In the life sciences sector, small and newly public biopharma companies have more flexibility to use equity liberally. Larger companies need to be more targeted in their approach to compete.

Smaller life sciences companies have an inherent advantage over more established, larger biopharma companies: principally, the flexibility to grant higher levels of equity to their smaller workforce without as much concern about managing dilution rates. This is a powerful tool in the competitive life sciences sector.

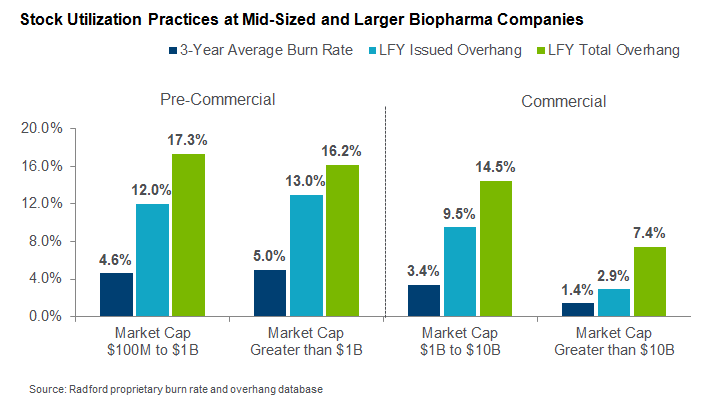

The chart below illustrates how burn rates and issued overhang drop as companies transition from pre-commercial to commercial. Among commercial companies, higher market cap is also associated with decreased burn rates and overhang.

There are several reasons for this disparity in burn rates and overhang. For one, newly public life sciences companies that qualify for emerging growth company status aren’t subject to as much shareholder and proxy advisory firm scrutiny over their compensation. Secondly, a majority of companies going public (about 80%) have evergreen provisions in place that afford them flexibility to issue more shares. Finally, with typically smaller workforce sizes, mid-sized market cap businesses may afford to spend more on equity per employee— and typically have less cash to spend on payroll vs. larger, commercial companies.

The Four Pillars that Drive Equity

So what can larger, commercial biopharma companies do to compete on equity? There are four important levers in an equity compensation program that can be pulled in different directions depending on each firm’s unique circumstances: participation, award size, equity vehicles, and administration. Companies need to prioritize what is most important to them, while also realizing they will have to make sacrifices in order to attract and retain high-performing employees, ramp up hiring needs and/or compete for talent in markets where demand outstrips the supply for certain skilled workers. In other words, acknowledging you simply can’t “have it all” on equity is an important admission to make internally.

A startup company that values wider equity participation and uses stock options may have a 100% participation rate that allows all employees to be rewarded upon a successful IPO. Most startup company employees are familiar and comfortable with the high risk/high reward associated with this type of equity program. But differences between these pillars are more nuanced as companies grow. For example, what should a mid-cap company with growing headcount do when it still uses stock options and the projected share needs exceed the annual equity pool funding? In this case, it might be time to consider using the equity plan levers to adjust the overall equity strategy. Alternatives may include:

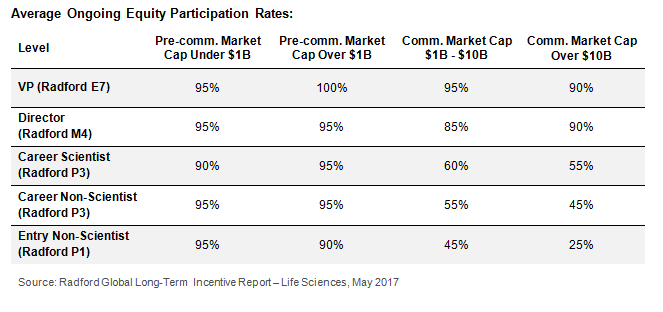

- Selective participation: Consider reducing eligibility at lower levels, for non-scientific or sales employees, or for employees in smaller markets or international locations. The chart below shows a dramatic drop-off in participation rates at commercial life sciences companies below the director level.

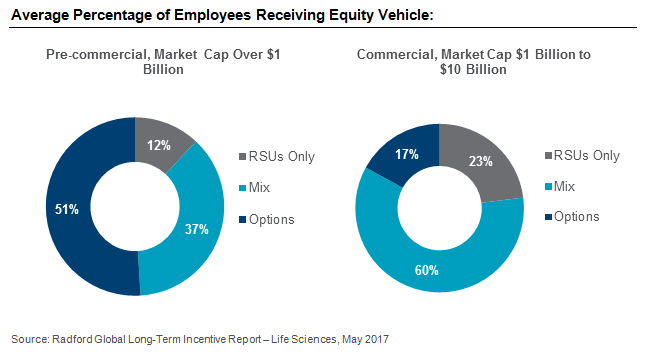

- Add restricted stock into the vehicle mix: Consider migrating to RSUs to deliver similar value via fewer shares, but be mindful of downstream implications (e.g. taxation upon vest, employee education, etc.). The charts below illustrate the growing popularity of RSUs as life sciences companies go commercial.

- Adjust award levels: Consider applying a reduction to ongoing and new-hire award guidelines to manage burn rate and share pool usage. While this may seem like an easy solution, companies should be mindful of keeping their equity award levels competitive for their most critical and high-performing employees. New-hire awards at the top of the market tend to be 2x to 3x ongoing equity award values. However, not everyone needs to pay at the top end of the market, and it might make sense to lower targets and stretch to the higher end for certain hot jobs or high-impact talent.

- Consider administrative components of your program: As award sizes are adjusted down, a shorter vesting schedule (typically three years instead of four years) could be considered as a means to deliver value sooner and offset the reduction. Before making any changes, you’ll want to factor in the timing of when new hires are eligible to receive an ongoing equity award. Do you have a cutoff date or prorated award policy for new hires in their first ongoing award cycle? Similarly, how are you handling promotional adjustments? Tightening up these policies can generate significant share pool savings.

Next Steps

Aside from considering how the four pillars can influence equity practices, there are additional measures life sciences companies can take to compete more aggressively on equity in certain markets and jobs. While we mentioned reducing equity participation, that can raise concerns about retention. To prevent losing your most critical talent, you may want to introduce additional cash opportunities or introduce benefit enhancements at job levels where eligibility is reduced. Some of these opportunities don’t have to cost a lot either. Our own research on talent and perquisite practices shows that companies with small monetary recognition programs can result in significantly higher employee engagement.

Most importantly, consider your equity plan in the context of your total rewards philosophy and plan ahead. An effective equity strategy will balance external competitiveness, internal constraints and company culture. And not all are weighted equally. The most effective equity strategy involves planning your growth and hiring strategy over the next one to three years and taking a proactive stance.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles