More than half of technology firms in Radford's recent Hot Topics Survey awarded retention bonuses in the past year to combat rising turnover rates.

Market Volatility Sets the Stage

A growing roster of venture capital investors have expressed the opinion that this year's highly volatile markets are not indicative of a pending technology sector bubble, but rather, the beginning of a period of slower, sustained growth. For example, Mary Meeker, a well-known partner at the venture capital firm Kleiner Perkins Caufield Byers, discussed the implications of slower growth in her widely-read annual Internet Trends Report. In a nutshell, many investors believe soaring stock prices, gangbuster hiring rates, and lavish, at-any-cost, perks might not be part of the Silicon Valley playbook for much longer.

At Radford, we see similar signs of a move to slower, sustained growth in our global workforce trends and rewards data. Yet, our survey and consulting clients around the world are asking us for help with hiring, rewarding and engaging all of the talent they need to support business objectives. Why is this still the case as companies shift down from hiring at breakneck speed? Some of our client's most common pain points include finding employees with the right skillsets in key locations, motivating employees when their equity holdings have lost value, and retaining critical employees who are still approached by competitors with regularity. These challenges are further compounded by renewed efforts to control costs while identifying and rewarding top performers.

Looking at equity award values specifically, on a 12-month trailing basis ending in May 2016, US software and hardware stocks declined by an average 14.5%, while the Russell 3000 dropped by only 4.5%. As a result, employee equity holdings during this period decreased in value by a meaningful amount. This makes employees feel less secure in their current roles, and simultaneously easier to poach with new-hire grants. Managers can pursue a number of avenues (which we discuss here for private companies and here for public companies) to combat underwater stock options and/or stock awards that have dropped in value, but cash-based retention awards often appear high on the list of remedies. These payments, which can include one-time or multi-payment options and clawback provisions, provide an immediate liquid reward, and typically don't carry performance restrictions.

Survey Results

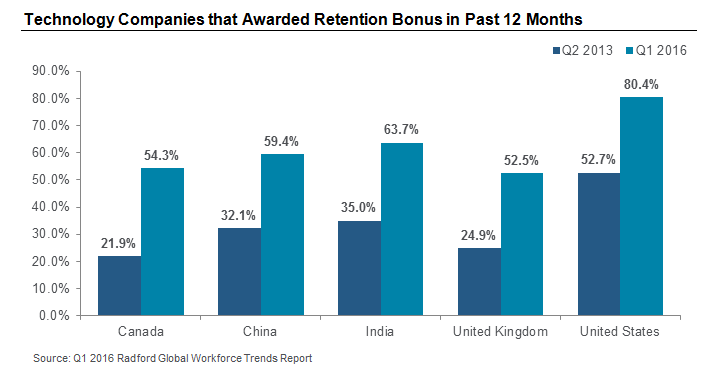

To explore recent retention bonus practices, participants in the Radford Global Technology Survey were asked to complete a special Hot Topics section of our quarterly Global Workforce Trends Report. Across a number of select markets, the prevalence of companies awarding retention awards, overwhelmingly in the form of cash, to at least some employees in the last 12 months increased significantly vs. three years ago – the last time Radford conducted a similar survey. The following chart illustrates the dramatic uptick in retention awards in Canada, China, India, the United Kingdom and the United States between Q2 2013 and Q1 2016:

As we noted above, companies award retention bonuses for a variety of reasons, which can include motivating employees with underwater stock options, retaining key project members during the middle of a major product development cycle, or restoring confidence in a team when they see other expenses getting cut. In all cases, the goal of retention bonuses is to maintain continuity while avoiding the costs of turnover— some studies indicate replacement costs for key talent can range from three to six times base salary.

The Convergence Effect

In addition to competing with each other, technology firms are increasingly fighting for skilled talent across industry lines. These new competitors, which we call "converging" industries, are reinventing their core businesses around massive investments in software and cloud enabled technologies. Examples include retailers building ecommerce storefronts, banks developing mobile banking platforms, and the internet of things. These groups of emerging and more diverse competitors mean that even as growth and hiring rates might be slowing, the competition for talent remains robust.

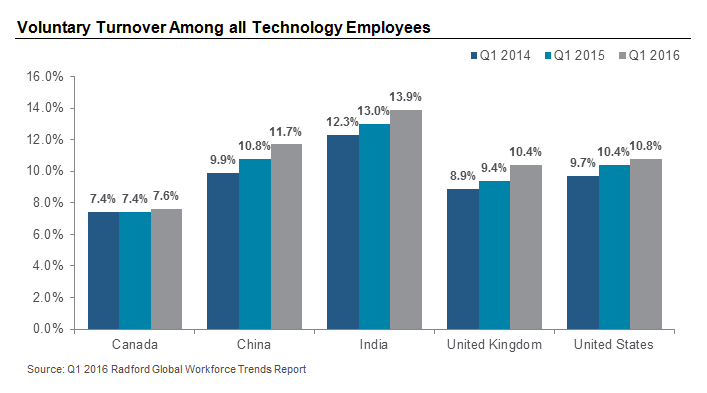

This trend is evidenced by turnover rates that show little signs of slowing down in the immediate future. As the chart below illustrates, median voluntary turnover rates at technology companies are still rising in Canada, China, India, the United Kingdom and the United States.

Higher turnover rates reinforce the sense that employees themselves do not believe we are in the middle of a tech bubble. If we were, employees would be less willing and able to leave their employer voluntarily.

What's Next?

When considering whether retention bonuses are the right strategy for your company, you should weigh the merits of bonuses against other options, such as increasing long-term equity awards; replacing underwater stock options with new options that have a lower strike price; increasing base salary to ensure competitiveness; improving working conditions that differentiate your firm; and communicating a clear path for future professional development and job growth.

Retention bonuses can also be tricky because, by design, they are temporary. They may help solve a pain point in the short-term but they won't solve longer-term retention issues if there is a more systemic issue at play. The competitive hiring landscape among technology companies— even in the face of slowing growth and less access to easy capital— means retention will continue to be a concern for technology companies, which must be addressed with a longer-term strategy. Retention bonuses can be part of an effective rewards strategy, but shouldn't be used as a "bandage for a larger wound" based in a strategic shortcoming.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles