Annual equity grant values and participation rates have risen since the financial crisis. Here’s our playbook for competing in this environment while still conserving shares.

Technology companies are faced with having to do more with less— at least when it comes to granting equity compensation across their employee populations. The root of the problem is driven by competing interests: attracting employees in a red-hot job market, which typical requires a premium above standard annual grants, all while managing shareholder expectations to keep dilution rates at a satisfactory level.

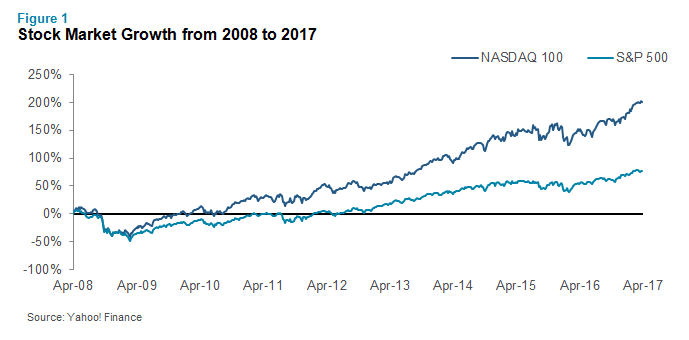

While many mid-size and larger technology companies have migrated away from stock options to restricted stock units (RSUs), smaller and emerging growth companies continue to grant a portion of their overall equity pools in options. Options provide added compensation leverage for employees (particularly given today's robust stock market), but is a more dilutive approach. For reference, see Figure 1 below, which shows how well the Nasdaq 100 has outperformed an already strong S&P 500 since the financial crisis of 2008-2009.

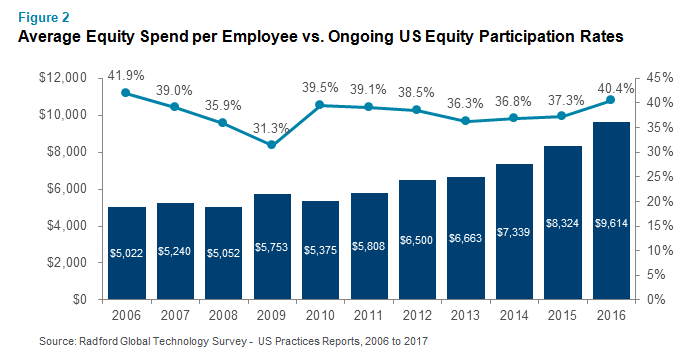

As the value of equity delivered to employees has gone up, participation rates at technology companies in long-term incentive programs have remained relatively flat according to the Radford Global Technology Survey. However, don't be misled by this statistic— the sector has been adding to staff over this period of time, meaning more employees are actually getting an annual grant, and again, as Figure 2 so clear shows, equity spend per employee is rising significantly.

Figure 2 shows that leading up to and during the financial crisis we observed generally flat equity spend from 2006 thru 2010 when the market was facing less talent pressure. However, by the end of 2016, average equity spend per employee has nearly doubled to almost $10,000. This level of growth is consistent with the growth in the stock market. What does this all mean? It suggests that the increase in equity spend is a direct byproduct of an increase in share price rather than a change in the amount of equity being issued.

While we might expect to see rising stock prices resulting in a decline in the number of units issued, and therefore a reduction in total dilution rates, this has not happened. Companies continue to issue between 2% to 3% of the company in stock grants on an annual basis (absolute dilution rates between new hires, annual grants, promotions and to their board). When we factor in the increased reliance on RSUs, technology firms have been able to maintain participation rates at the same level (~40%) even as they continue to scale the organization.

Radford does observe a tail of two markets when you examine these practices: more mature companies that need to seek shareholder approval every year or every other year have more constrained share pools, while recently public companies have the benefit of an “evergreen” provision. These provisions provide a company with an automatic replenishment, typically at 4% of the share pool annually. This provides these companies with a competitive advantage to include a broader portion of the employee population in the new hire and/or ongoing equity program, which many mature technology companies cannot do (evergreen features are typically active for 10 years following an IPO and are then phased out).

Next Steps

Companies that are constrained by their pool and/or shareholder concerns regarding annual dilution can explore a number of alternatives for addressing competitive pressures, including:

- Consider changing equity distribution by location. While most companies with employees in multiple locations will use discretion in their base salaries based on local market pay, we don't see a widespread approach to doing this with equity grants. Consider whether employees at your satellite office (particularly in a lower cost city) will expect the same value of equity awards as their colleagues at the headquarter city or in markets constrained by supply and demand. In addition to local market data, your equity strategy should take into account local talent pools, your hiring and growth strategy, and where certain key jobs are located. Taking a discerned approach to equity allocation can save precious shares for the markets where attracting and retaining critical jobs is most difficult. This may also include making trade-offs in different global markets.

- Analyze equity participation rates. Consider whether your policy should emphasis attraction over retention, broad equity participation vs. targeted grant practices. Making company-specific policy decisions that address your unique challenges can be a competitive advantage when you factor in hiring and retaining talent by level, role, location, and/or function. Growth companies scaling a commercial function may need to be more aggressive to attract talent while a more product-centric business may need to focus on key engineering functions.

- Evaluate equity vesting periods. Consider how vesting periods might impact the value of equity delivered to new-hires and whether it makes sense for your organization to adopt shorter (or longer) vesting periods. Shorter vesting periods will deliver more value to participants in the short-term, but can create retention risk over time as less and less equity is unvested.

We urge clients to consider the pros and cons of changing all aspects of their policies to manage risk while creating policies that can differentiate your employment offering in the market.

If you have any questions about your equity program and want to speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles