Burdened by low oil prices and macroeconomic instability, the regional banking sector is suffering from squeezed earnings as liquidity tightens and credit growth remains tepid. Given these conditions, many banks across the GCC will not meet profit targets, subsequently reducing bonus pool funding. How should banks in the region respond to the new economic climate and can they somehow convert this into an opportunity to derive competitive advantage?

The majority of GCC banks reported flat or negative third quarter net profit growth resulting from the dual challenge of liquidity dry-up from reduction in government oil deposits and low credit offtake and tight credit supply due to lending caps. This slowdown is likely to continue as the UAE Banks Federation (UBF) projects a 10 to 20 percent profit contraction in the UAE banking sector; a trend that is also expected across the GCC.

Despite tailwinds for the UAE banks on account of the new bankruptcy law in the UAE and the Interim Marginal Facility (IMLF) from the Central Bank, industry outlook remains weak. The onset of IFRS 9 and Basel III will increase capital requirements, tightening liquidity and adding stress to an already insecure environment.

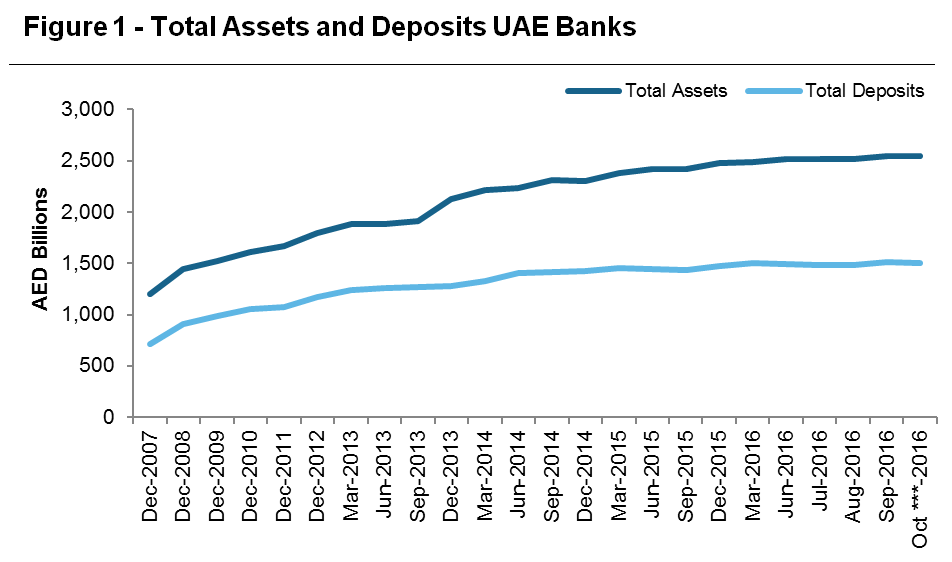

Figure 1: Total Assets and Liabilities For UAE Banks Taper Off in Growth in 20161. Given this outlook, low (or even zero) bonus pools are likely, making it difficult to retain and motivate talent. We will further explain, in this article, a few aspects that banks should consider in these difficult times.

Variable Pay Structure

A well designed variable pay structure caters to all possible scenarios of business performance. Such structures would not need frequent adjustments to cater for exceptionally poor (or good) years. However, in cases where the variable pay structure is not sufficiently robust, banks should make suitable adjustments in exceptional years. For instance, in a sub-optimal year, the bonus pool for the mid- and junior-level staff should be 'ring-fenced' to avoid the senior staff commanding a disproportionately large share of the available pool.

However, annual bonus plan design is only as good as the performance measures driving it. The resilience of the chosen KPIs is tested in volatile years. It is important to ensure a relative frame of reference — is it more important for our shareholders to see YoY growth on our financials or do they equally care about us outperforming the market? A balance of absolute and relative measures can better cater to all types of business and economic scenarios.

In more challenging economic periods, long term incentives can serve as a useful tool to drive long-term firm health. However, although the prevalence of long-term incentives within the regional financial industry is fairly high, the design of these plans across many firms is often suboptimal. For instance, most banks across the GCC operate LTI structures only to cancel or adjust plans in later years with poor payouts! This reflects a culture of entitlement and drives expectations of almost guaranteed payouts; something of this nature would hardly be encouraged (especially within the financial industry) in most parts of the world. Long-term incentive design in the region often suffers from two noticeable flaws:

- They are backward looking and focus on historic performance levels, and

- They fail to take account of long-term multi-year performance

Where possible, the delivery of incentives through a combination of cash and equity better mitigates risk. Additionally, the current accounting treatment of equity-based awards (IFRS 2) makes the grant of equity-linked awards generally more optimal in a tough market. Regional stock exchanges have enjoyed higher trading volumes and better transparency in recent years strong rationale to consider the deployment of equity-based compensation structures.

Long-term incentives are great ways to deliver the right payouts whilst ensuring that the executive focus remains on forward looking multi-year performance. If properly structured, the plans can help mitigate the talent flight risk of lower bonus payouts in tough years.

In addition to Bonus and LTI plans, many banks in the region operate a suite of sales incentive and commission plans. Such plans, if designed properly, are self-funded with the expense charged contra-revenue. It is important that targets are carefully calibrated in reference to the Market. In years of low corporate bonus pools such plans best manage employee expectations, given their strong line of sight.

Efficiency

In times of weak business and economic outlook, firms often direct their attention towards cutting expenses however, it is perhaps more effective to measure and improve efficiency and productivity. Measures of productivity can be employed in variable pay plans to move the firm towards increased productivity. Banks typically use the following three measures of efficiency:

- Capital Efficiency

- Economic Efficiency

- Manpower Efficiency

Efficiency in the banking sector has traditionally relied on efficient usage of Capital. Historically, many financial institutions in the region (as well as globally) have given a strong focus on Return on Equity (ROE). Extensive focus on ROE, without a balance around equity to asset ratios, exposes banks to a pertinent risk around executives over-leveraging balance sheets to boost performance numbers.

The Basel III Accord enforces stricter Tier One capital thresholds in addition to the proportion of such capital that must be comprised of common equity and/or retained earnings. In preparation for these changes, banks must consider capital efficiency measures such as Return on Assets (ROA), which to a large extent alleviate the issue of leverage.

Moving toward economic efficiency measures such as Risk Adjusted Return on Capital (RAROC) and Economic Value Added (EVA) offer even better measurement of risk. Though relatively uncommon in the Middle East, such metrics are ideal as funding criteria for annual bonuses, as well as, grant or vesting criteria for long-term incentives. These measures also allow for better comparison of business performance across verticals. In the absence of Economic measures, the relative allocation of a (fixed) bonus pool is less likely to take into account the risk profile of individual businesses and the commensurate relative costs of capital.

Manpower efficiency, the final productivity measure, is an integral part of the overall efficiency landscape in banking. Given that people costs are the single biggest component of the overall expense base for a financial institution, the optimization and control of this component often makes or breaks the relative competitiveness of a firm. The obvious measures of Manpower efficiency are Employee Cost to Income Ratio and Income per Capita measure manpower efficient; however, efficiency can be more accurately measured and enhanced by considering the following:

- Staffing ratios between front office and back office: What percentage of the staff are engaged in revenue generating activities versus support? How does this compare with the Market and what are the opportunities to optimize the mix?

- Spans of control: Is the organizational structure relatively flat or is it too layered?

- Seniority mix: A structure that is top-heavy, can often be expensive.

McLagan is uniquely positioned to assist clients by measuring and benchmarking productivity to drive business growth.

Pay Segmentation and Differentiation

Banks in the region often do not vary the outcome of the pay mechanics based on either performance or the nature of the role. For instance, it is relatively common in the region for banks to award bonuses as multiples of salary linked solely to individual performance ratings. This laissez faire approach yields poor results, particularly in a weak economic climate punctuated by poor reported financials. It does not consider the diverse talent landscape nor does it make explicit adjustments for business or bank-wide performance.

Mature compensation structures often give importance to pay segmentation across job families in an organization. The pay-levels, pay-mix, performance measures and incentive approaches should relate closely to the nature of accountabilities and the business structures. In this regard, banks in the region would be advised to move beyond simple 'grade-based' approaches and adopt pay segmentation approaches like job-family models that consider the risk profiles of individual business lines. Such segmentation should relate to all elements of reward — both fixed and variable.

In years of lower bonus pools, it is imperative that the best and the brightest are given the necessary attention. In such years, banks should reassess the relative payouts across the spectrum of individual performance. Team-based performance, where appropriate, should be suitably rewarded. For instance, it is possible that one particular business group produces flat financial results in a year when the overall bank posts a decline. In this case, it is important to reward relative business performance and not just absolute performance.

Change Management and Communication

An expected response to the tight market situation is an increased scope on consolidation in the regional banking sector through mergers and acquisitions. Countries like the UAE remain overbanked compared to international averages and consolidation is likely to yield better efficiencies. A merger between NBAD and FGB is a clear example of a regional behemoth with $170bn in assets. Whilst M&A activity cannot be accurately anticipated, banks in the region should be prepared for such events.

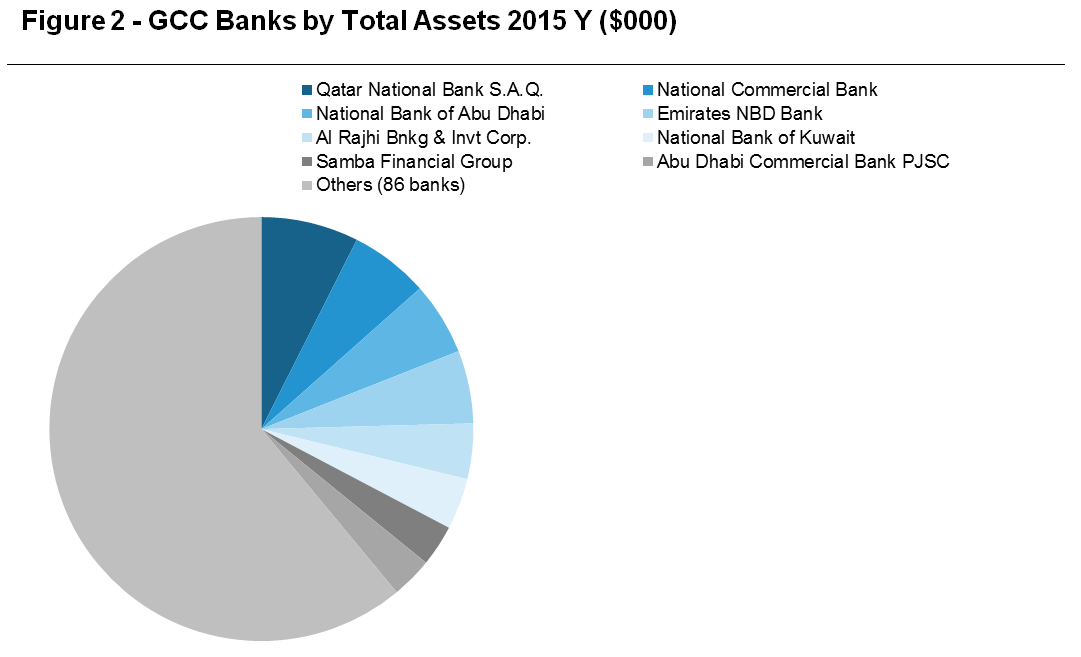

Figure 2: While the GCC retains upwards of 90 banks, by assets, the market is dominated by a handful of key players.2

Organizations often make the fallacious assumption of equating compensation expense with value delivered to employees. According to our research only a portion of the total compensation expense is perceived as 'value' by employees. This generally happens as organizations structure their rewards according to what they believe their employees need. Firms should optimize their 'Total reward' spend in line with business as well as people requirements. McLagan leverages a customized 'Total Rewards Optimization' tool to help clients achieve cost savings and drive value.

Reward communication attains utmost importance in difficult years; as it becomes increasingly crucial to remain competitive in the talent market. Employee communication is deemed to be the sole responsibility of the HR function; however, the most effective employee communication strategies are two pronged — they focus on communication from line managers as well as HR. This is the time to help employees understand how various elements of the total reward structure work and why the payouts have been sub-par in line with the corporate performance. This is also a good opportunity for organizations to incorporate Total Reward statements that best communicate the quantum of the reward spend.

In Conclusion

Banks in the region are likely to face a protracted period of slow growth and even a possible contraction. It is crucial to align the expectations of employees (financial rewards) with those of the shareholders (financial results). Robust reward and organizational design can help alleviate the pain. Organizations would be well advised to build robust HR structures for the future, in anticipation of the good times.

1Central Bank of the UAE, Monthly Statistical Bulletin — Banking & Monetary Statistics — October 2016 and Monthly Statistical Bulletin — Banking & Monetary Statistics — December 2013, "Table 1: Selected Monetary and Banking Indicators", http://www.centralbank.ae/en/pdf/bulletin/SBull-Oct-2016.pdf and http://www.centralbank.ae/en/pdf/bulletin/SBull-December-2013.pdf (accessed December 1, 2016).

2"Custom Peer Group GAAP / IFRS Companies," SNL S&P Global Intelligence.