Investment banks are hiring in Riyadh in anticipation of a boom in fees, as the government emphasises efforts to wean the economy of oil.

The Kingdom of Saudi Arabia (KSA) is diversifying its economy away from oil under the National Transformation Program (2020). The growing clamour around this, and the Crown Prince’s 2030 vision, has resulted in all firms under the jurisdiction of The Capital Market Authority (CMA) to consider how to exploit potential opportunities. In light of these developments, firms should review their business and operating models, client service, and ensure that employees and shareholders are aligned through a resilient human capital framework and philosophy.

Local Authorised Persons Show Mixed Performance, While Global Banks Breed Optimism

The Kingdom has seen re-investment from international heavyweights such as Citigroup, who in 2004 sold its 20% stake in Samba Financial Group, reallocating the capital to core investments. Fast forward 13 years, and Citigroup is awarded a license by the CMA, which provides a full range of Investment Banking and Capital Markets services, marking a spectacular return to the Kingdom. Credit Suisse has allocated around $600 million of its capital to expand in the country, as it seeks a fully-fledged, on-shore private banking business. Deutsche Bank recently announced its intention to target the Middle East as a priority region for wealth management and the firm’s growth agenda. This is a result of more capital flowing into the region as the Kingdom opens up. Goldman Sachs recently received approval to trade equities in the Kingdom, joining the growing group of investment banks and asset managers who are looking to expand their businesses here.

Against this backdrop of future optimism from international firms, some local firms have been struggling with current financial realities and performance constraints. 2016 Net income across a spectrum of the top local regulated Authorised Persons (AP’s) reduced on average by approximately -20% between 2015 and 2016. The brokerage business was hit particularly hard across the industry, causing firms to revise budgets and targets downward throughout 2016. However, in 2017 we are seeing companies returning to the drawing board to ascertain how to recoup these losses. Actions are being taken to review incentive plans to focus on sales to drive growth, including right-sizing the franchise. Firms are applying measurement to determine the optimal skillset within the sales function, establishing new business lines such as private equity and asset management and diversifying existing business lines through joint ventures. Simply put, every company is repositioning itself in some way.

The Kingdom’s Capital Markets Development Efforts

Development efforts are contrasted against increasing changes in regulation and the modernisation of the capital markets business. The investment needed and mandated by the regulators to facilitate the broader opening of the Saudi Stock Exchange (Tadawul), and the inclusion into the MSCI index, has resulted in firms looking at all business/product lines and corners of their infrastructure to ensure optimal performance. They are ready to ‘hit the ground running’ once the market rebounds.

Earlier this year, the Tadawul completed its transition to a T+2 settlement cycle for all listed securities. It introduced securities borrowing and lending, and covered short selling for all listed stocks. This substantially enhances the ease of trading, creating new opportunities for global market participants, many of whom use securities lending and borrowing to manage the settlement process. In addition, the Tadawul launched the “Nomu Parallel Market” as an alternative Equity Market with less stringent listing requirements compared to the main Market.

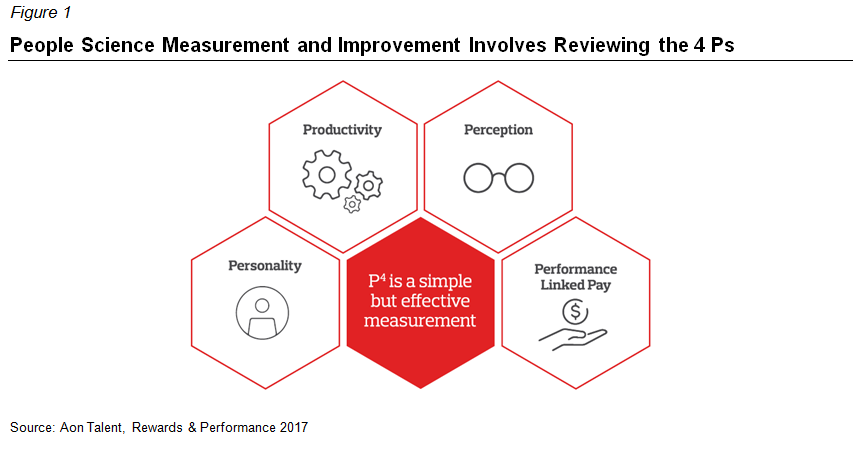

Firms should be taking a bold approach, and using the latest people science to improve their current performance, and effectively adapt to reap the benefits of a market turnaround.

1. Productivity

Productivity evaluates a firm’s performance across a number of metrics, benchmarking them against the local market standard. How can you ensure that your firm or business unit is a top performer compared to other firms? The context in productivity is attained through evaluating vital scaling metrics including:

- Revenue per head

- Cost per head

- Front office / back office ratios

- Grade pyramids

- Total and relative headcount

Annual financials provide a helicopter view of performance, yet struggle to show the true detailed story. Our proprietary analysis reveals that some firms are significantly over-investing in certain front office functions. This may be a result of too many heads for the size of the generated business, or an over-staffed back office, which causes role duplication and other inefficiencies. It can also lead to incorrect structuring of sales teams, and companies not bifurcating appropriately by product type:

- Should firms have dedicated or centralized sales teams for discretionary portfolio management vs mutual funds vs brokerage?

- APs are increasingly branching out into private equity, but are compensation models aligned for investment professionals versus capital raisers?

- Is sales staff sufficiently skilled to market alternative products to more sophisticated investors who are diversifying asset allocations?

- How many investment centres should a firm have and how big should they be across all three provinces in the Kingdom?

- How are the local banks and capitals incentivised to collaborate and foster growth and synergies

- Client centricity is of paramount importance.

- For bank affiliates, how big should the back office be?

- Some firms run certain control functions with a skeleton staff, which could result in them being unintentionally subjected to material key man and operational risk.

In some instances, firms appear to have the right mix of staff across business units, from front office to back office, yet still lag the competition in performance – but why? It is likely that employees in these functions may not have the required skill set or personality to do the job.

2. Personality

Our Adept-15 assessment tool that evaluates 15 unique aspects of personality—grouped into six broad work styles, has shown that highly successful relationship managers, business developers, and salespeople tend to share common traits when measured pre-entry and developed post hire. This is palpable performance management from the start to the end of the employee life cycle. You can measure and identify the best personality traits, align them with a firm’s culture and a particular role such as an optimal producing salesperson, and determine the gaps that an organisation has. This then allows opportunity to formulate recruitment, training, and development exercises to grow the culture and performance from a bottom-up and top-down perspective. Every firm should aim to place the right talent in the right role, and provide training for employees when necessary.

3. Perception

Once the right people are in place, the perception, the third P, of a company is vital in driving performance. A firm could be structured optimally and hire exceptional relationship managers, but if its overall perception is subpar, the company and its employees will never achieve their true potential. All too often, a firm may hire highly skilled sales or capital raising staff from a competitor in the hope of migrating and growing a thriving business, such as an investment management or private equity firm, only to see it never fully succeed.

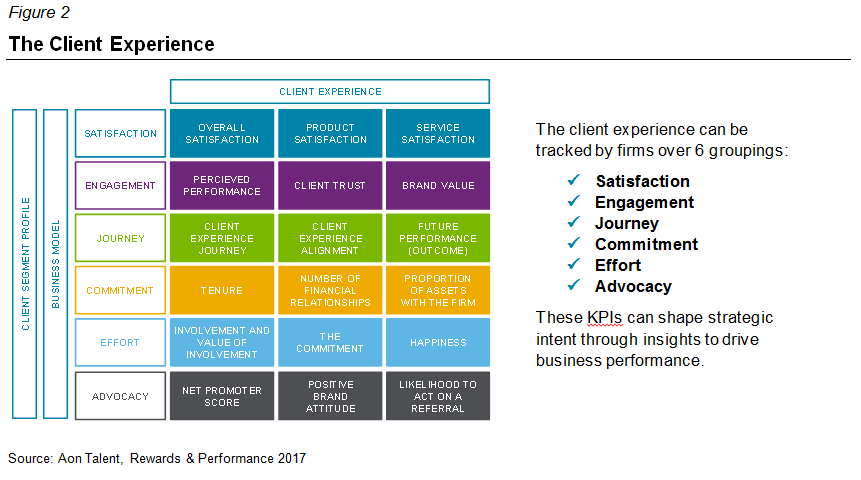

Linking client feedback and the perception of a firm to employee measurement is a key step in enhancing firm performance. Whether a small investment house or a large brokerage, investment banking, or wealth management firm, strategic intent should be partly driven by client satisfaction and feedback on the following:

- People: How well are the clients served, interaction with RMs, products specialists, etc.?

- Process: Focus on technology, onboarding process, transaction process, after sales, etc.

- Products and Services: Satisfaction level with products, pricing, access to global markets, transaction banking, and broader wholesale banking products

Firms, especially those with large asset and wealth management functions, need to track, develop, and unearth insights through KPIs across all of the above. Our approach to this is illustrated in Figure 2.

4. Performance-Linked Pay

Managing pay and linking it to performance is imperative under the current economic conditions. Local firms struggled in 2016 to produce budgeted results, with many having to adjust throughout the year and lower their forecasts. This was typically followed by a year-end quagmire. Firms fought for a bonus pool that was big enough to retain key employees and reward successful business lines, while balancing the return to shareholders, where net income had reduced materially.

The problem is evidenced by the high-level pay-out ratios of total staff costs as a percentage of revenue, which rose +25% on average across the industry, >50% when viewed versus net income. Although firms generally paid less or the same on a per capita basis, as a percentage of revenue and net income, they were forced to pay more to retain key employees and avoid jeopardising future business performance. Companies without a clear flexible framework that contains no checks and balances often struggled to attain or agree a bonus pool that was fair for both the business and shareholders.

Another area that firms grappled to understand is the right level of commission. Some firms have commission schemes that are not incentivizing enough. To earn a commission, the targets reach too far or are too stringent—this is hardly the system to choose for your sales staff. Investor sentiment is changing, and with it, investor requirements. This is all happening during a market downturn. Furthermore, a number of bank affiliated firms did not have appropriate sharing schemes in place with the bank. In some cases, this resulted in the capital arm servicing and managing client relationships yet provided little incentive to service those client relationships beyond the first year. From a business perspective, such a situation is counterproductive.

In Conclusion

It is necessary for firms to continually evaluate and innovate their business and total compensation strategies to adapt to changing business conditions and environments. A transparent compensation and reward strategy should attract and retain the very best talent. A well thought-out strategy will ultimately foster business growth and deter the disengagement and disenfranchisement that can potentially result in both employees and shareholders.

To avoid surprises, we recommend that your firm clarifies the value-sharing proposition between shareholders and employees. It is imperative to upgrade your HR analytics and performance management, while embracing top performers at all job levels. The sooner firms fully understand the 4 P’s – productivity, perception, personality, and performance-linked pay – the sooner they can move towards growing their business.

In today’s business environment, it is no surprise that the delivery of “business performance through people performance” has risen to the top of the CEO and leadership agendas. It appears destined to stay there for a good while to come, and the firms that do not address these issues are sure to fall behind.

Related Articles