Life sciences companies record a slight increase in shareholder support for Say-on-Pay and an even larger drop in failures.

Vote Support Rises

The fifth year of Say-on-Pay voting just wrapped up for most companies. A Radford report with in-depth results focused on the life sciences sector is available here. This article will highlight some of the biggest takeaways from the 2015 Say-on-Pay voting season.

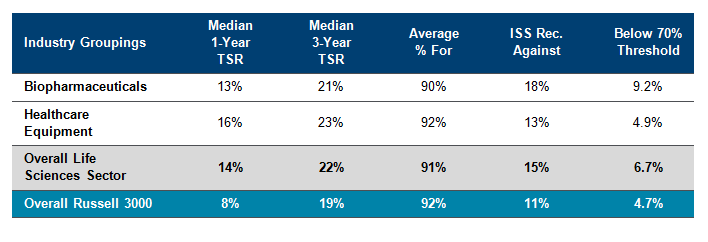

Shareholders of life sciences companies showed continued strong support for Say-on-Pay with an average support at 91.1% vs. 90.6% last year. That's in line with 92% average support recorded among Russell 3000 companies. The percentage of companies receiving more than 90% support also rose from 76% in 2014 to 79% this year.

Outright failures on Say-on-Pay are rare and materially lower for life sciences companies than a year ago at 1.7% in 2015 vs. 3.5% in 2014. Among the Russell 3000, Say-on-Pay failures also dropped to 1.7% from 2.1% last year. This reflects companies' increasing effectiveness at explaining and rationalizing their pay programs to institutional investors. This has, in turn, caused some shareholders to be more flexible with executive pay practices and willing to overrule ISS where they believe circumstances warrant.

Influence of ISS

ISS recommended against pay at 15% of life sciences companies this year, which is materially higher than last year's 12% and when compared to the Russell 3000. Nonetheless, with failures down and average shareholder support on the rise, it would seem ISS' influence could be waning. In this fifth year of mandatory Say-on-Pay votes, companies are getting better in their engagement efforts with shareholders and reaching out directly to investors to address their concerns over executive compensation programs. We're also seeing institutional investors break from ISS' voting recommendations in circumstances where the investors have developed their own policies or the company's reasoning for certain compensation arrangements is persuasive.

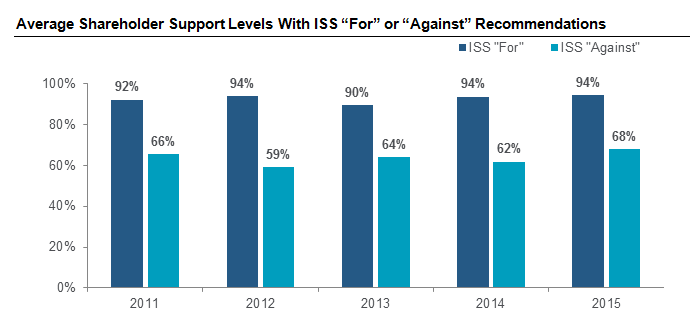

Meanwhile, average shareholder support for companies with an "against" recommendation from ISS rose this year from 62% to 68%, remaining in the same range we've seen for the past five years. If we see this number continue to rise next year, it would signal a more statistically meaningful drop in ISS influence. However it's important to note that ISS recommendations still have sway over a large voting block of shareholders. As we can see from the chart below, the average difference in shareholder support between an ISS "for" and "against" recommendation is striking at 26%.

Connection to Performance

We continue to see a strong connection between Say-on-Pay support and company performance. While proxy advisors and many institutional investors say they focus more on five- and three-year TSR to minimize the influence of short-term gains and losses in the market, we do see a correlation between lower one-year TSR, ISS negative recommendations, and shareholder support.

One-year total stockholder returns among biopharmaceuticals were materially lower than cumulative three-year returns. This has directly led to a larger proportion of biopharmaceutical companies receiving negative ISS recommendations. ISS has flagged many of these firms with a "pay-for-performance disconnect" under its methodology when stock awards are made at higher values at the start of the year, followed by the stock trending downward. Biotech companies also have a higher rating of "compensation risk" on ISS' GICS scoring system compared to the Russell 3000— largely driven by stock volatility and industry-specific compensation practices, such as limited performance-based equity programs tied to relative total shareholder return, single-trigger equity acceleration in change-in-control provisions, legacy tax gross-ups, fewer extensive clawback provisions, and smaller stock holding requirements.

To read Radford's complete report of 2015 Say-on-Pay votes in the life sciences sector, click here.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles