Share limits can impact your compensation expense

Employee Stock Purchase Plans (ESPPs) have continued to gain favor as an employee rewards tool to drive engagement and share ownership. On the plus side, they are generally straightforward to administer and represent an inexpensive way to create employee equity ownership — particularly when compared to stock options and restricted stock. However, the valuation techniques used to derive accounting fair values can be complex and often misunderstood. Fortunately, with a better understanding of the valuation mechanics, there are ways to more accurately value ESPPs that also reduce the expense. This article will explore the impact of share limits on ESPP fair values and how it can be used to reduce compensation expense.

Share Limitations

Most ESPPs allow participants to purchase company shares at a discount from contributions they have made over the purchase period, which is usually a three- or six-month period. The discounted price is often based on the lower fair market value at the start or end of this period. If the stock price declines during the offering period, additional shares can be purchased with their contributions. However, in certain instances, share limitations within the ESPP may prevent participants from purchasing these additional shares in the event of a price decline. The three main causes of share limitations include individual share limits, individual IRS purchase value limits and overall share limits of the plan — each of which is outlined below.

- Individual Share Limits: All ESPPs should impose share limits on individual purchases to establish a grant date for tax purposes. The limit does not have to be something a company would expect to hit, but some companies purposefully set a lower limit to conserve shares. For example, a plan may stipulate that an individual can purchase no more than 500 shares in a single purchase. Again, under the normal course of operations, this limit may not be hit. However, a price drop can result in plan participants bumping up against the purchase limit and the final number of shares purchased being constrained.

- IRS $25,000 Purchase Limit: In addition to the individual purchase share limit, tax-qualified 423 plans (which are about 80% of all ESPP plans) limit participants to purchase no more than $25,000 worth of shares (based upon the offering date fair market value) annually. For employees that are making significant contributions, this limit can cause purchases to be limited to keep them under the $25,000 threshold. Additionally, a sharp decline in stock price could cause employees who normally would not hit this limit to be impacted by it.

- Overall Plan Limits: Tax-qualified ESPPs must be approved by shareholders and include an overall share limitation for the plan. Generally, these share limits are set high enough that they do not impact the normal course of share purchases. However, sometimes these limits are reached more quickly than expected, especially if there is a rapid drop in market price and participants are able to purchase more shares. If the share limitation is at risk of being hit, the overall shares available for participants to purchase will be limited. For example, a plan may limit each purchase to 500,000 total shares each period. Less frequently, plans have an overall per-purchase share limit that may or may not be regularly hit, depending on employee contributions and stock price. In either case, contributions to purchase shares above the limits of the plan will be returned to the participants.

- Contribution Amount Limit: A less common limitation is a defined dollar limit applied to each purchase period. For example, a plan may limit individual participant contributions to $7,500. This limit can be useful for controlling costs and avoiding the administrative difficulties of the IRS’ statutory limit.

Under normal circumstances, a price drop during the offering period would allow participants to purchase more shares than they otherwise would have. However, in circumstances where the purchase of additional shares is prohibited or limited, the participant is not receiving the full benefit of the plan. This limitation on the potential value delivered to a participant should be incorporated into the fair value and provide a savings toward the overall ESPP expense.

Fair Value Impact

The goal when developing accounting fair values is to capture the potential value conveyed to plan participants. Share limitations can have real implications on an ESPP’s value proposition and should be reflected in the valuation. Listed below are the fair value components for ESPPs with a discount and a look-back feature:

- 15% of a share of stock

- 85% of a call option with the term equal to the length of the purchase period

- 15% of a put option with the term equal to the length of the purchase period

- Present value of interest foregone

Part of the fair value of an ESPP share is derived by taking 15% of a put option. What’s the logic behind this? As a participant, the look-back feature protects you from the risk that the market price of the company stock will drop. If the price drops, you can now purchase at the lower price, and your payroll contributions will buy more shares at that lower price. In other words, there is a protective put embedded in the structure of the ESPP that must be valued and accounted for properly. However, that benefit is dependent on the ability to purchase more shares in the event of a price decline. If that benefit is lost or diminished because of share purchase limitations, the fair value should be adjusted accordingly. Depending on the impact of the share limit, the value of the put option can be ignored or limited, thus decreasing the fair value of a share.

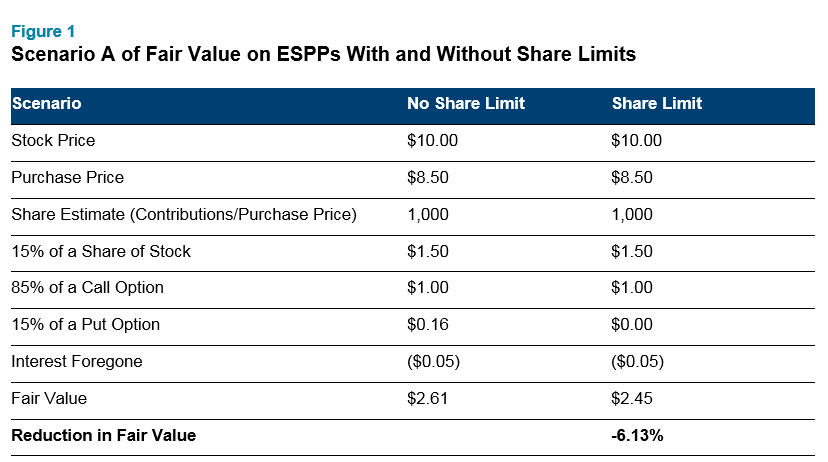

Consider a company that has an ESPP with a six-month offering period, a 15% discount and a look-back feature. The ESPP has a share limit of 1,000 per person and the stock price is $10. The following table illustrates the impact on the fair value for an employee who is contributing $8,500. The fair values below assume 40% volatility, 2.5% risk-free rate of return and a 0% dividend yield.

For this individual, or anyone contributing at or above $8,500, the maximum number of shares that can be purchased is 1,000. This means that the put option component has no value, resulting in a fair value of $2.45 rather than a fair value of $2.61 for an ESPP without a contribution limitation. This is approximately a 6.1% reduction in the fair value. The impact will vary by the individual depending on the amount of contributions. Employees contributing at levels less than 1,000 shares will receive the full benefit of purchasing additional shares if the stock price declines. Other employees will be limited in their purchase. For example, an employee who contributes $8,000 in the above scenario will be limited to 1,000 shares if the stock price falls to $9.41 or below ($8,000 / ($9.41 x 85%) = 1,000 shares). For these employees the put option component would fall in between the $0.00 - $0.16 range depending on the contribution level. Thus, the overall impact on expense will depend upon the distribution of contribution amounts, the stock price and the share limit.

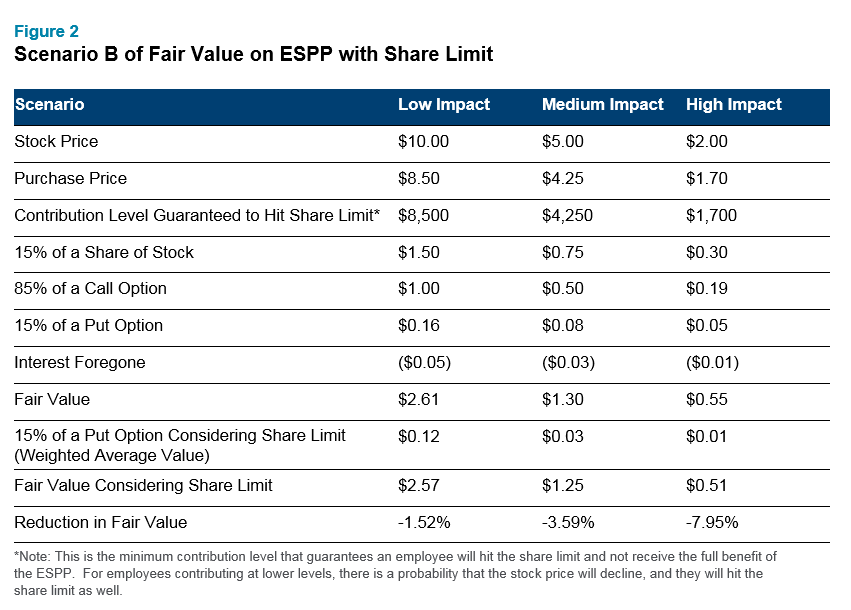

In Figure 2, we’ve categorized the impact to employees under the same scenario outlined above by low, medium and high impact. We assume that employee contributions are evenly distributed from $0 to $10,000. On the low end, an employee will experience a reduction of 1.52% in fair value, while a medium impact sees a reduction of 3.59%. The highest impact to a potential employee that contributes $10,000 annually to the ESPP plan under our scenario will see fair value drop by nearly 8%.

If a company experiences a drop in their stock price, participants are more impacted by a share limit than they ordinarily would be. In periods of even moderate decline, the impact on the compensation expense becomes more material and a company should incorporate the impact into the fair value for the ESPP. Even if a company has a high per-person share limit, a precipitous drop in stock price could still result in limitations due to the $25,000 annual limit for qualified plans, even if a share limit does not kick in. Ultimately, the right combination of contribution levels, share limit and stock price can result in more participants unable to purchase additional shares, and a company could realize a material reduction in the compensation expense with a more accurate measure of fair value.

Next Steps

If your company has an ESPP with a look-back feature, Aon recommends you make an assessment of the share limitations that participants may be subject to. If you determine that share purchase limits may be hit, either on an individual or aggregate basis, the fair value of the ESPP should be adjusted accordingly. Following this advice has the potential to save upwards of 5% on the overall cost of an ESPP. By taking advantage of these accounting considerations, you may be able to extract a better return on investment from your ESPP.

If you have questions about whether this valuation technique can be used to reduce your ESPP compensation cost, contact us at consulting@radford.com or visit us at radford.aon.com/valuation/.

Related Articles