home or other flexible working arrangements, were identified as the most accelerated agenda items in response to the impact from COVID-19,” says Michael Densmore, senior manager of people analytics in the Rewards Solutions practice.

Alternative Ways of Managing Costs

While it’s clear that many companies across a variety of sectors are reducing headcount or considering such measures, in select industries these actions are not widespread, and many businesses are taking other measures to control costs.

There are other ways firms can review and make a change to their spending. Many companies, especially banks, are taking public pledges to hold off on workforce reductions for a stated period of time. Alternative measures include:

- Workforce Planning: Look at the size and shape of your current workforce and determine ways to manage costs through hiring and attrition.

- The Future of Work: How will emerging technology impact the workforce of the future and how can we plan for these disruptions now? Job functions that may be impacted by automation or augmentation down the road could be areas of focus now depending on your firm’s rate of investment in disruptive technology such as artificial intelligence.

- Employee Agility and Resilience: Review how employees work and what is needed in the future, such as increased remote working. Consider the longer-term cost savings from having specific functions permanently working remotely or alternative work arrangement such as a four-day work week.

- Total Rewards Optimisation: Consider the full employee value proposition and people spend through compensation planning. Survey employees to determine the rewards they value and where changes can be made with minimal negative impact.

Looking Ahead

As organizations begin to rethink their workforce needs in light of the changing economic realities arising from the COVID-19 crisis, there are a host of short- and long-term implications they will need to consider as they analyse and optimize workforce costs. Now more than ever, companies are facing unprecedented challenges to manage workforce costs and talent.

To address these challenges and help clients make informed decisions, we have designed tools to help businesses, including our new Talent Impact Modeler. This tool enables businesses and HR leaders to analyse their workforce and compare multiple scenarios to determine the impact of several voluntary and involuntary measures on the people costs within their organization.

If you have any questions about the topics discussed in this article, please reach out to one of the authors or write to rewards-solutions@aon.com.

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles