As pre-IPO companies generate more revenue, they are more likely to make changes to their short-term incentive plan targets, eligibility levels and performance measurements.

As pre-IPO companies generate more revenue, the composition and design of employee compensation packages naturally evolves. Smaller revenue-generating companies are more likely to grant employees incentive compensation delivered almost exclusively in stock options rather than invest in a cash program. However, with pre-IPO companies taking longer to go public on average, employees can become concerned about the liquidity of their equity compensation. In response, some private companies have begun to allocate a significant amount of their payroll to variable bonus plans.

With that in mind, we took a closer look at bonus plan design at pre-IPO technology companies to provide some insight on how plans evolve as companies grow their revenue. To begin our analysis we divided the pre-IPO companies in the Radford Global Technology Survey into three buckets: companies with revenue up to $10 million (small companies), over $10 million but less than $50 million in revenue (mid-sized companies), and $50 million or more in annual revenue (larger companies).

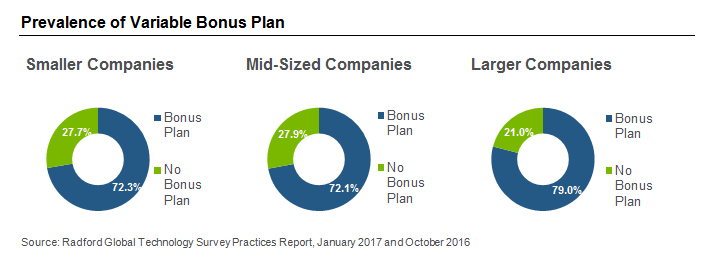

At a broad level, our analysis finds bonus plans are more common among the larger companies but there is little difference among the small and mid-sized companies.

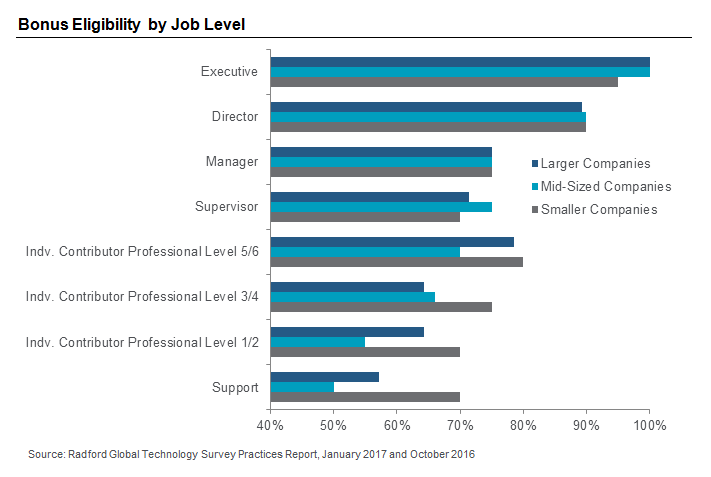

Beyond the presence of a bonus plan, there are also significant differences among bonus plan features based on company size. Smaller companies are more egalitarian in their eligibility below the C-suite. There are several reasons that explain this: smaller companies typically have fewer employees and less hierarchy in the organization. Position titles may also be more inflated. With this workforce structure there is a mentality that everyone pitches in and has a part in building the company that can be more pronounced than larger pre-IPO companies.

Beyond workforce structure and culture, there are also the obvious competitive pressures that can cause smaller companies to adopt a bonus plan. As they become more popular, competitive pressures dictate that more and more startups will adopt short-term incentive plans and eventually prevalence figures will rise. However, once a job role is eligible for a bonus plan, that eligibility is almost never taken away. This should be an important consideration for startups. As new job roles and levels are created, larger pre-IPO companies may be more discriminating in their eligibility for those new positions.

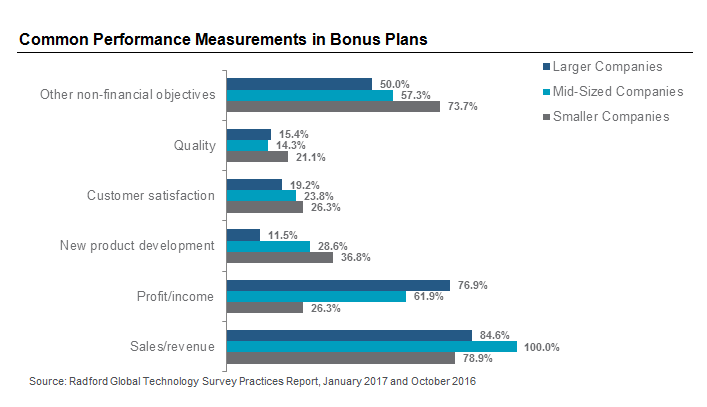

When it comes to performance measurements for bonus plans, there are clear differences based on revenue size. Smaller companies are more likely to tie their bonus plan to sales and revenue targets and other specific non-financial objectives, whereas larger pre-IPO companies are more likely to use a variety of measurements including profit and income, customer satisfaction and quality.

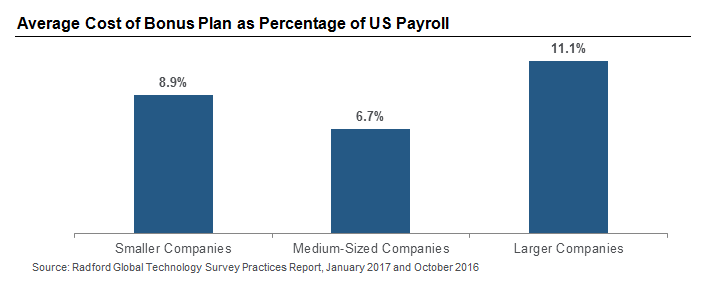

Finally, we looked at the cost of a bonus plan. Smaller companies spend 8.9% of their US payroll budget on bonuses (for US employees only). The expense drops a little to 6.7% of payroll for mid-sized companies but jumps up significantly to 11.1% at larger companies. Smaller companies appear to be stretching their budget to provide a cash program to retain employees and provide them with tangible rewards beyond salary in the absence of immediate liquidity in their stock awards. Additionally, the egalitarian approach to bonus eligibility is likely a contributing factor in the expense as a percentage of payroll. On average, bonus amounts are more at larger companies, which accounts for the higher percentage as a cost of payroll.

Next Steps

Bonus plans are not an automatic component of a total compensation package for many pre-IPO technology companies in the US, but they are becoming more common. As such, it would be prudent for startup organizations to think about whether a bonus plan makes sense at their own organization by asking questions such as:

- How much can you afford to fund a bonus plan?

- Should our bonus plan be self-funding?

- Is a bonus plan the best use of your cash resources?

- How does variable cash comp fit into our overarching pay philosophy and impact other pay elements?

- How much of the bonus should be weighted towards corporate, unit or individual results?

- How frequently should I be paying out?

Smaller companies that want to adopt a bonus plan will want to carefully consider how much to fund the plan and how to set targets that drive the most important business goals, such as sales growth and profitability. Larger firms may consider non-financial measurements, such as operating metrics and customer satisfaction. As we can see from our research, plan design features will vary depending on the unique characteristics and goals of the company. Company size is an important influencer of plan design, but ultimately it’s just one of many influencing factors.

To speak with a member of our compensation consulting group about adopting a bonus plan or other questions, please write to consulting@radford.com. To learn more about participating in a Radford survey, please contact our team.

Related Articles