Starting in 2010, Radford's compensation consulting team began tracking US-listed initial public offerings (IPOs) in the technology and life sciences sectors to examine key shifts in compensation strategy occurring just before and after IPO events. Such shifts include the adoption of new, more flexible equity incentive plans, changes to pre- and post-IPO equity overhang rates, the creation of broad-based employee stock purchase plans (ESPPs), and adjustments to executive officer compensation.

Today, Radford's database of recently public companies includes information for a total of 243 organizations that went public between January 1, 2010 and December 31, 2013. During this four year period, technology and life sciences companies raised a median of $75 million by virtue of selling shares to the public, while having a median pre-IPO headcount of 289 employees and median pre-IPO annual revenues of $63 million.

The following research excerpt from Radford's four-year study, produced with data collected from public Securities and Exchange Commission (SEC) filings, explore adoption rates and practices for new equity incentive plans, employee stock purchase plans and evergreen provisions at recently public companies.

New Equity Incentive Plans and IPOs Go Hand-in-Hand

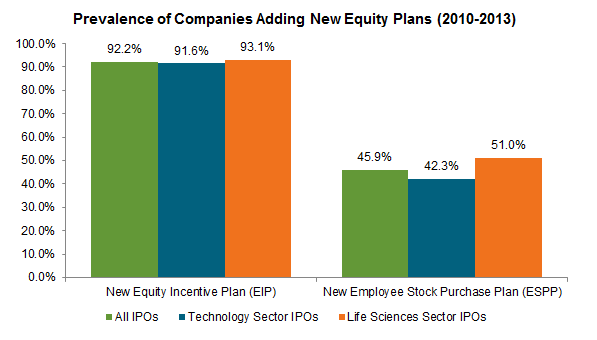

Across all years covered by Radford's analysis of newly public companies in the technology and life sciences sectors, over 90% of firms introduced at least one new equity compensation plan at, or very near the time of their IPO. This includes both equity incentive plans (EIPs) and employee stock purchase plans (ESPPs).

Introducing new EIP and ESPP plans prior to going public can be advantageous for several reasons. First, establishing new EIPs with the flexibility to grant a variety of vehicles, including performance shares (a.k.a. an omnibus plan), gives newly public firms the ability to adapt more readily to evolving market practices. Second, it is easier and less costly to implement a new EIP or ESPP while private, when approval usually only requires the support of a closely held group of founders and venture capital investors. Once a company goes public, it quickly must seek support from a broader, more diverse set of shareholders who will likely impose stricter governance standards for equity compensation practices.

The following chart illustrates the prevalence of recently public companies adopting new EIPs and new ESPPs at the time of their IPO across all years in our study:

Readers should note that "at, or near the time of an IPO" generally refers to the year prior to an IPO. However, some plans adopted outside of this timeframe are included, especially when a company clearly indicates a new plan was adopted with an IPO event in mind.

Prevalence and Size of Evergreen Provisions

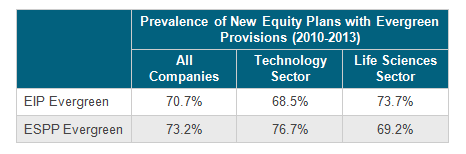

Roughly 70% of all companies included in our analysis across all years added "evergreen" provisions to their new EIP and ESPP plans while private. In the vast majority of cases, these evergreen provisions allow companies to replenish equity plan shares on an annual basis for as many as 10 years.

More specifically, evergreen provisions allow for an automatic, formulaic increase in plan reserves, typically at the start of each new plan year. Absent such a provision, increases in plan reserves after an IPO require shareholder approval via a proxy vote.

The median "size" of evergreen provisions for new equity incentive plans is 4.0%, meaning companies typically reserve the ability to add a maximum of 4.0% of total common shares outstanding into their equity plans each year. For ESPPs, the median evergreen "size" is equal to 1.0% of total common shares outstanding.

Impact of Evergreen Provisions on Plan Design

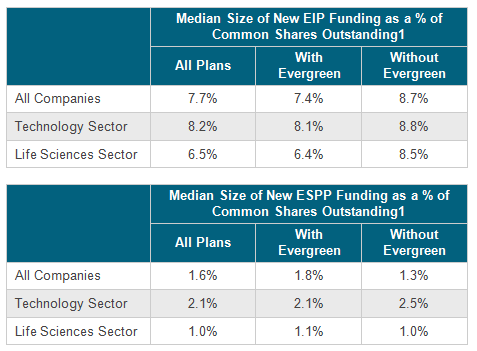

The influence of evergreen provisions on overall equity strategy should not be taken lightly. Plans without evergreen provisions typically need a larger initial pool of shares than those with built-in evergreen features. Considering this trade-off will impact equity plan design efforts and the size of share requests prior to an IPO. To highlight this point, the following tables list the initial size of EIP and ESPP funding (as a percentage of shares outstanding post-IPO) for plans with and without evergreen provisions.

(1) Plan size is calculated as a percentage of total common shares outstanding post-IPO. Values are based on the original size of the plan and do not take into any account shares issued from the plan prior to an IPO. Additionally, any shares assumed from prior plans are excluded.

Evergreen Adoption Trends

Despite continued consternation from proxy advisory firms and many institutional investors, adoption rates for evergreen provisions are rising. Once considered a "must-have" plan provision in the heady dot-com bubble days, evergreens fell sharply out of favor in the mid-2000s. However, as Silicon Valley and the overall IPO market regained steam in late 2011 and early 2012, evergreen provisions once again returned to favor. While 2013 saw a contraction in EIP evergreen adoptions, evergreen provisions continued to rise in popularity for ESPPs throughout 2013.

To learn more about participating in a Radford survey, please contact our team. To speak with a member of our compensation consulting group, please write to consulting@radford.com.

Related Articles