Setting the appropriate base salary-to-incentive pay mix can have huge implications. (This article was first published in WorldatWork's Sales Compensation Focus newsletter.)

Pay mix — the ratio of base salary and target incentives that makes up target total cash compensation — is a common pain point for growing companies wanting to maintain competitive and consistent sales compensation structures. While it's sensible for similar job roles to have dissimilar mix levels, managing such dissimilarities can get complex and contentious.

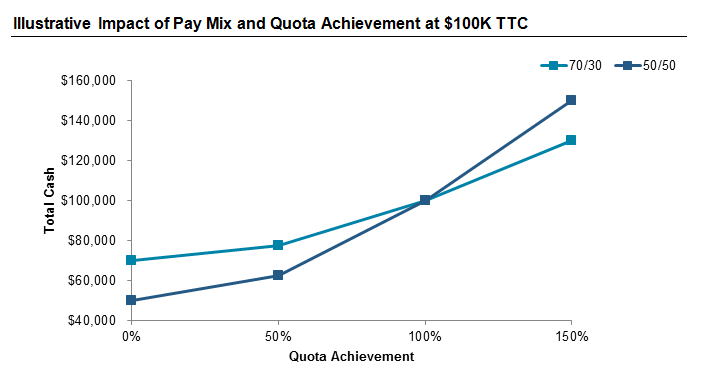

To begin with, the purpose of pay mix is to help establish a motivating risk/reward proposition for employees with influence over sales outcomes. The higher the job's influence, the higher the incentive portion of the pay mix should be. Mix works in conjunction with the plan's payout curve to determine leverage — the rate of target cash earned at various levels of performance. High leverage means an opportunity for higher pay variability relative to target pay.

The chart above illustrates the impact of pay mix on two, otherwise identical plans. The light blue curve represents total cash pay of a 70/30 pay-mix plan across a spectrum of quota achievement. The dark blue curve shows a 50/50 pay mix across the same spectrum using the same payout rates as a percent of target incentive. Higher incentive mix means higher leverage, all other factors being equal.

Ideally, similar jobs have similar pay mix levels. However, you can expect to see disparities in the pay mix following an acquisition of a salesforce, or period of rapid growth. Mergers and acquisitions can bring together like jobs with dissimilar mix levels. During periods of high, organic growth, companies are aggressively hiring and often lack the structure for keeping pay mix consistent. Some companies maintain dissimilar mix levels as a path of least resistance. Indeed, most employees don't appreciate a reduction to their regular earnings following an increase in incentive mix. A mix shift in the other direction, to increase the base portion, can frustrate high performers who then have less leverage for high income.

To set the appropriate pay mix for a job, start with a competitive target total cash level. Ultimately, your plan needs to deliver competitive pay for target performance. While market data should represent a key input for your mix decision, there can be differences in mix across different sets of peers. We reviewed the mix levels for two types of account manager jobs within a software industry selection of the "Radford Global Sales Compensation Survey" and found the top 15 highest growth companies (using one- and three-year revenue growth rates) used slightly more incentive-heavy mix levels relative to those used in the group of slowest growth companies. Yet counter to this approach is a move by some, pre-IPO SaaS software companies during this latest hiring boom. Eager for top-tier sales talent, these companies target base salary for new recruits above the market at the 75th percentile level. With the aggressive base salary comes an aggressive quota with the result being unrealistic target incentive. In an effort to guarantee pay, these companies are putting forward risk-adverse, salary-heavy mix levels.

Beyond market-driven target total cash levels are company and job-level factors that can influence the base/incentive mix:

- Quota reliability: If your company has struggled to deliver near target pay to the median performer, then you might need to use a mix that's heavier on base salary than what the market suggests. Alternatively, if you can demonstrate consistent, above-target earnings for more than 40%-50% of your sales team, and this performance translates to the company consistently beating its revenue goals, then you're better off with a mix that's heavier on incentives.

- Company philosophy: Within some industries, like life sciences, are different levels of risk tolerance that can impact sales compensation design and mix. One company may chose a high-degree of incentive in the mix to motivate sales urgency for a new product launch, while another might use a conservative mix to mitigate the risk of off-label selling, or a product that's yet to hit the market.

- Time allocation to sales versus developmental, supervisory or administrative responsibility: You may decide to use a less-aggressive mix for newly-hired employees to compensate for time allocated toward training, at the expense of selling, or for employees within in a job family expected to take on coaching or advisory duties.

You might conclude the plan is paying competitively based on the plan rules and individual performance results. Yet members of the leadership team insist the company's compensation cost of sales is too high. Such perceptions can stem from familiarity with other sales organizations or from nothing more than an anecdote. In any case, you need reliable, competitive information.

Before you change the incentive mix of your salespeople, consider all the factors unique to your company and the particular jobs in question. Factors in addition to those listed above include your company's brand equity, the product's complexity, the role's degree of service (versus sales) responsibility and number of accounts covered. Taken together these factors can have considerable influence on an employee's ability to leverage their incentive target.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles