We interviewed leading multinationals in the technology industry to understand what policies are in place and what lessons they have learned when handling volatile external situations.

Managing global rewards is challenging under normal circumstances, but when economic events or changes in trade or fiscal policy cause turmoil, the complexity skyrockets. It’s often difficult to understand the impact of sudden or volatile external situations on employees in faraway countries and to know if, how and when to intervene with a rewards solution.

To gain some insight into how companies handle these situations, we interviewed several of the leading multinationals in the technology industry that have operated internationally for many years — in some cases, for decades. We asked them what policies are in place and what lessons they have learned. How do they react, for example, when:

- There’s a sudden spike in inflation?

- Inflation is dramatically and stubbornly high, impacting the employee’s cost of living?

- Local currency takes a nose dive relative to the U.S. dollar or other hard currency?

- Changes in the local code cause employees’ net pay to shrink?

All these situations may impact employee well-being to some degree or, at the very least, can be a distraction from work. Often local management will reach out to headquarters and ask them to do something about it. Should you? And if so, when and what?

Below are some examples:

- “We did not intervene in Russia (in 2014, when the ruble plummeted, inflation spiked, and dollar-denominated loans became unmanageable) and are glad we did not”

- Monitor your actual compensation levels relative to the market over the short- and long-term to be sure you are not out of alignment

- “We are guided by how we pay to market’”

- “We use the ranges”

- “At the end of the day, we want to make sure we’re aligned with the market by offering competitive merit budgets

- “In locations where volatility remains high, we review after six months”

To illuminate these points, here are some specific examples:

Situation: Inflationary spikes / currency devaluation

Countries: Turkey, Egypt, Russia, Ukraine, Mexico

Generally, when inflation ticks up by more than a percentage or two, or the inflation rate reaches double digits, companies take a closer look at what’s going on in that market. The primary reaction tends to be “wait and see.” There may also be an upward adjustment of the overall salary increase budget. This is generally accompanied by a detailed analysis of market pay data to determine if further market adjustments to salary would be justified.

Situation: Chronic, very high inflation

Country: Argentina

Argentina has experienced chronic high inflation over the last several years, which has been partially built into the cost of labor and cost of doing business.

Historically, from 1944 until 2019, the inflation rate averaged 198%. During that period, inflation reached an all-time high of 20,263% in March 1990 and a record low of -7% in February 1954. More recently, from 2010 through 2015, inflation was relatively tame at about 15%, but then started to edge up to over 20% in 2016-2017 and spiked again in 2018, climbing monthly to reach 45% by year-end. It is now over 50% (as of March 2019) with expectations to end the year at 30%.

While companies do not match the inflation rate one-for-one in their pay actions, they do monitor it closely and it is an important consideration in their salary planning.

- “Argentina is a special situation. It’s been like this for years, but in the last six months it’s been really bad.”

- “Some companies have developed an ‘inflationary program.’”

Because of the high level of inflation and its unpredictability, nearly all companies have a policy of granting salary increases at least two times a year. They closely monitor the market by reviewing multiple and consistent sources of economic data along with market pay data and using that information, along with other market pay indicators, to grant salary increases at least twice a year. The first salary increase would typically be in the spring or beginning of the year, while the second would typically be in the fall.

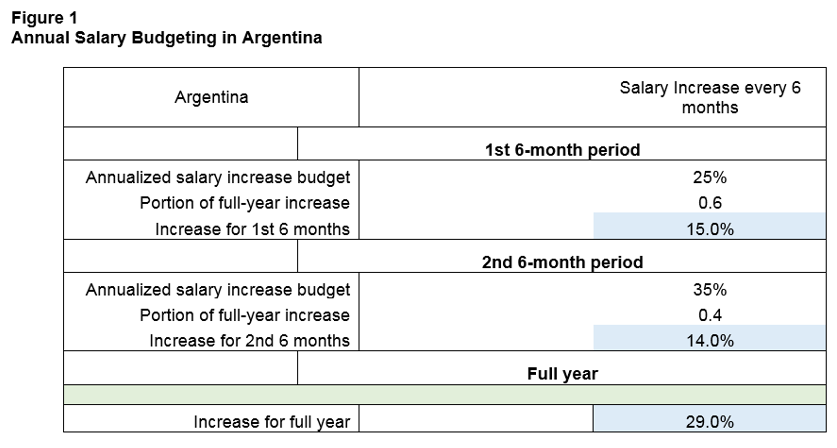

For example, if the overall annual salary increase is determined to be 25% at the beginning of the year, then a portion of that annual amount (e.g. 60%) or a 15% increase might be given in April (60% of 25%). If in the fall (i.e. 6 months later), the annualized increase amount has changed due to inflation and market pay changes, it would be adjusted. For example, if the annualized increase now trends at 35%, then for this 6-month period, the additional “true-up” for the year would be 14%, for a full year increase of 29%. An example of this can be found in Figure 1 below.

Although inflation is heavily considered in Argentina salary budgeting, it is not the only factor. Companies review the annual salary increase figures reported by survey vendors, conduct spot polls and track market pay, as well as consider overall attrition and payroll costs.

For reference, Radford’s Quarterly Trends Survey as of Q1 2019 indicates that median salary increase budgets for Argentina were 25% in 2018 and are forecast at 28% for 2019.

Companies do not, under any circumstances, pay in USD in Argentina, which is illegal, or tie the amount of local pay to the currency exchange rate. It is also generally not the practice to grant allowances or bonuses, temporary or otherwise, to cope with the volatility; increases go straight to base salary.

Situation: Tax code change significantly impacts employee net pay

Countries: Romania, Lithuania

An example of this situation is Romania in 2018 when the tax code changed, shifting the burden of social contributions from employer to employee, causing employee net pay to drop by 20% to 26%. Employer reactions were mixed. Many companies provided a one-time adjustment to pay to offset the tax impact, but many others did not. Some companies adjusted their ranges while others left them as they were until they had a solid read on market pay. When the dust settled, market pay in Romania increased by about 10%, far less than the amount of the full tax offset, one-time adjustments made by some employers.

Situation: Unionized environment

Country: Brazil

In recent years, the pervasive power of unions has declined, but it’s nonetheless important to know what salary increases are being negotiated as they may influence non-unionized environments. In general, unions negotiate increases along the lines of the inflation rate. Non-unionized employers may want to go above the salary increase percentages being negotiated based on the supply and demand and pay levels in their specific market.

Situation: Lower-cost countries

Countries: Portugal, Sri Lanka, Armenia, Bulgaria

In some countries, computer coding and other technical talent is relatively inexpensive, and demand is increasing. Because the absolute amount of the total payroll is still low, some companies are more relaxed about high compa-ratios and/or if the cost/productivity ratio is not as robust as in more experienced markets. However, what they watch out for is the point when expansion becomes costlier. (For example: lessons learned from China, where costs have accelerated over the years, and India, where the pay for higher-level jobs in particular have increased substantially.)

Next Steps

Compensating employees fairly and effectively with the optimal mix of rewards elements takes some philosophy, data and local market knowledge. For many companies, it helps if there’s a framework in place for sorting out different situations and then having general policies for dealing with them. Not every company approaches each situation the same way, but there are some common philosophies and principles guiding them all.

By and large, most companies have the following general guiding principles:

- Pay is set based on the local market cost of labor, not the cost of living.

- “We treat people consistently.”

- “We don’t match inflation or devaluation.”

- The cost of living or inflation rate is an indirect factor in setting salary increase budgets and pay levels.

- “We do not ‘equalize’ for inflation.”

- Local employees are always paid in local currency.

- “We made the mistake of paying in USD in Russia — and would never encourage that.”

- Local employee pay is never pegged to the U.S. dollar, other hard currency or a currency exchange rate.

- “We did that 10 years ago when we were smaller and less sophisticated, and it was a disaster.”

- “Never again; painful to unwind.”

In addition, when a country is experiencing a volatile, extreme, or unexpected external event, based on the experiences and advice of our leading multinationals, best practices include:

- Partnering with local HR/management and encouraging them to “talk to us about fact, not emotion.”

- Dig in to understand the facts and help all parties understand the market and how compensation practices are developed and support local business objectives.

- Get a pulse on what competitors are doing.

- “Spot surveys are a lifesaver.” If the situation is uncertain and a rewards intervention seems justified, make it temporary, but first review with Legal (because it may not be easy to eliminate when the situation passes).

- “If we need to react quickly, say for retention purposes, a temporary allowance may work, but it can be hard to wind down.”

- “Never heard of a company taking back money.”

- “Allowances, when given, are funded by local operating expense.”

If you have questions and want to speak with a member of our compensation consulting group, please write to consulting@radford.com. To learn more about participating in a Radford survey, please contact our team.

Related Articles