Recent volatility in the stock market for the life sciences sector is a good reminder for companies to examine their approach to employee equity that loses value.

Recently volatility in the stock market for the life sciences sector is a good reminder for public companies to examine their approach to employee equity that loses value due to drops in the market. Between November 5, 2018, and November 4, 2019, companies that experienced stock price declines lost more than 40% in value. Much of this value decline is attributed to drug trial failures, FDA rejection of New Drug Applications, lacklaster earnings and corporate restructurings.

Anytime there is a sharp decline in stock market value, employees can see their stock options go underwater and full-value shares lose their value, which in turn impacts employee engagement and retention. And even if your company isn’t currently experiencing volatility in the market, it’s smart to be prepared and have a contingent plan in place. In this article, we describe some strategies companies can take to address underwater equity.

Methods to Supplement Underwater Equity

Supplemental Full-Value Share Grants – A company can offer supplemental full-value shares or units of their stock to compensate for the value loss of employee equity. This method leaves the outstanding grants intact in case the stock price rebounds in the future, but also provides immediate relief to key employees. This approach does not require shareholder approval (only board approval), thus allowing a company to respond quickly. However, it can increase dilution, which is often viewed unfavorably by shareholders. Additionally, it can be expensive, as the company is required to maintain the original grant expense for the outstanding equity and incurs an additional expense for the new, full-value awards.

Supplemental Cash – Rather than providing full-value awards settled in stock, a company can offer a cash payment to address lost values of outstanding equity. As with supplementing full-value shares, this approach leaves the original grants intact and does not require shareholder approval (only board approval). Even though this does not add to dilution, which can be well-regarded by shareholders, this method is not generally viewed as shareholder-friendly given their financial declines, while employees are provided with cash payments. Furthermore, the company must have the cash available to provide payments to employees.

Cancel and Re-Grant – Under this approach, the company can cancel outstanding equity awards and replace them with new, full-value awards or stock options. This almost always requires shareholder approval, which can drastically impact timing. While following this method can help with dilution since the impact of the replacement grants can be offset by reclaiming the original awards, the replacement awards are typically more dilutive because they are granted at a lower stock price. Moreover, companies must continue to recognize related compensation expense on the cancelled awards, which almost defeats the originally purpose of cancellation. All of this makes canceling and regranting stock an unattractive approach to address equity with diminished value.

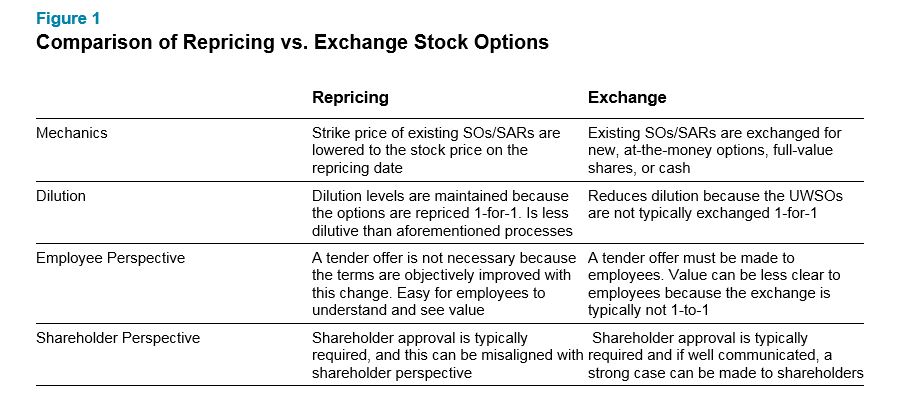

Repricing or Exchanging Underwater Stock Options – With this approach, only underwater options are addressed, ignoring other potentially impacted equity. However, this tactic can be helpful as it repurposes outstanding equity, which is already budgeted for new equity awards with value, helping to manage dilution at the same time. It is important to note that most of these programs require shareholder approval, increasing the complexity of program implementation. Specifically, repricings do not align with shareholder perspectives, making the process of shareholder approval very difficult.

In situations where an entire industry has seen a stock decline, we recommend a multi-faceted approach. The extent of this approach is highly dependent on the situation. While option exchanges and repricings can be very attractive conceptually, a company’s ability to successfully implement such a program requires careful navigation of accounting, proxy advisor and shareholder policies and considerations.

Accounting Considerations

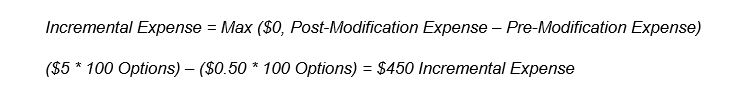

Repricings and exchanges are considered modifications by the applicable accounting guidance (ASC 718). Conducting a modification requires the vesting probability to be assessed immediately before and after the actual modification occurs. This happens on the day of the repricing or on the last day of the tender offer for an exchange. The assessment must include an assumption for the expected life of the pre-modification options that are underwater, since the original expected life used at the grant date is likely no longer reasonable. The fair value immediately before the modification is compared to the fair value of the awards immediately following the modification. Any increase creates incremental expense that must be added to the original grant date fair value of UWSOs. The original grant date expense is continually recognized over the original vesting terms, and the incremental expense would be recognized over the new vesting terms of the new awards. Generally, repricings are very employee-friendly and therefore create a significant amount of incremental expense. Exchanges create an offset of value and can be performed on a more “value-neutral” approach, resulting in significantly less or even zero incremental expense.

Example:

If a grant of 100 underwater options have a pre-modification fair value of $0.50 per option, then modifying the strike price results in a post-modification fair value of $5 per option:

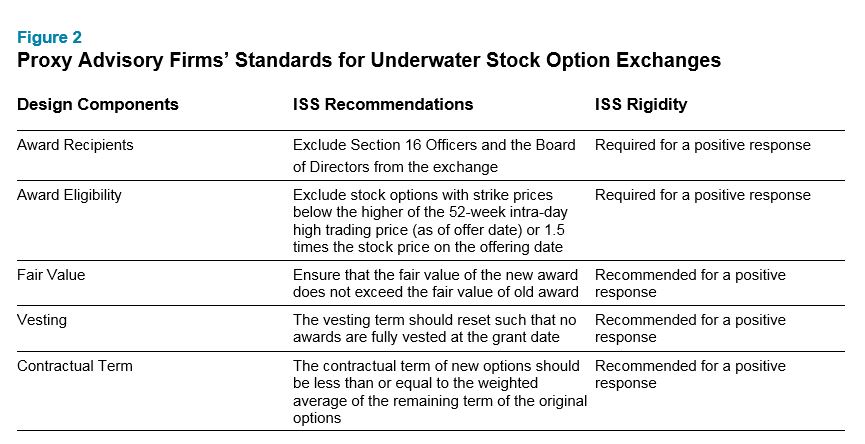

Proxy Advisor Considerations

Proxy advisors, such as Institutional Shareholder Services (ISS) and Glass Lewis, are responsible for making shareholder voting recommendations on all items on the voting ballot. When your program is subject to shareholder approval, navigating proxy advisor guidelines for underwater stock option exchanges can be challenging. ISS is particularly rigid regarding its advisory recommendations for underwater stock option exchanges. To meet ISS standards, companies must attend to the following requirements and recommendations outlined in Figure 2.

Achieving an affirmative vote for an underwater stock option exchange is easiest with proxy advisor support. However, if it is in the company’s best interest to execute an exchange that doesn’t meet one or more of ISS’ standards, it is still possible to pass the exchange successfully by engaging directly with shareholders.

Shareholder Considerations

In the face of their own financial losses, it can be difficult to convince shareholders to approve a process that provides stock value to employees. Taking steps to address losses in equity value for employees is easier with closely-held companies, but not insurmountable with companies that have larger shareholder pools. When engaging in an exchange, it is important that the company reaches out to shareholders and clearly explains its rationale for the exchange, highlighting business benefits and the ways in which these benefits will have positive effects for shareholders. This is especially important in cases where proxy advisors are less likely to recommend investor votes for underwater stock option exchanges.

Next Steps

Organizations affected by market volatility should understand the tools at their disposal to address any underwater equity. The right approach will be very specific to each company’s exact situation, including the shareholder population, the type and amount of equity underwater and the shares remaining in the pool. It’s important to pursue an approach that is not just meaningful to employees, but also likely to be supported by shareholders to avoid negative consequences on the company from future shareholder votes. Option exchanges or repricings can be effective in the right situations, but there may be other scenarios where different approaches or a blended approach can have the biggest impact.

If you have questions about addressing underwater equity and want to speak with a member of our rewards consulting group, please write to rewards-solutions@aon.com.

Related Articles