Missing some tricks from your top bankers and relationship managers? Paying them too much? Evidence suggests you are likely doing both.

The Mid-Life Dip

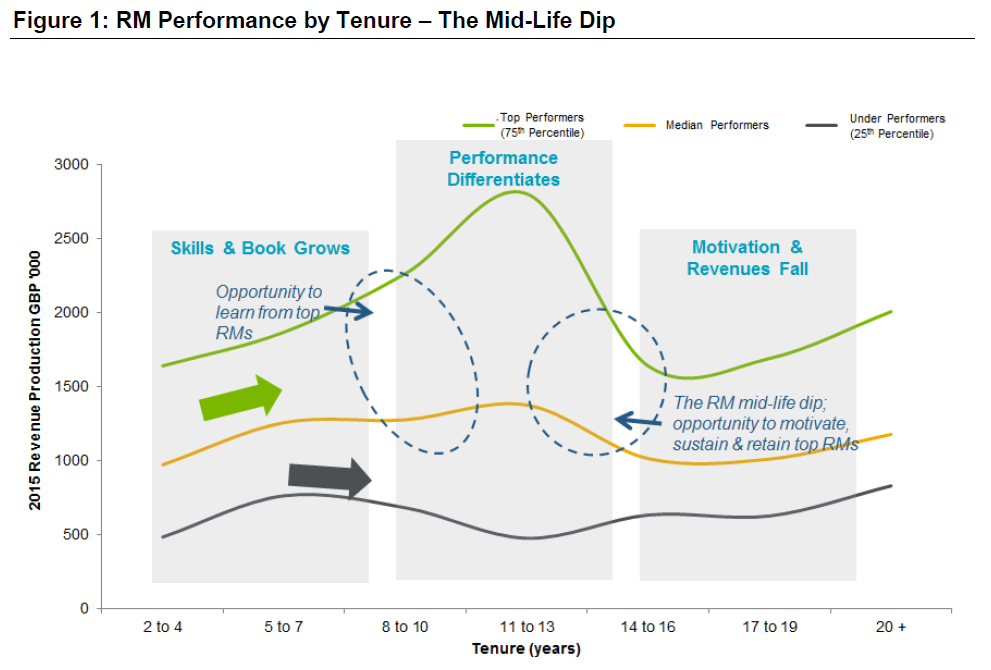

Recent analyses of relationship manager (RM) productivity are quite thought provoking. Figure 1 shows that at the start of their tenure in a firm, top performers typically outperform their laggard colleagues by a multiple of three, rising to four to five times at their peak performance after about 10-12 years. But, maybe most worrying, after 10-12 years, performance typically drops back to a multiple of only two to three in the later years of their mid-life dip.

Indeed, not only could we be learning from this elite group of top performers in their early years, but also we should be trying to better understand what motivates and engages them to better sustain their own superior levels of performance in this mid-life dip.

The Hidden £10-100 ms

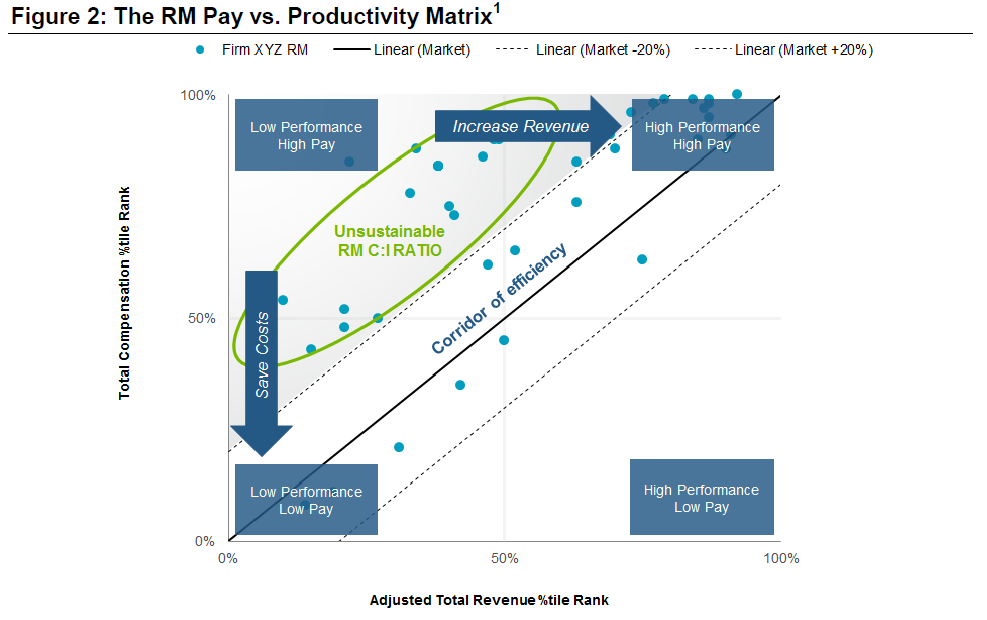

Increasingly, a number of the more progressive private banks and wealth managers have been using the appliance of people data science to improve business performance of their front office, often to the tune of tens and hundreds of millions of pounds. As in Figure 2, analyzing a market view of individual relationship managers’ pay and productivity, firms are identifying cost savings and revenue enhancements, depending on where their RMs sit in a simple pay versus productivity matrix. RMs sitting above the corridor of efficiency have cost:income (C:I) ratios that are simply not sustainable over the long term.

Military Secrets

However, to date firms have struggled to generate insight and apply objective learnings from their top performers, struggling to bottle what makes them so successful, let alone administer that secret potion to their other bankers.

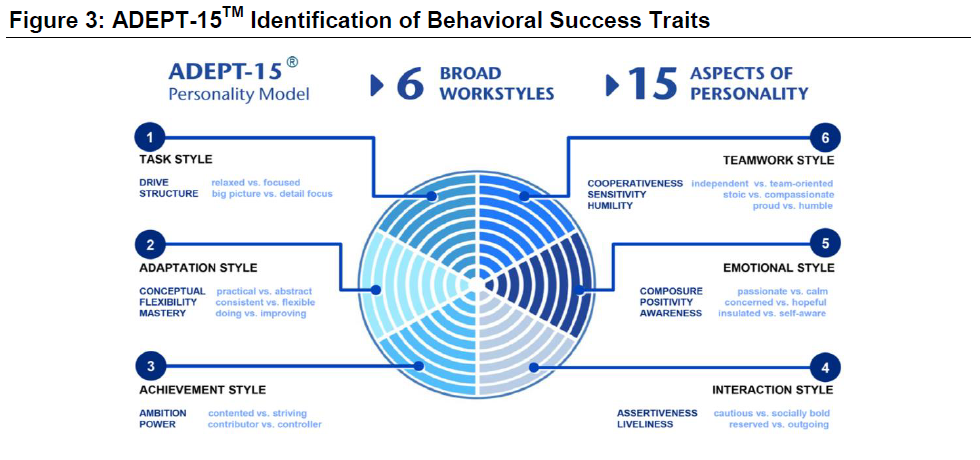

But, times are a changing – the recent emergence of more sophisticated artificial intelligence profiling tools such as ADEPT-15 is now enabling firms to create a true DNA blueprint unique to their firm of top performers' behavioral success traits. Borne out of technology used by the U.S. military, assessments can dynamically adapt questions asked of candidates to stop them from gaming what the right answers should be for a particular role. This adaptive, artificial intelligence aspect is vital to create a true profile of an individual’s behavioral traits.

It’s Not Just About What You Do, It’s About How You Do It That Makes the Difference

When we link these profiles to business results, such as client experience, productivity, and conduct, we see that another commonly accepted adage is holding true – it’s not just what you do, it’s about how you do it that makes the difference. Despite many firms diligently distilling best practice into manuals of what a RM should do, evidence is now suggesting that it is an individual’s behavioral traits – the how – that really make the difference between being a top performer or not. Of course, these success traits vary not only by role, such as a relationship manager versus a product specialist versus support functions, but also by firm culture. So, what might make a RM successful at one firm can be subtly, but critically, different at another.

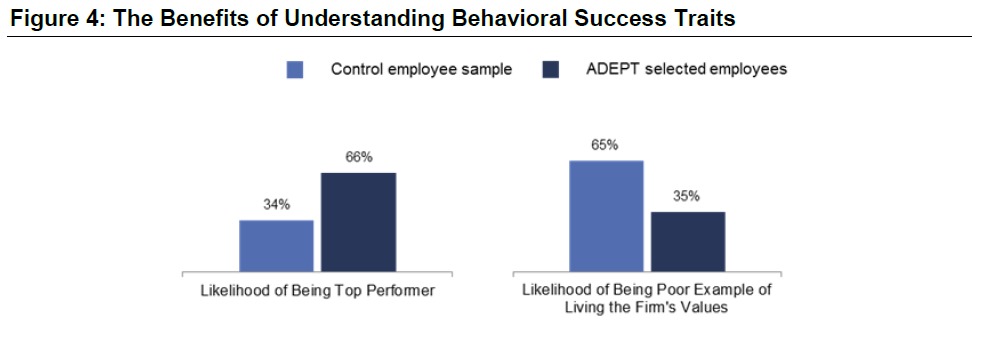

Improving the Chances of Hiring a Top Performance by 200-300%

In fact, the firms applying this science to their talent selection are already seeing dramatic improvements – ultimately increasing the chance of recruiting a top performer by a factor of 200-300%.

The Appliance of (People) Science

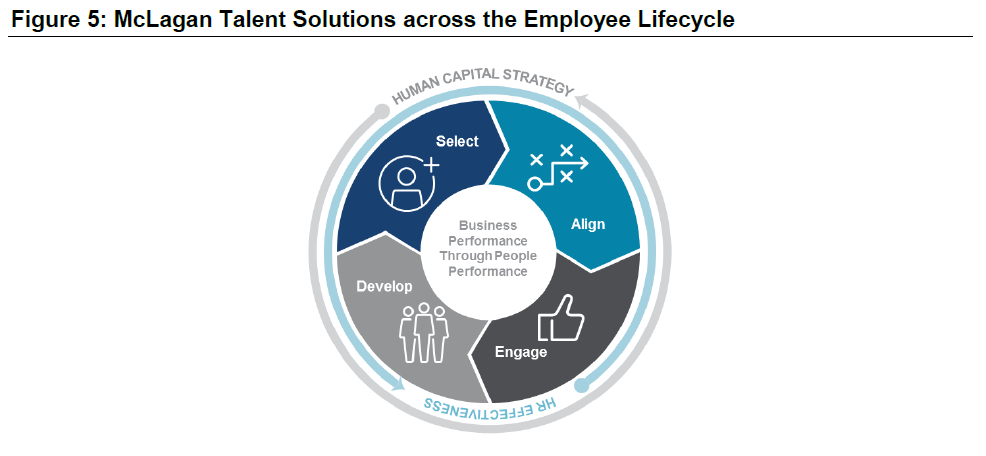

This new wave of people science is increasingly being used successfully across all elements of the talent lifecycle to make more effective hiring decisions, design more impactful development curriculum, reduce conduct risks, and improve engagement and the client experience.

Some firms that are applying these learnings to enhance the development curriculum for under performers are even taking it a step further to identify RMs that won’t make the grade, freeing up precious investment and resources for those that will.

Better Business Performance through Better People Performance

So are we missing some tricks? Are these top RMs worth every penny? By better understanding the behavioral traits and engagement drivers of the aforementioned RMs, not only can we help learn what makes them special, but also we can sustain their motivation after their mid-life dip. Benefits for the firms grasping this new opportunity are not only obvious, but very significant.

The bottom line is that applying people science and leveraging smart data and insight across the talent lifecycle is already seeing dramatic improvements in the effectiveness of firms’ human capital and business performance metrics.

Even in this age of digitalization, people are not only still a firm’s biggest cost, but also their greatest asset. It’s therefore maybe no surprise that delivering better business performance through better people performance has risen to the top of many CEOs’ agendas and looks destined to stay there for a good while to come. Maybe there is more to be learned from top performers.

If you are interested in learning more, contact the author.

Have you read the first article in this thought leadership series? Read Where Human Meets Capital.

1 A Pay versus Productivity Matrix shows how a firm’s RMs are plotted against a percentile rank of the whole market, both for their pay, defined as total compensation of salary plus bonus, and productivity, defined as total revenue generated per RM. The dotted lines define the zone, a corridor of efficiency, where productivity rank and compensation rank are most closely aligned. RMs within this zone have their pay aligned with productivity – an ideal situation. Points outside of these lines suggest that the firm’s pay is not aligned to revenue generated. This means the business is inefficiently rewarding their RMs relative to their productivity. The graph is further split into four performance quadrants; the top left high pay, low productivity quadrant offering specific opportunities to either reduce costs by reducing pay in line with the market or increase revenue in line with the market.

2 ADEPT-15TM is the most advanced commercially available adaptive personality assessment tool that leverages the latest artificial intelligence techniques in psychometric assessment.