Introduction

Institutional Shareholder Services (ISS) recently released a set of Frequently Asked Questions covering its new Equity Plan Scorecard (EPSC). These FAQs are intended to provide clarity on how ISS will implement its new approach for annual shareholder meetings starting on February 1, 2015. The FAQ on EPSC follows ISS’ announcement in November of final Policy Voting Guidelines for the upcoming year.

Given the relatively high frequency with which life sciences and technology companies need to replenish equity plans, and the significance of equity in the overall pay mix (at all employee levels) in these sectors, the adoption of EPSC by ISS warrants careful scrutiny and consideration as companies plan their equity strategies for 2015 and beyond.

Key EPSC Practices to Watch

Under ISS’ new approach, equity pay plan proposals will be evaluated using a "scorecard," which will consider a host of factors that are individually weighted and then plugged into an overall assessment model. Along with the cost of administering corporate equity plans, ISS will consider numerous additional factors/practices in its scoring system, including:

- Automatic single-trigger vesting upon a change-in-control

- Broad discretionary vesting authority that may result in "pay for failure" or other scenarios contrary to a pay-for-performance philosophy

- Liberal share recycling

- The absence of a minimum required vesting period (at least one year) for grants made under the equity plan

- The company's 3-year average burn rate relative to its industry and index peers

- Vesting schedule(s) under the CEO's most recent equity grants during the prior three years

- The plan's estimated duration, based on the sum of shares remaining available and the new shares requested, divided by the 3-year annual average of burn rate shares

- The proportion of the CEO's most recent equity grants/awards subject to performance conditions

- A clawback policy that includes equity grants

- Post-exercise/post-vesting shareholding requirements

Of note, equity pay plan proposals that only seek approval to ensure tax deductibility of awards pursuant to IRC Section 162(m) will generally receive a favorable recommendation. ISS says that other plan amendments will be analyzed on a case-by-case basis to determine whether or not the more expansive EPSC approach should apply.

Some plan features will continue to automatically result in negative recommendations regardless of other factors; these items include:

- Authority to reprice stock options without shareholder approval

- "Liberal" change-of-control definition that could result in vesting of awards by a single trigger

- Plans that are vehicles for "problematic pay practices"

- Tax-gross-ups related to plan awards

- Provisions for reload options

Scoring System Overview

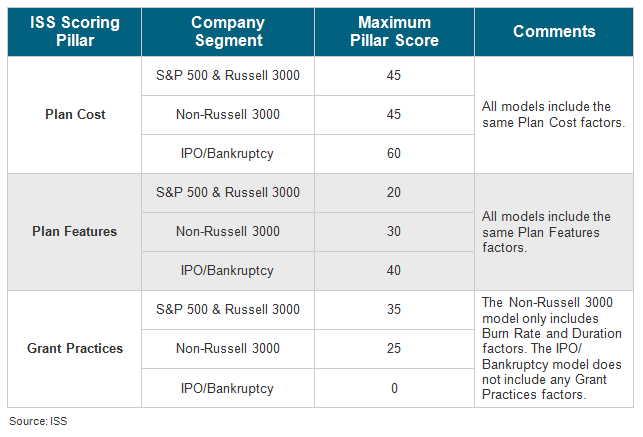

The total maximum number of points that may be accrued under the new EPSC model is 100. Absent other overriding factors, a score of 53 or higher will generally result in a positive recommendation from ISS for an equity plan proposal.

For Russell 3000 companies, ISS says it will allocate the maximum number of points to factors involving the plan’s cost, followed by grant practices and then grant features. Companies that have completed an initial public offering (IPO) or emerged from bankruptcy within the prior three years are not subject to any of the grant practices features considered. They are, however, subject to the same plan cost and plan features factors.

ISS’ updated treatment of recently public companies is a significant development for the large number of technology and life sciences companies that went public in the past few years. ISS is tightening its oversight of newly public companies, which should be a consideration as companies develop their strategy for transitioning equity programs from private to public environments. ISS revisits its models annually, and has a history of incremental additions. It would not be surprising if ISS begins to treat all companies in a similar fashion in upcoming years.

For reference, the table on the following page outlines ISS’ EPSC scoring system for S&P 500, Russell 3000, non-Russell 3000, recently public (IPO) companies and companies that have emerged from bankruptcy in the past three years.

Conclusion

We view ISS' new EPSC policy as a net positive for life sciences and technology companies, as it now introduces more flexibility into ISS’ methodology rather than holding companies to hard and fast share limits insensitive to the particulars of a company’s situation. However, the scorecard approach will also make ISS voting recommendations less predictable, and could lead to the homogenization of plan design and governance practices among life sciences and technology companies over time as companies seek to satisfy all of ISS’ factors to maximize the probability of a positive ISS recommendation. We also expect that some companies will ask shareholders for authorization to grant additional shares more frequently than in the past, but seeking smaller share reserves at each vote, until more clarity emerges about how the new methodology will work in practice.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles