When market data suggests that a lower level job is paid more than a higher level job, it's important to diagnose what might be happening before deciding how to proceed.

Sometimes market-based compensation data can be counterintuitive. Most people expect pay to increase from job level to job level, reflecting rising pay for positions with more responsibility and higher qualifications. And for the most part, this holds true; "more senior" positions tend to have higher compensation levels. However, in some cases, the data doesn't stack up as anticipated, and it's the job of human resources and compensation professionals to decode what is actually going on in the market. When data "misbehaves," this is where the science of analyzing market data turns into an art.

While situations of this nature are very rare, when they do pop up, it's often for Support function jobs outside of the United States (US). This is where survey data samples may be more limited, differentiation between job levels is harder to define, and the number of job levels populated within each participating company may be inconsistent with global job architectures.

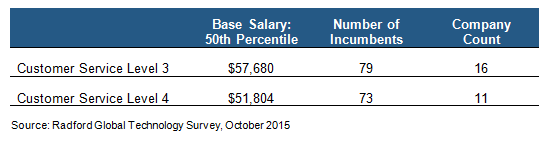

The chart below illustrates an example of reverse pay progression in an administrative job family in Poland from the Radford Global Technology Survey. In this case, the median base salary for a customer service job at a level 3 is 11.3% higher than the same position at a level 4.

Most jobs in the Radford Global Technology Survey have robust employee counts, but when data progression is broken, as in the example above, we often find it to be one of four situations: low incumbent counts (fewer than 30 employees in a job), low company counts (fewer than 10 companies reporting data for a job), a high concentration of data in one job level relative to all other job levels, or a small number of companies with many more employees than the other companies in the data sample, which can skew results.

In the case above, the smaller company count in job level 4 (11 companies vs. 16 companies in job level 3) suggests that some companies — potentially the higher paying ones — do not have a fourth level in their Customer Service job family. If those companies were excluded from the level 3 data, the data might very well progress normally. But, that type of data manipulation— where we hold participating companies constant level over level— isn't possible and doesn't reflect the overall market reality. Thus, when compensation analysts price jobs and encounter this phenomenon, determining how to proceed depends on the specifics of the situation.

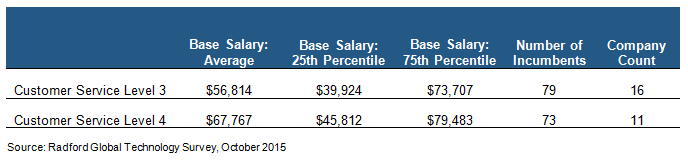

In the case of customer service positions in Poland, both the smaller number of companies and the larger number of employees per company in the job level 4 explain why the data doesn't compute as expected. The first step in deciding what to do next is to look at other data points in our survey results.

In this case, instead of relying solely on median base salaries, practitioners may choose to use average data for this position or family, or interpolate between various other percentiles. Given that we observe normal pay progressions at the 25th and 75th percentiles (and for average base salaries), it is likely that the median is influenced by a large cluster of employees earning similar pay. Some interpolation of the data is likely appropriate.

Additional Considerations

There are several potential approaches to use when encountering situations where compensation data doesn't progress linearly from job level to job level.

- In our example, analyzing alternative pay data points, such as the average vs. the median (or vice versa) identified data aligning in a more expected way and presented a solution for estimating market rates.

- In other cases, a more holistic view can help. If the "misbehaving data" is a total compensation figure, look at individual pay components (such as target or actual incentives, incentive participation rates, or base salary data) to see if certain elements are causing total pay figures to behave unexpectedly.

- For base salary analyses where the ratio of employees per company is high, consider looking at the company-weighted average. This output treats every business as if it has the same number of incumbents. If one company has more people relative to everyone else or job matching isn't consistent with the other companies in the survey (for example, one company doesn't have anyone in level 3 but does report data elsewhere), the company-weighted approach will reduce the impact of outlying data.

- If either the number of incumbents or companies reported is small, consider using a more generic job family or a "roll-up" job family for the analysis where data populations are larger and more reliable.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles