While the COVID-19 pandemic is unique, lessons can be learned from the Great Recession to manage this crisis. Below, we examine the rewards and workforce changes large technology firms made before, during and after the 2008-09 recession to see what can be applied today.

COVID-19 is forcing business leaders to react and respond to the first global pandemic in a hundred years. In the early days of the crisis, businesses moved quickly to keep frontline workers safe, establish regular methods of communications, set up remote working processes, update sick leave policies and initiate special short-term compensation arrangements. Now that these measures are up and running and stay-at-home orders are starting to expire, business leaders are thinking ahead about how they can stabilize and reshape their organizations. To help companies prepare for this next stage of this pandemic, we reviewed survey data from large technology firms during the Great Recession of 2008–2009 to see what lessons can be learned to manage the months and years ahead.

The observations below are taken from employment data submitted to the Radford Global Technology Survey by 33 market-leading, large-cap technology companies based in the United States. While our research covers the technology sector, we believe that the results are exemplary for other industries as well as they reveal managerial action designed to save costs but simultaneously protect employees and maintain the long-term viability of the business.

Lesson #1: Companies Changed Location Footprint and Proportion of Employees by Job Function

In times of economic uncertainty, organizations often reduce headcount. However, that did not happen on a widespread basis among large-cap technology organizations during the 2008-09 recession. Instead, these companies changed their employment profile. For example, staffing was refocused from the U.S. and Europe to China and India. These firms also redistributed the proportion of employees within certain job functions within the U.S. The percentage of employees in internal IT, finance and support functions saw an immediate decline during the recession that by 2013 still had not rebounded to 2006 levels. The proportion of support staff, for example, was reduced from around 20% in 2006 to around 12% in 2013. Conversely, in the U.S., there was an increase in the percentage of employees within the product development function. The proportion of sales employees also declined during the recession but rebounded fairly quickly. By 2013 the ratio of sales employees was actually higher than before the crisis began.

As businesses think about where to deploy resources during the current crisis, they can learn from how companies responded to the past economic downturn. First of all, history teaches us that large organizations who can afford it are successfully avoiding dramatic headcount reductions. However, unexpected risks (“shocks”) do become an accelerator of change. At the onset of the last recession there was already a trend towards offshoring support staff and focusing more on technical staff to drive product development in high-cost labor markets. In contrast, the COVID-19 pandemic will likely accelerate the digitalization of work with more people working remotely connected through quickly evolving networking technologies. Functioning teams will depend more on proximity by time zone and perhaps culture than proximity by location.

Lesson #2: Rewards Were Adjusted to Conserve Cash and Promote Long-Term Retention

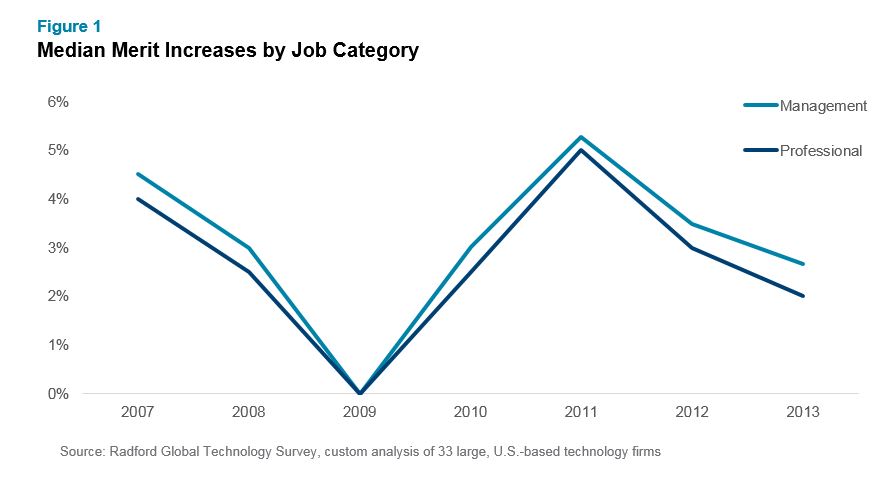

During the 2008-09 recession the more common approach among large-cap technology organizations was to freeze wages rather than cut pay. Immediately before the recession, there was evidence that labor markets were overheating with year-over-year merit increases at about 4% (the long-term average is around 3%). Merit increases then dropped to 3% in 2008 and were roughly 0% for both professionals and managerial employees by 2009. By 2010, merit increases were up again to between 2-3%. Interestingly, by 2011 large technology firms were able to “make up” for the lower merit increases two years prior with year-over-year pay increases near 5% for professionals and managers. By 2012, annual merit increases reverted back to their long-term average of around 3% for all employee categories.

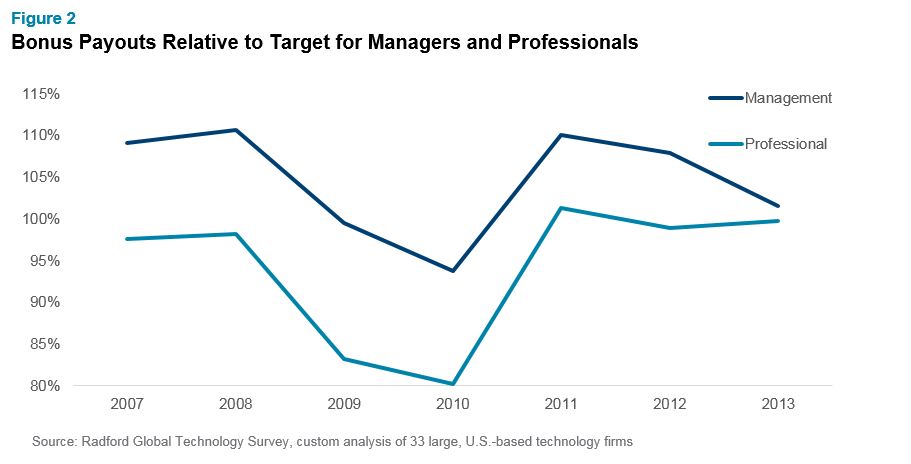

Meanwhile, bonuses declined rather significantly through 2009 and 2010. Still, even at its lowest level, the median bonus payment was about 85% of target for managers and professionals. By 2011, bonus payments were back up to historically average levels.

Interestingly, the data also shows that organizations partly replaced short term bonus payments by increasing equity grants. This was particularly pronounced in 2010 when bonus payments relative to targets were at their lowest and equity pay grants peaked for professionals, managers and executives.

Lesson #3: Prepare for Decreased Employee Mobility, but Still Pay Competitively for New Hires

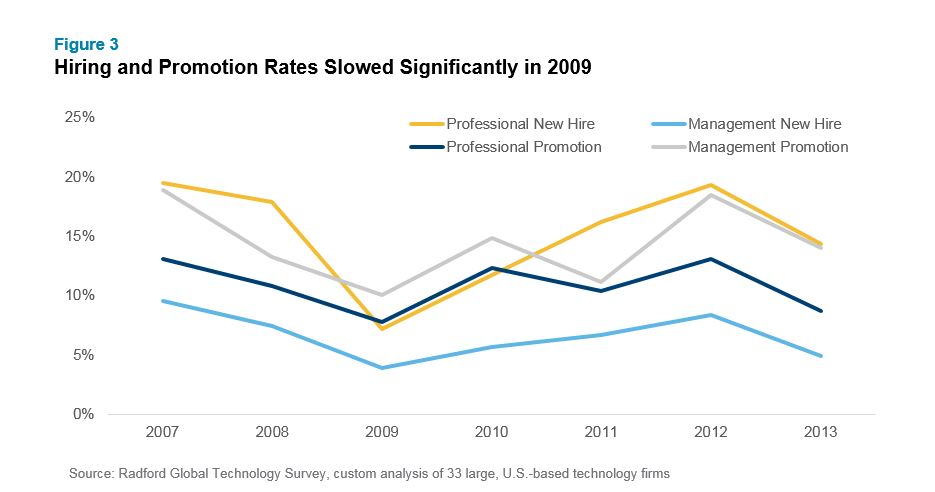

Generally speaking, an economic decline will slow down employee mobility, including hiring, promotions and turnover. The 2008-09 recession was no different. Once the financial crisis hit in 2008, the technology sector didn’t freeze all hiring but did become more selective in hiring only for critical positions. In 2009, for example, 6% of employees were new hires compared to 15% to 20% under a normal hiring environment. Throughout the crisis, technology firms still paid their skilled new employees higher base pay than their incumbent colleagues at the same level. This means firms were more selective in their hiring but offered what it took to attract the key talent they needed. The same did not hold true for support employees where newly hired workers were paid much less than incumbents.

Meanwhile, promotions declined sharply between 2008 and 2009 and did not recover to pre-crisis levels until 2011. Employee turnover also declined in 2009 as increasing uncertainty and lack of opportunity made employees more reluctant to take chances with a new employer.

A lack of mobility within and across organizations can slow down innovation and learning and we suspected that these large-cap technology organizations may have driven up opportunities for lateral career moves during those years to allow for staff development when lack of business growth limits career opportunities. To our surprise, however, lateral moves declined through 2009 and only slowly increased again in 2011 as company growth and increasing employee turnover generated more career opportunities for everyone.

Looking Ahead

The fact that large-cap technology organizations, by and large, did not have to resort to drastic employment measures during the financial crisis may not apply equally to today’s situation or to smaller technology organizations. Yet, it can be reassuring to see that rewards remained relatively stable during those years in this sector.

Importantly, it seems that technology companies did not reactively cut staff but rather continued to shape their organization through changes of their global footprint, vertical structure and functional structure to meet their long-term business goals. Also, while drops in their financial performance led to limited pay actions, the data suggest that the immediate impact on the workforce was measured rather than dramatic. What’s more, by 2011 employers started to “make up for it” by providing bigger merit increases and bonus payments.

What makes us look optimistically into the future is what we are hearing from our clients:

- Trends towards remote work and virtual shopping/entertainment will be accelerated and will likely increase the need for technology solutions

- Key people priorities related to competitive pay, fairness, diversity, long-term planning, rewards optimization and efficiency will remain

- Pandemic response efforts will continue and will undoubtedly elevate the importance of the HR function and likely drive broader conversations related to employee Health and Wellness.

For more information about the data, technology and services we can provide to help inform your COVID-19 response, please contact one of the authors or write to rewards-solutions@aon.com. We can run similar analyses for your industry or your peer group to help inform your next steps.

For more insights on how rewards professionals are responding to the COVID-19 pandemic, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles